Cover your essential business needs

We're passionate about meeting your goals. Let's work together to easily and safely manage your commercial bank accounts. Choose from specialized checking accounts along with traditional savings accounts, money markets and CDs.

Commercial Checking

Our analysis business checking account is designed for companies with complex financial needs and those that need advanced treasury management services.

Commercial Savings

The flexibility you need to reach your short- and long-term savings goals.

Let's start a conversation—we're here to help

Digital Banking

Commercial Advantage

Accurately track cash flow

Manage your business on the go

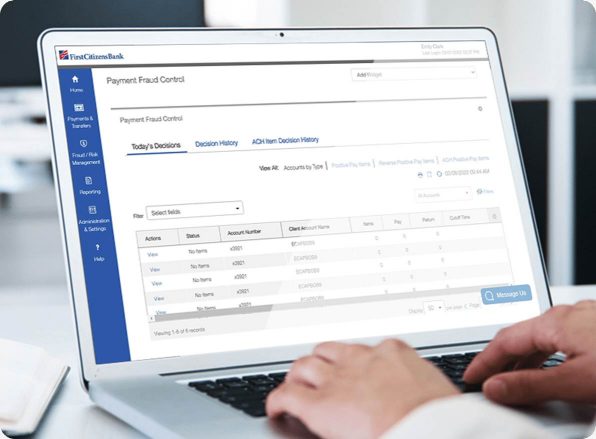

Keep your assets secure