Balance transfers

0% introductory APRD for the first 12 monthsD on balance transfers, then variable purchase rate of 13.49% to 22.49% based on creditworthiness applies

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Market Update

Phillip Neuhart and Blake Taylor take a deep dive into GDP growth, the housing market, policy developments and the scale of AI investments.

Our low-interest Smart Option credit card puts you in charge. Consolidate your credit with lower interest, no annual fee and added protection wherever you make purchases.

Forget the fees

Pay no annual fee and get our lowest interest rate.

Enjoy benefits

Convenient credit card benefits help protect you and your purchases.

Balance transfer

Use our introductory offer on balance transfers to consolidate your debt.

Manage your spending or consolidate higher interest rate balances on our lowest-APR, no-fee credit card.

0% introductory APRD for the first 12 monthsD on balance transfers, then variable purchase rate of 13.49% to 22.49% based on creditworthiness applies

Variable 13.49% to 22.49% APR based on creditworthiness

Variable 25.49% to 28.49% APR based on creditworthiness; each transaction is subject to a 5% fee (minimum $10)

$0 with this no-fee credit card

Pay with your phone

Add your cards to your mobile device and pay securely with Digital Wallet.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

Whether you should transfer your balance depends on several factors. In some cases, it can save you money. Use our handy balance transfer calculator to see if it's worth it for you.

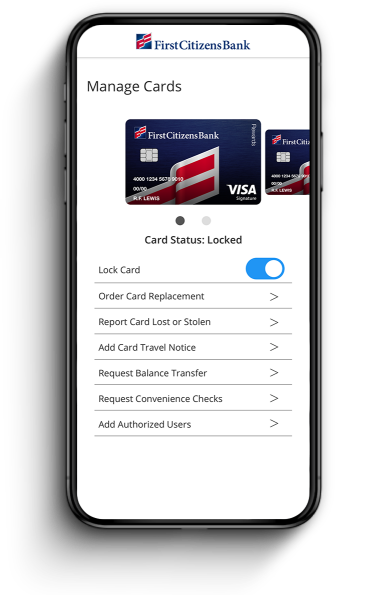

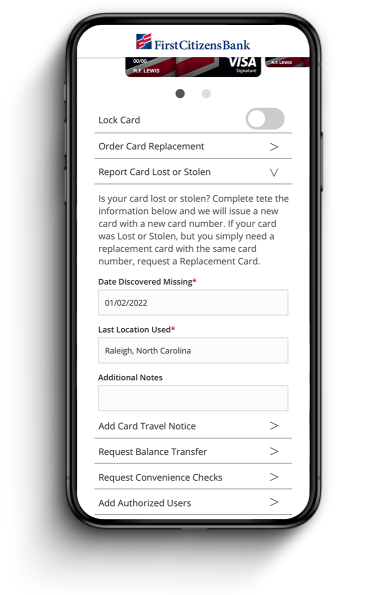

Temporarily lock your card

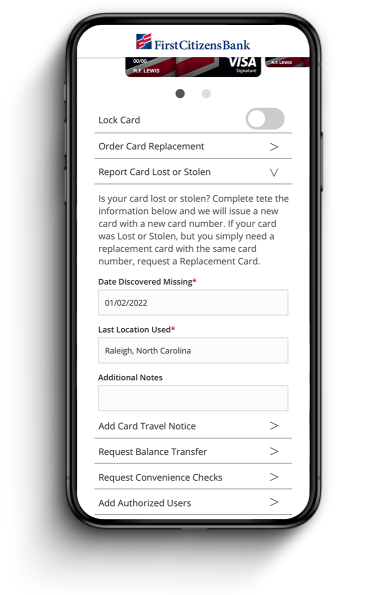

Report a lost or stolen card

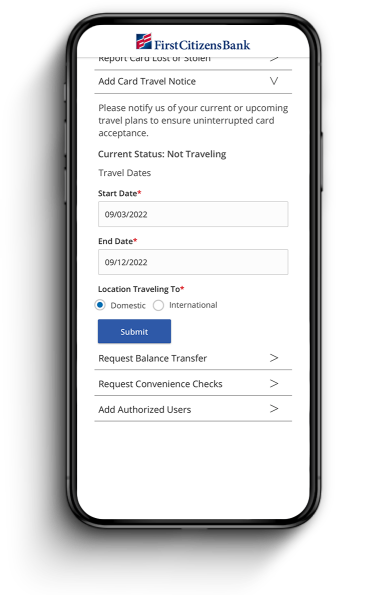

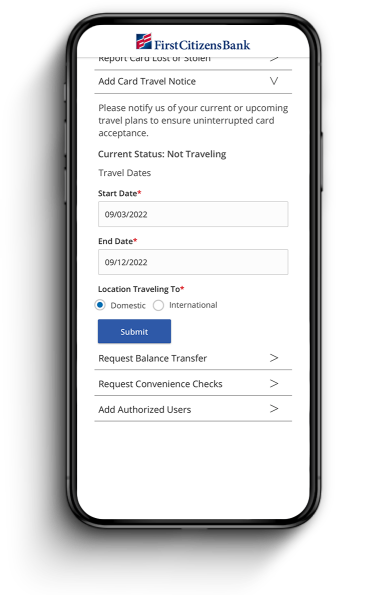

Notify us if you're traveling

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling

There are several reasons you might choose a low-interest credit card. Chief among them, of course, is the lower interest rate. Having a card with a lower rate means you pay less interest, which is especially helpful if you happen to carry a balance from one month to the next.

Lower interest can also be a boon if you're looking to consolidate your debt. If you have credit cards with higher rates, you can transfer those balances to a low-interest credit card and pay it off as a single debt. This approach can help you pay off your debt faster because you'll only be accruing interest on the lower-rate card, rather than one or more higher-rate cards.

Lastly, you might prefer a low-interest credit card if you don't want or use credit card rewards. Higher-rate cards often offer rewards programs, where you earn points based on your spending. But if these programs aren't important to you—or if you forget to redeem your rewards—that higher-rate card might not be worth the cost. In those cases, a lower-rate card could be a better fit.

Low-interest credit cards work much the same as other credit cards. Having a card gives you access to a line of credit that you can use to make purchases, pay bills and transfer balances. Each month, you receive a bill for what you've spent with a required minimum payment. If you don't want to accrue any interest, aim to pay off your balance in full each month. Otherwise, you'll accrue interest on the remaining balance based on your annual percentage rate, or APR.

With our Smart Option credit card, not only do you enjoy a lower APR, but you also get great benefits and the same digital functionality as our other credit cards. Plus, you can use it anywhere Visa® is accepted worldwide.

When you apply, your interest rate is determined based on your credit quality and history. If you're aiming for our lowest APR range, you can work to improve your credit before applying. Reviewing the 5 Cs of credit can help you see how your application might look to a lender.

Yes. If you've set a goal to build or rebuild your credit, managing a low-interest credit card can help you get there.

To help build good credit, use your credit card regularly and make all your payments on time. You'll also want to keep an eye on your credit utilization and aim to use 30% or less of your card's credit limit.

Long-standing accounts reflect positively on your credit report, which in turn helps rebuild your credit. When managed properly, a low-interest credit card can be a valuable part of your credit-building strategy.

No. However, anyone can rebuild credit after filing for bankruptcy, though it may take time to qualify for preferred cards and rates. Depending on the type of bankruptcy you filed, it can take up to 7 years to qualify.

First Citizens is here to help, and we invite you to visit your local branch to discuss other opportunities that may meet your needs based on your individual circumstances.

Yes. A low-interest credit card can be a good option for students looking to establish credit history. Students may also benefit from having a small-limit credit card to help cover emergencies while they're away from home.

Along with using a credit card responsibly, students can follow these key strategies to help them build credit.

Normal credit approval applies.

For more information, please see the First Citizens Consumer Credit Card Cardholder Agreement and Disclosure (PDF).

FICO® and “the score lenders use” are registered trademarks of Fair Isaac Corporation in the United States and other countries.

APR (Annual Percentage Rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of December 31, 2025, is 6.75% and may vary in the future. The transaction fee for cash advances is $10 or 5% of the amount of the cash advance, whichever is greater. The transaction fee for foreign transactions is 3% (0% for Travel Rewards) of each transaction after conversion to US dollars.

Balance transfer must occur within the first 90 days of account opening to qualify for the 0% APR (annual percentage rate) introductory offer and will be subject to a balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater. After the 12 billing cycle period, your APR will default to your purchase APR.

Cellular Telephone Protection, Travel and Emergency Assistance Services, Auto Rental Collision Damage Waiver, Porch Piracy Protection, Rideshare Protection and Trip Delay Reimbursement provided by Visa®. Certain terms, conditions and exclusions apply. For complete details, please refer to Your Guide to Benefits for Visa Signature Cardholders (PDF) or Your Guide to Benefits for Visa Traditional Cardholders (PDF).

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Credit card accounts are available to existing customers enrolled in Digital Banking.

If you don't have an account with us, you can join the First Citizens family with a checking account.

Earn more points on travel and get exclusive travel rewards.

Earn more points on special spending categories.

Transform everyday purchases into unlimited cash back.

Get our lowest available rate.

Still not sure? Compare Accounts

Need to make a change?