What wealthy Americans and business owners are doing differently this year

The Beyond Wealth reports offer an annual look at how wealthy Americans and business owners approach money, business and future planning. This year's findings reveal how economic pressures are reshaping both wealth strategies and business decisions.

At a glance

62%

Percentage of wealthy Americans who cite inflation as a top stressor—followed by market volatility and changing government economic policies

$6.3 million

The average amount wealthy Americans believe they'll need to both retire and transfer wealth

73%

Percentage of wealthy Americans who work with a financial advisor, citing reduced stress and greater preparedness for the future as the top benefits

2025 highlights

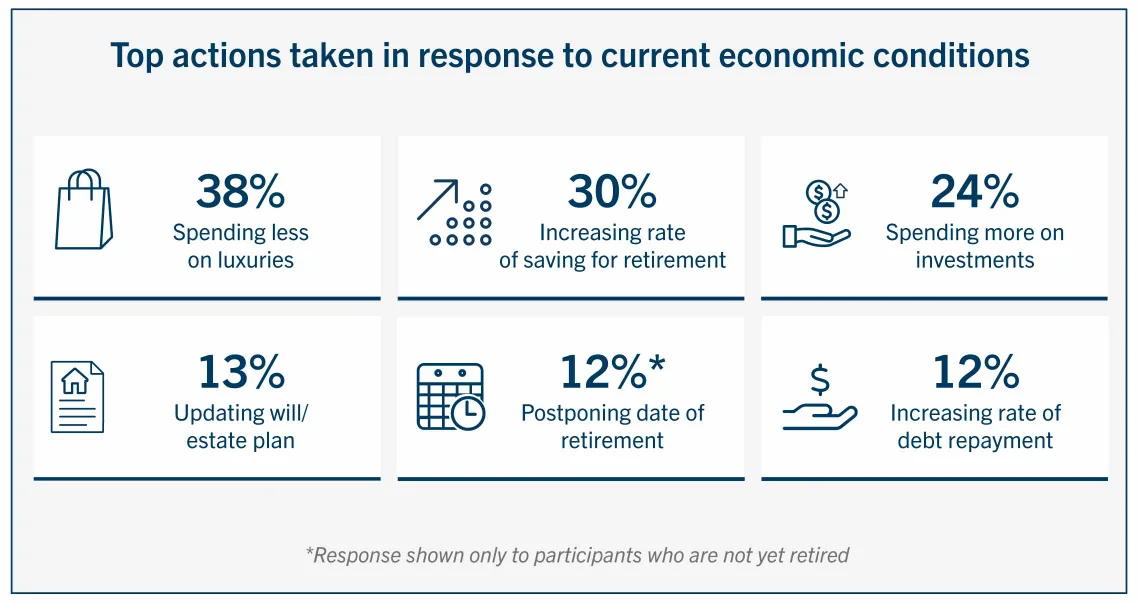

Economic stress sparks action

Many wealthy Americans are channeling financial stress into positive action by cutting back on luxuries, saving more for retirement and boosting investments.

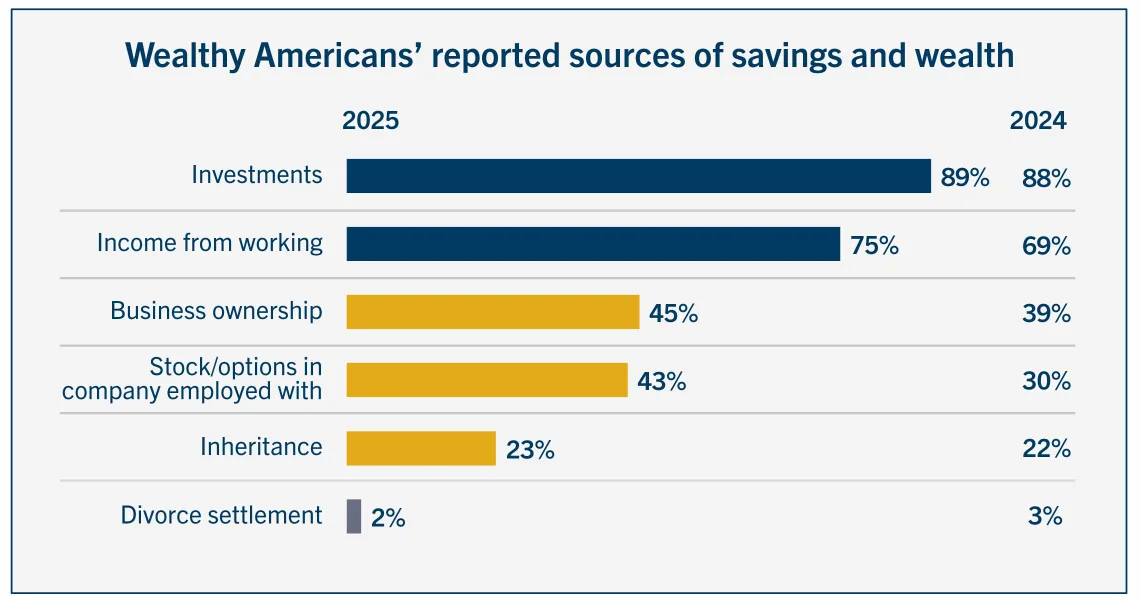

Overlapping sources of wealth

Sources of wealth are more varied than in 2024—spanning business ownership, investments, employee stock options and inheritance—making holistic planning more important than ever.

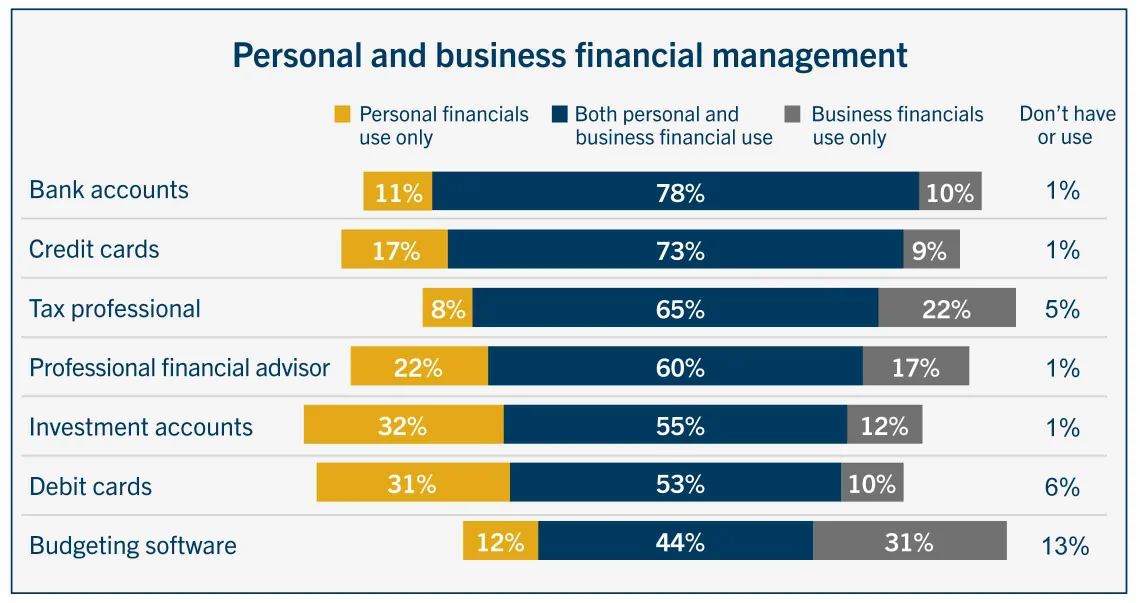

Business and personal lines blur

For many owners, business and personal finances are tightly intertwined, creating added complexity and increased risk.

Lead authors

Marc Horgan

Executive Director

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

Research Partner: Logica Research

Our authors partnered with Logica Research to conduct the second iteration of the Beyond Wealth study.

Methodology: The 2025 Beyond Wealth survey was conducted online in August and September 2025 by Logica Research among 1,100 Americans with at least $500,000 in investable assets, including 500 business owners. For purposes of this survey, affluent is defined as $500,000 to less than $1 million, high net worth as $1 million to less than $10 million and ultra-high net worth as $10 million or more in investable assets. Logica Research is an independent research firm and is neither affiliated with, nor employed by, First Citizens Bank.