Business Equipment Financing & Loans

Equipment loans and financing solutions for your business

Business equipment financing that works for you

Business equipment loans help maintain your cash flow and keep things running smoothly. Our knowledgeable financial specialists can guide you toward flexible, competitive small business equipment financing and leasing options for your new, used or custom-built equipment and vehicles—so you can focus more on your business.

Manage your business equipment financing solutions

Build your business with equipment financing and leasing

We offer business equipment leasing and financing solutions for a range of industries—from heavy equipment financing to golf and turf—so you have the equipment you need to run your business. Our specialists can also help you offer financing directly to your own customers, helping you close more deals.

Business Equipment Financing Success stories

Recent transactions

$1,000,000

$141,500

$33,000

Business Equipment Financing & Vendor Solutions

Serving a variety of industries

Get business equipment financing up to $3 million

Connect with a business equipment financing specialist

More options to consider

Tractor & Trailer Financing

Finance new or used heavy trucks, trailers or tractors, or use a Terminal Rental Adjustment Clause, or TRAC, lease to purchase transportation equipment.

Pre-Approved Credit Line

We offer the convenience of pre-approved lines of credit to fund annual capital expenditures or multiple purchases.

Manage your business on the go

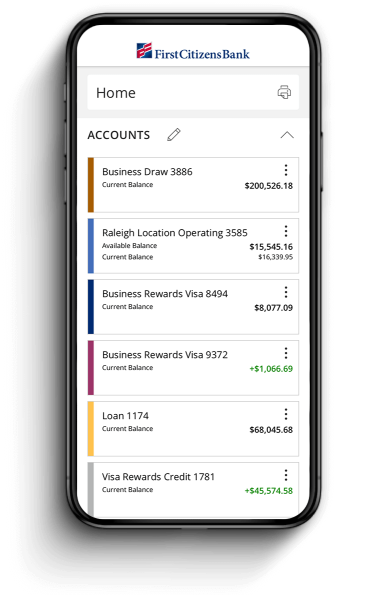

Manage your accounts from anywhere

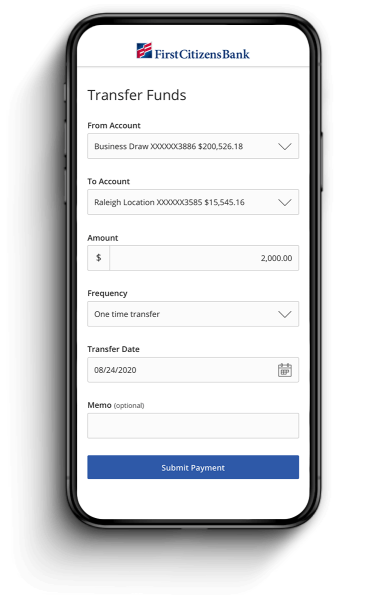

Send & transfer money with ACH and wires

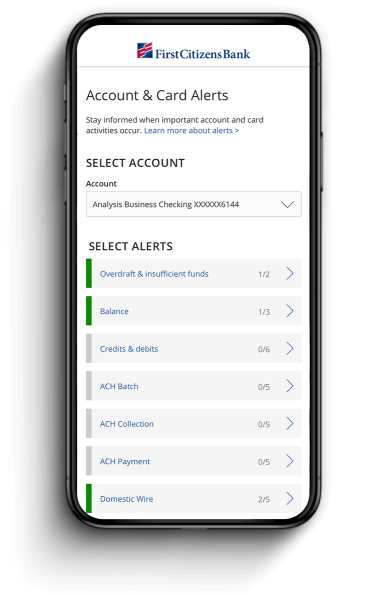

Receive account and security alerts