Keep your confidential financial information secure

You don't have to wait until your money has been misused to protect your business accounts. Our business fraud prevention services increase your control—so you're empowered to stop fraud before your small business loses funds.

ACH Positive Pay

Enable electronic fraud prevention by monitoring or screening ACH transactions.

Check Positive Pay

Protect your small business against fraudulent checks with our check-monitoring service.

Reverse Positive Pay

Simplify account reconciliation activity related to checks presented for payment with business fraud management tools.

Are you operating a commercial business?

Protect your business with commercial fraud prevention services.

First Citizens Positive Pay Video

See how it works

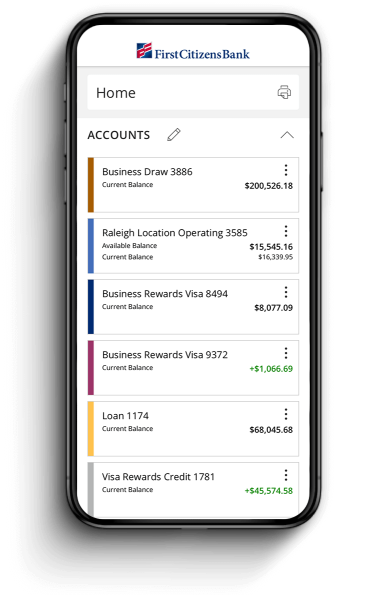

Business Digital Banking

Manage your business on the go

Manage your accounts from anywhere

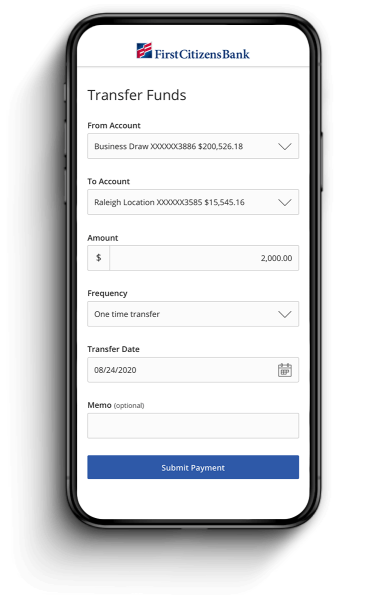

Send & transfer money with ACH and wires

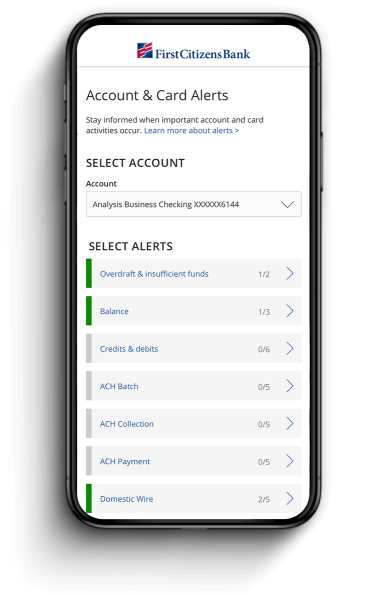

Receive account and security alerts