Open a Prestige account with less

Put your money to work today with a $100 minimum opening deposit.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Basis Points

The Making Sense team highlights key issues from the first weeks of the new year, including US equities and a low-hire, low-fire labor market.

Prestige checking offers exclusive benefits for customers with high checking account balances. Become a VIP banking customer and enjoy perks like competitive deposit rates, free checks and no banking fees.

Exclusive benefits

Enjoy free cashier's checks,D money orders and travelers checks.

Our best rates

Save on home equity lines, and earn more on CDs.

Superior convenience

Access your Prestige account online and use any ATM.D

Avoid the $25 monthly fee when you meet any one of these criteria.

Your Prestige checking account comes with a Visa® debit card, which you can use for a fast, touch-free, secure way to pay.

Put your money to work today with a $100 minimum opening deposit.

Use any ATMD that's convenient and get reimbursed.

Get 0.05% APYD on your balance with a Prestige interest-earning checking account.

Save the most with our preferred ratesD on home equity lines of credit.

Choose the overdraft protectionD options that work best for your account.

Bank when you want

Enjoy free Digital Banking, bill pay and 24/7 mobile deposits.

Get alerts

Securely keep track of your account activity with text and email alerts.

Pay with your phone

Link your debit card to digital wallets like Apple Pay® and Samsung Pay®.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

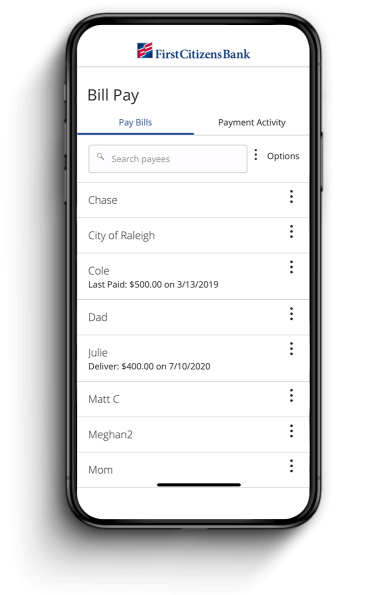

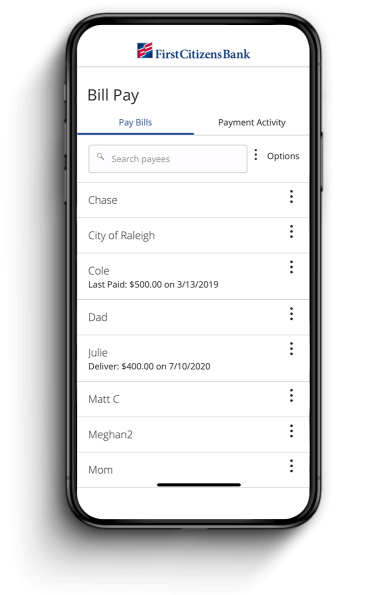

Automate your bills

Know your bills are paid through Digital Banking.

Manage wealth

See the full picture by tracking all your accounts, even from other financial institutions.

Pay your bills from any device

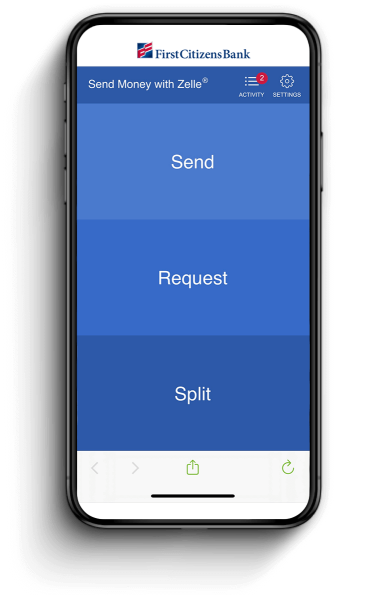

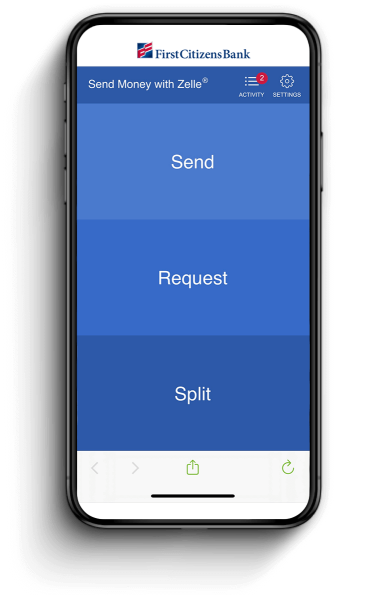

Send money with Zelle®

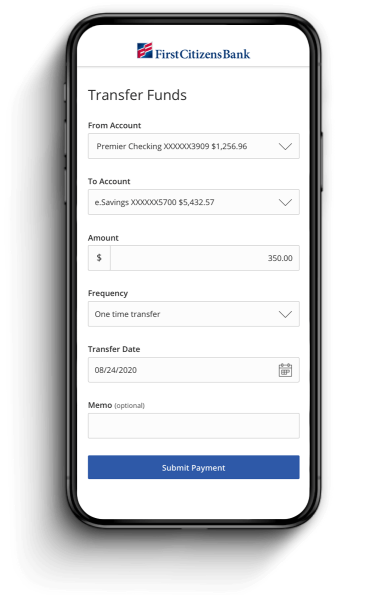

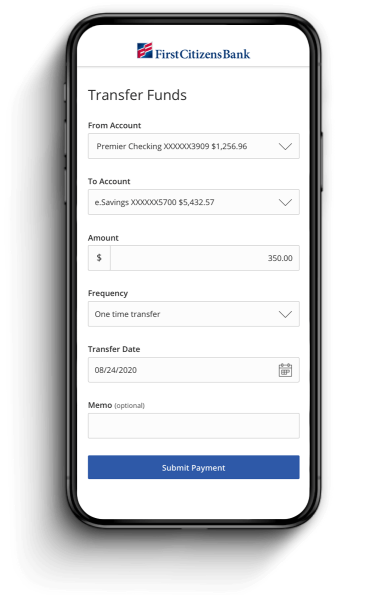

Transfer funds to other accounts

Pay your bills from any device

Send money with Zelle®

Transfer funds to other accounts

Prestige checking is a high-balance checking account option offered by First Citizens. The Prestige bank account gives customers VIP-level benefits like competitive rates on home equity lines of credit, unlimited use of non-First Citizens ATMs and interest on checking accounts.

Those who qualify for Prestige checking meet the following criteria:

With a Prestige account, you get premium interest checking with competitive rates and unlimited access to any ATM. You can also enjoy preferred rates on home equity lines of credit and have access to account management tools to make the most of your account.

The minimum deposit to open and maintain a Prestige checking account is $100.

Yes. When you open a Prestige checking account, you also get a Visa® debit card—which you can use for a fast, touch-free, secure way to pay.

You can check your Prestige card balance through the Digital Banking app, at any First Citizens ATM or by using Manage My Money.

As long as you qualify for the fee waiver requirement by maintaining a high checking account balance as a VIP banking customer, there are no banking fees.

While all three types of accounts offer debit cards, overdraft protection and access to free online account management tools, there are some differences to note.

Yes. All bank deposit products, including Prestige checking accounts, are FDIC-insured.

Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app. Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information. Fees may apply for use of certain services in First Citizens Digital Banking.

Apple, the Apple logo and Apple Pay are trademarks of Apple, Inc., registered in the US and other countries.

Samsung and Samsung Pay are trademarks of Samsung Electronics, Ltd.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Limit of five per month.

For current rates, please call or visit your local branch.

Service fees may be charged by the third-party ATM operator or owner, or by the network owner for transactions at non-First Citizens ATMs. For transactions initiated outside of the United States, the fee will be 3.00% of the transaction amount.

$25,000 combined daily balance in Together Card, Regular Savings, Online Savings, Tiered Money Market Savings, Premier Relationship Money Market Savings, CDs, IRAs or Investor Services Account.

Your investments in securities and insurance products are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by, any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. Past performance does not guarantee future results. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands, Products and Services Offered

First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares Inc. are the entities through which FCW products and services are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. (FCIS), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. (FCAM), and SVB Wealth LLC (SVBW), all SEC registered investment advisers. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions, or to all investors. Insurance products are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products are offered by First-Citizens Bank & Trust Company, Member FDIC, and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM, or SVBW and its investment professionals, visit: FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

New or used auto, light or heavy truck, boat, aircraft, unsecured personal loan, or mortgage (excludes mortgages that First Citizens Bank does not retain servicing).

APY (annual percentage yield) is accurate as of ${date-today}. After that time, the rate is variable and may change. Other account-related fees may apply. Fees could reduce the earnings on the account.

With the exception of the Sure Advantage and Together Card products (which are ineligible for overdraft service), if the available funds in your account are insufficient to pay an item when presented, First Citizens Bank will make a decision on whether to pay the item or return it unpaid. When we pay an item for which there are insufficient funds, it results in an overdraft. The following overdraft fee structure applies to eligible Consumer accounts: First Citizens Bank will charge you $25 each time we pay an item resulting in an overdraft, up to our limit of three (3) overdraft charges per business day. We will not charge you for overdrafts caused by transactions of $5.00 or less, nor for items returned unpaid. You are obligated to repay overdrafts immediately. Consumers have the option to decline overdraft service. First Citizens Bank also offers overdraft protection programs. Please see our Deposit Account Agreement (PDF) for additional details.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Make life easy with our simplest personal checking account.

Get the upgrade with the personal checking account that pays you interest.

Sign up for the VIP experience—an interest-bearing personal checking account with the best features.

Still not sure? Compare Accounts

Need to make a change?