Quick, convenient and contactless

Choose from four Visa® business credit cards to help support your needs. Protect your spending with robust fraud protection, track and limit expenses, build your credit, and get great benefits like travel and emergency assistance.

Premium Rewards Business credit card

Rewards Business credit card

Cash Rewards Business credit card

Low-Interest Business credit card

Business credit card rewards calculator

Choose how you want to earn rewards

First Citizens offers several credit cards, but the best credit card for your business depends on how you spend money. When it comes to earning reward points, which of our credit cards will be the most rewarding for your business? Use this handy credit card rewards calculator to find out.

Connect with us to learn more about business credit cards

Compare small business credit cards

Still not sure? Here's a quick glance at our credit cards for businesses to help you decide.

Premium Rewards Business credit card |

Rewards Business credit card |

Cash Rewards Business credit card |

Low-Interest Business credit card |

|

|---|---|---|---|---|

Special offer |

50,000 bonus points after you spend $4,500 in the first 90 daysD |

10,000 bonus points after you spend $3,000 in the first 90 daysD |

$100 cash back after you spend $3,000 in the first 90 daysD |

icon: sys-close |

What you can earn |

3 points for every $1 spent on restaurants, advertising and travelD 1.5 points for every $1 spent on all other purchasesD |

3 points for every $1 spent on gasD 2 points for every $1 spent at restaurants and on travelD 1 point for every $1 spent on all other purchasesD |

5% cash back on utilities and wireless phonesD for the first 12 months, then 3% 2% cash back on gas and office suppliesD 1% cash back spent on all other purchasesD |

icon: sys-close |

Purchase and balance transfer APR |

17.49% to 26.49% variable APRD based on creditworthiness |

0% intro APR for the first 9 months following account opening, then 15.49% to 24.49% variable APRD |

0% intro APR for the first 9 months following account opening, then 15.49% to 24.49% variable APRD |

0% intro APR for the first 12 months following account opening, then 13.49% to 22.49% variable APRD |

Annual fee |

$0 for first year, then $95D |

$0 |

$0 |

$0 |

Foreign transaction fee |

None |

None |

3% of each transaction after conversion in US dollars |

3% of each transaction after conversion in US dollars |

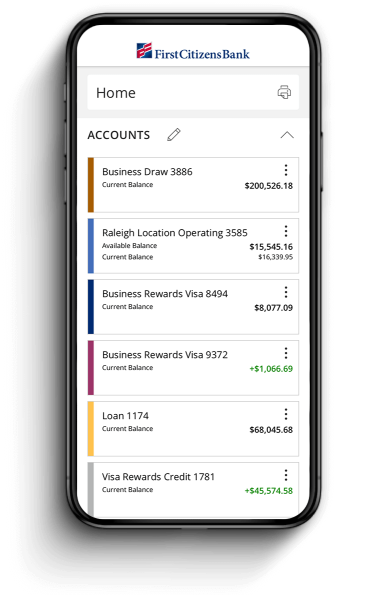

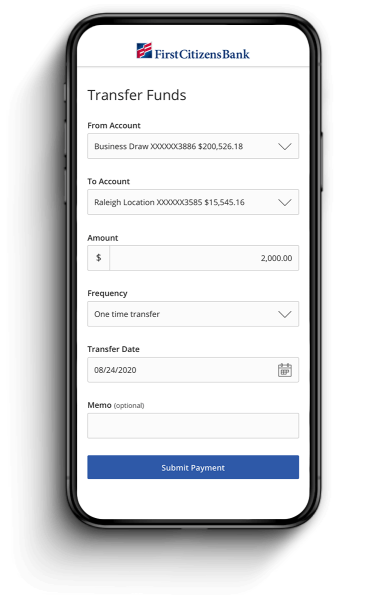

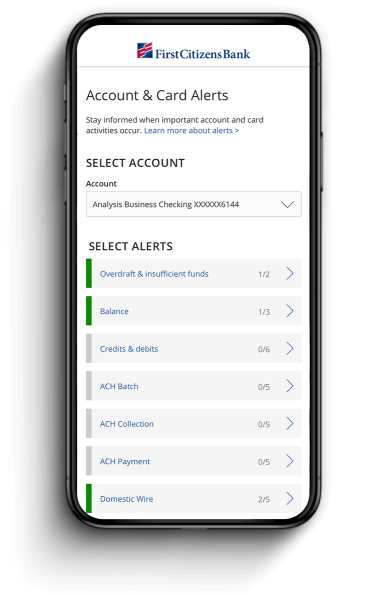

Business Digital Banking

Manage your business on the go

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts