Request a Card

Log in to Digital Banking to request a debit card

Convenience

Writing checks and fumbling for cash can slow you down. Instead, do it all with a First Citizens Visa® debit card—and leave your checks and cash at home.

Security

First Citizens uses real-time fraud monitoring and alerts to keep you informed and protect your money—all you have to do is enroll.

Benefits

Visa debit cards come with even more great benefits

No fee

There's no fee to request a Visa debit card for your checking account.

Overdraft protection

Choose the right level of overdraft protectionD for your account.

Contactless payments

Use a fast, touch-free and secure way to pay.

Exclusive discounts

Enjoy shopping with exclusive Visa discounts.

Secure online shopping

With Verified by Visa, you can shop online confidently wherever you see a Visa Secure badge.

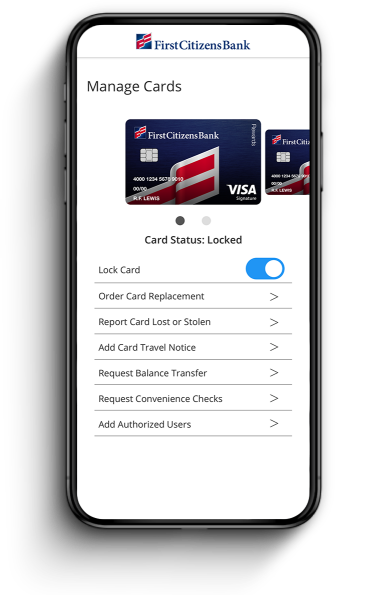

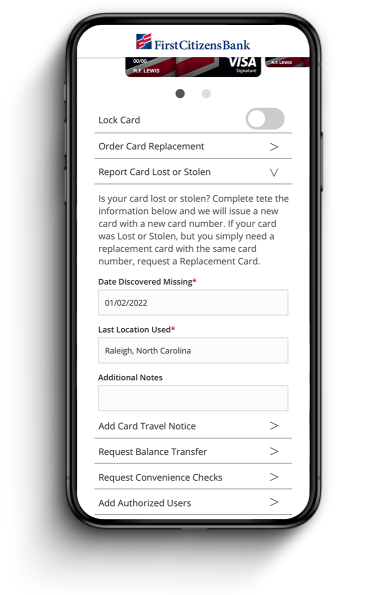

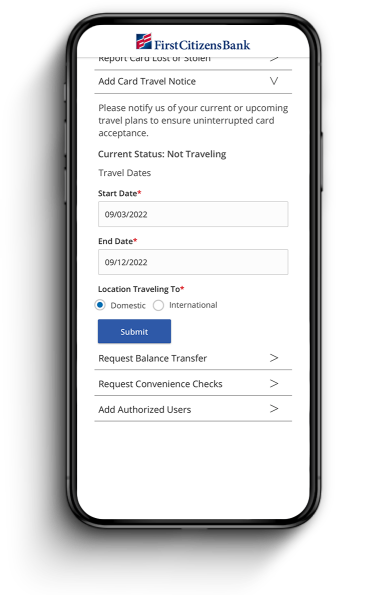

Manage Your Cards

Access any of our card services from your phone

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling

Don't have a checking account?

To request a Visa debit card, you'll need to have a First Citizens checking account. Answer a few simple questions to find the right one for you.