ACH Receivables

Receive electronic payments from your customers securely.

Check Recovery Service

Effectively recover 100% of bad checks.

Image Cash Letter

Deposit checks using your existing imaging system.

Electronic Bill Presentment and Payments, or EBPP

Replace paper with online billing and payments.

eReceivables

Integrate online accounts receivable payments into your cash management system.

Lockbox Processing

Outsource the collection, processing and posting of payments.

Remote Deposit Capture

Deposit checks remotely for faster processing and extended deposits.

Let us guide you to the right receivables service

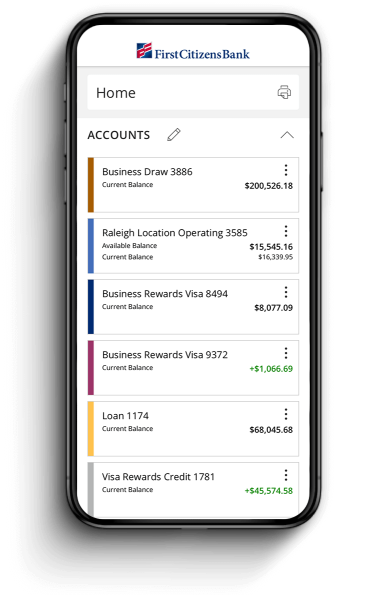

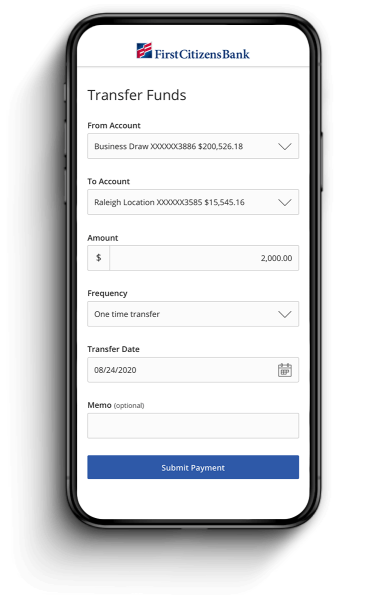

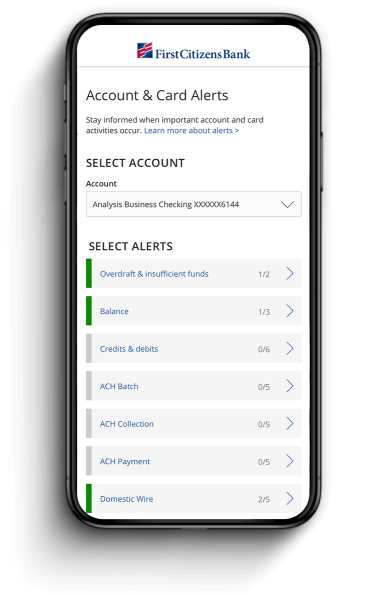

Business Digital Banking

Manage your business on the go

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts