Credit card benefits

Benefits for all business credit cardholders

When you open a First Citizens Visa® credit card account for your business, you're auto-enrolled in great benefits to provide added convenience and protection.

Coverage for travel and emergencies

Travel and Emergency Assistance is available for covered First Citizens credit cardholders from anywhere in the world.D

Auto rental collision waiver

Rent a car with your covered First Citizens credit card and get built-in Auto Rental Coverage.D

Purchase security

You'll get protection on new purchases within the first 90 days of buying them.D

Extended warranty

Extended warranty coverage can help you manage, use and extend any warranties you have.D

Expense tracking

Keep your personal and business finances separate.

Cash flow and improved credit

Help your business grow with added working capital.

Spending limit management

Get employee credit cards with spending limits you set at no additional cost.

Cell phone protection

Protect your cell phoneD when you pay your monthly bill with your First Citizens business credit card.

Special deals on dining, entertainment, shopping and more

Premium Rewards

Unique benefits for Premium Rewards cardholders

You're auto-enrolled in Visa Signature benefits when you open a Premium Rewards Business credit card.

Trip interruption coverage

Receive up to $5,000 per insured person for non-refundable tickets you paid for with your Premium Rewards card.D

Lost luggage reimbursement

Get reimbursed for up to $3,000 per trip per bag for any luggage that was lost, stolen or misdirected.D

Travel accident insurance

You're protected against financial hardship caused by an accident that occurred on a trip paid for with your Premium Rewards card.D

Visa concierge services

You'll get personalized information and assistance related to travel, dining and entertainment.D

Convenient ways to pay

From contactless payments to digital wallets, you have more ways than ever to quickly, conveniently pay for your purchases.

Contactless payments

Just tap and pay for business on the go

Your credit card has contactless payment technology, which means you can tap to pay for purchases anywhere contactless payments are supported.

Look. Tap. Go.

At checkout, check for the contactless symbol

Tap your contactless card on the terminal

Your payment will be processed in seconds

Digital Wallet

A simple way to pay to go cashless

Your smartphone's Digital Wallet is a fast and secure way to pay—and it works seamlessly with First Citizens Visa business credit cards.

Fraud protection

Along with your credit card benefits, First Citizens offers robust fraud protection services to help keep your cards and information safe.

Visa Zero Liability Policy

Protect your account from unauthorized transactions

The Visa Zero Liability PolicyD is a guarantee that you won't be held responsible for unauthorized charges made with your account or account information. You're protected if your Visa credit card is lost, stolen, or fraudulently used online or offline.

Card Alerts

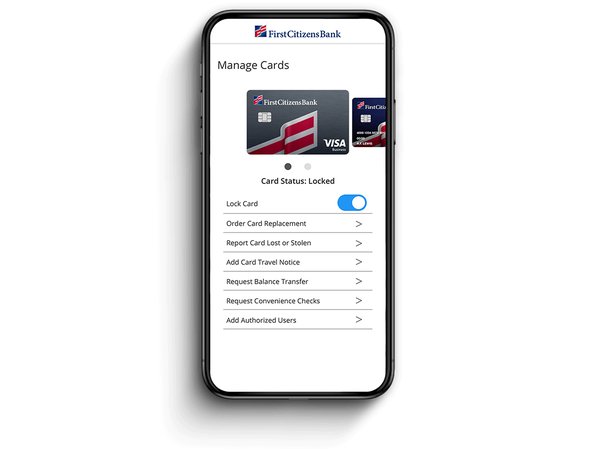

Set card alerts within Digital Banking

Businesses that use Digital Banking gain the added benefit of card alerts.