Compare

Looking to compare our checking accounts before you enroll? Here's an overview of their features to help you decide.

Features |

Basic Checking |

Earn Interest |

Get Perks |

|---|---|---|---|

Monthly fee |

$0D when enrolled in paperless statements |

$0 or $18D |

$0 or $25D |

Minimum opening deposit |

$50 |

$100 |

$100 |

No overdraft transfer feesD |

icon: sys-close |

icon: sys-close |

icon: sys-checkmark |

Higher purchase & ATM limits |

icon: sys-close |

icon: sys-close |

icon: sys-checkmark |

Fee-free use of non-First Citizens ATMsD |

icon: sys-close |

icon: sys-close |

icon: sys-checkmark |

Preferred ratesD |

icon: sys-close |

icon: sys-checkmark |

icon: sys-checkmark |

Free checksD |

icon: sys-close |

icon: sys-checkmark |

icon: sys-checkmark |

Earn interestD |

icon: sys-close |

icon: sys-checkmark |

icon: sys-checkmark |

Together Card® includedD |

icon: sys-close |

icon: sys-checkmark |

icon: sys-checkmark |

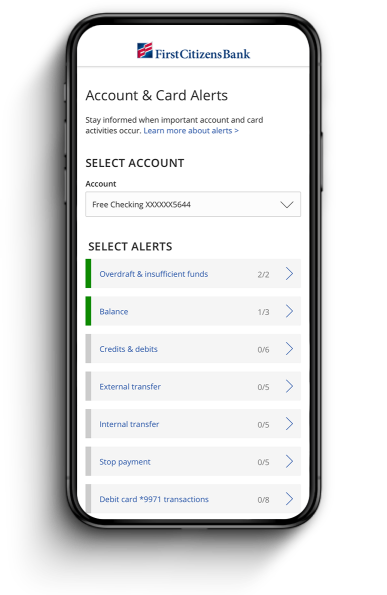

Free Digital BankingD and card alerts |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

Not quite sure? Answer a few questions to find the right checking account for you.

Digital Banking

Bank from anywhere with your mobile devices

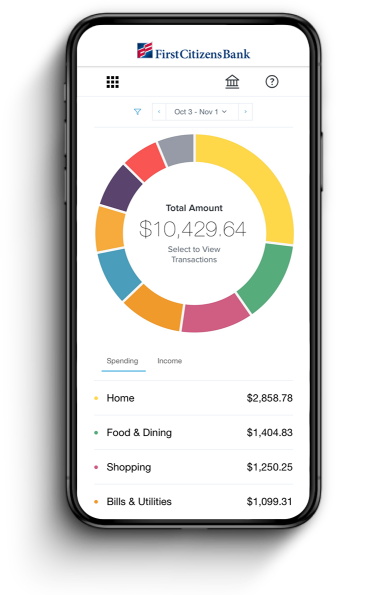

Track your spending habits

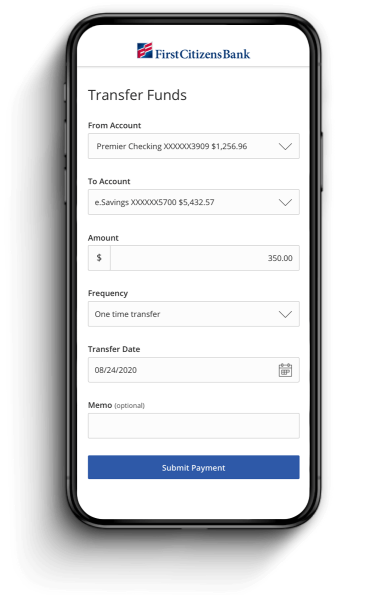

Seamlessly move your money

Set alerts for transactions