Products for every stage

We can help you manage your cash flow. With options for both short- and long-term commercial savings needs, you can rest easy knowing your liquid savings are secure.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Basis Points

The Making Sense team highlights key issues from the first weeks of the new year, including US equities and a low-hire, low-fire labor market.

Commercial savings is best suited for businesses focused on earning interest on reserves, while also maintaining liquidity. We offer account options for a variety of different savings needs, all backed by the financial expertise our customers expect and deserve.

Savings growth

Retain more earnings with a high-yield savings account that will grow with your business.

Money market savings

Maximize your savings potential with tiered interest rates.

Certificates of deposit

Get steady interest rates and flexible terms to meet your business needs.

We can help you manage your cash flow. With options for both short- and long-term commercial savings needs, you can rest easy knowing your liquid savings are secure.

A sensible savings account is perfect for businesses of any size. A premium savings account offers the flexibility for your interest rate to grow right along with your money. Business certificates of deposit give your small business the ability to save for the future, with a variety of flexible terms available.

We understand how hard you work. Having a reliable financial partner can help take some of that stress off your plate and improve your bottom line. That's why we offer a variety of sensible commercial savings options.

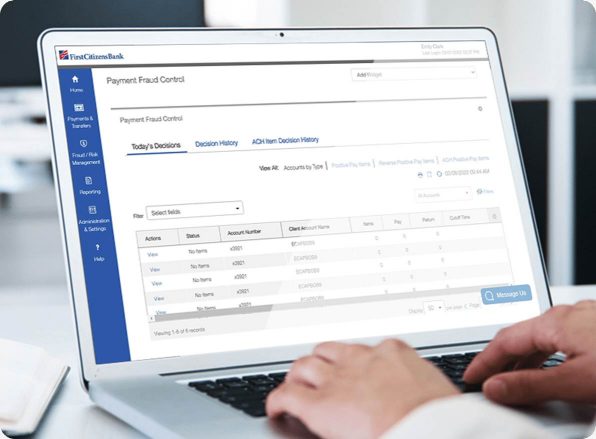

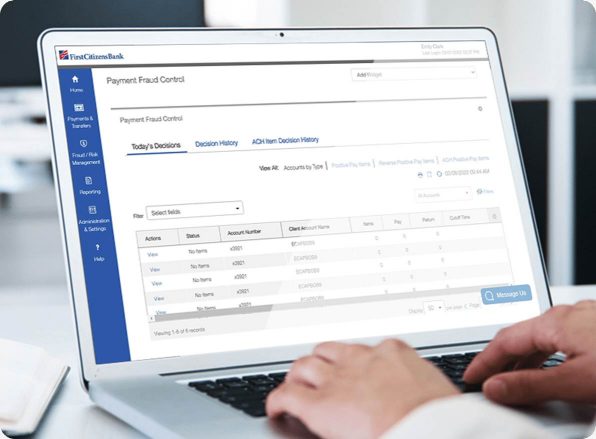

Accurately track cash flow

Manage your business on the go

Keep your assets secure

Accurately track cash flow

Manage your business on the go

Keep your assets secure

Talk to a banker to get started.

The documentation you need to open an account will vary based on your business type and needs. To learn more, talk to a banker for assistance.

Yes. A commercial savings account is an important tool for earning interest and maintaining liquidity, outside of cash and checking reserves.

Account openings are subject to bank approval.

For a list of account details and fees, see our Disclosure of Products and Fees—Business Accounts and Services (PDF).

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Fields denoted with an asterisk (*) are required.

If you prefer to speak with someone directly, please give us a call.