Consolidate Debt

Combine your credit card balances into one convenient monthly payment.

Save Money

You could save on interest and potentially pay down your balance faster.

Easy Process

Transfer your balance online in three quick and simple steps.

Enjoy this inclusive offer within 90 days of opening your accountD

0% APRD

0% introductory APRD for the first 12 months, then the purchase rate of 16.49% to 25.49% for all cards except Smart Option, which is 13.49% to 22.49%.

Balance Transfers

You're only three steps away from a great new rate

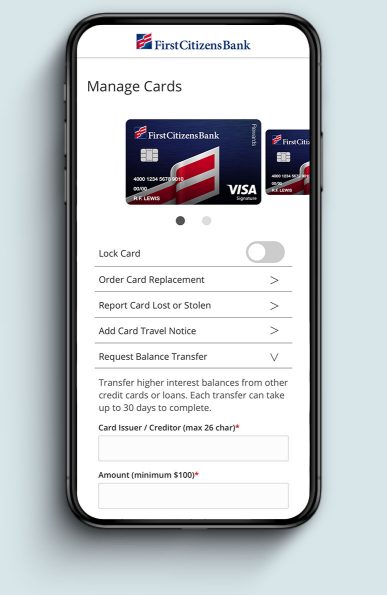

Log in and go to Manage Cards

Specify your card, select Request Balance Transfer

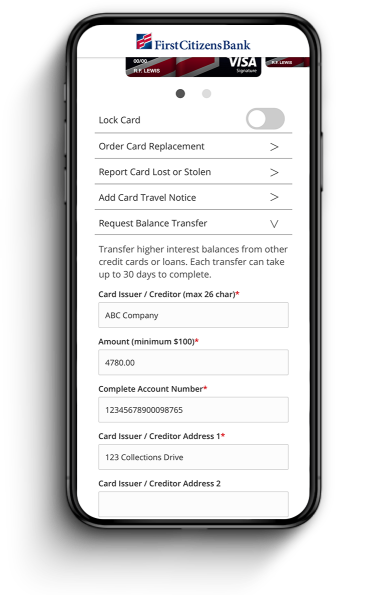

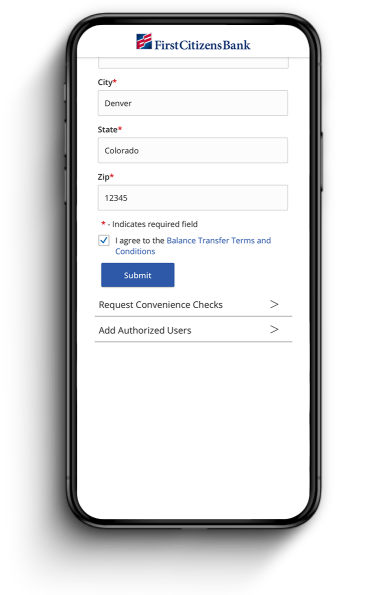

Provide transfer info and accept terms

Requirements

Start a balance transfer quickly and easily

Here's what information you'll need to request a credit card balance transfer.

Don't have a credit card with us yet?

Whether you're looking to earn rewards or build your credit score, we make it easy to answer a few questions and find the right credit card for you.