Purchase rate

Variable 25.49% APRD

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Market Update

Phillip Neuhart and Blake Taylor take a deep dive into GDP growth, the housing market, policy developments and the scale of AI investments.

Our secured cash back credit card lets you earn cash back while you work toward building or rebuilding your credit. It's a win-win.

Unlimited cash back

Earn 1% cash back on every $1 you spend on qualified purchases.D

Raise your score

Use your card responsibly to help establish or build your credit.

A card that evolves

Eligible accounts will be upgraded to an unsecured Cash Rewards account with additional benefits.D

A minimum refundable security deposit of $500 is required. It will determine, in part, your maximum credit limit.

Variable 25.49% APRD

$29D

Variable 25.49% APRD

3% of each transaction in US dollars

Pay with your phone

Add your cards to your mobile device and pay securely with Digital Wallet.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

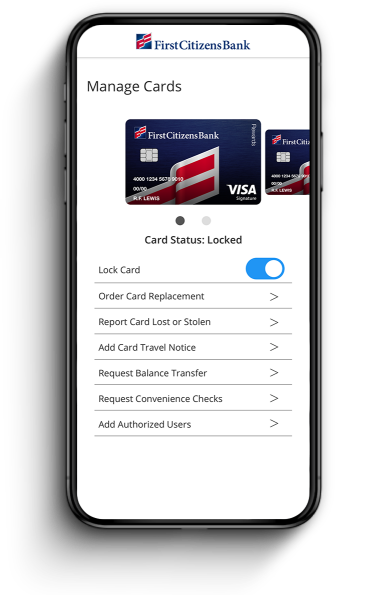

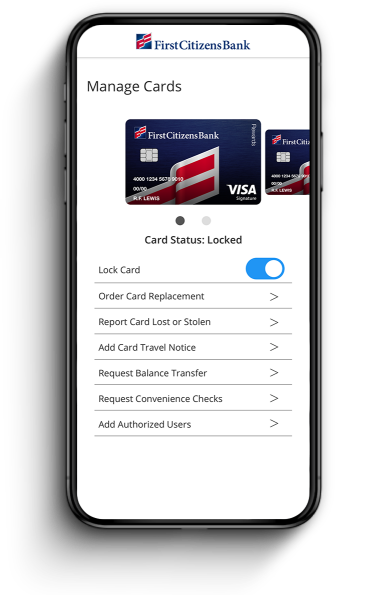

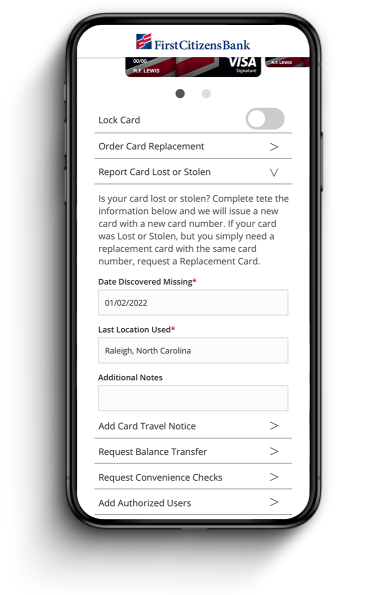

Temporarily lock your card

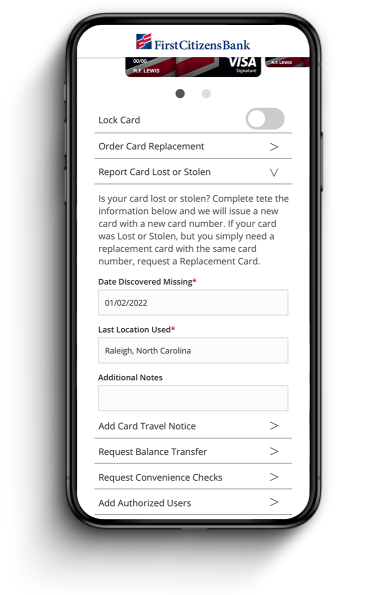

Report a lost or stolen card

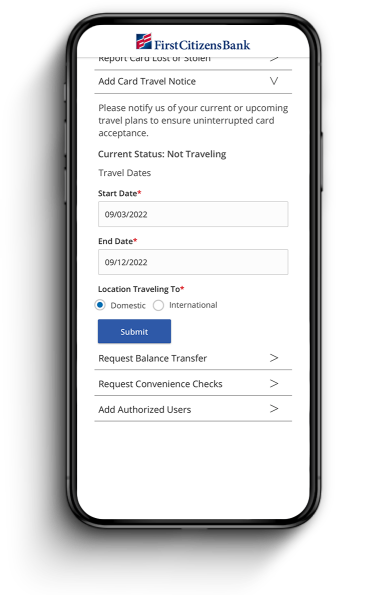

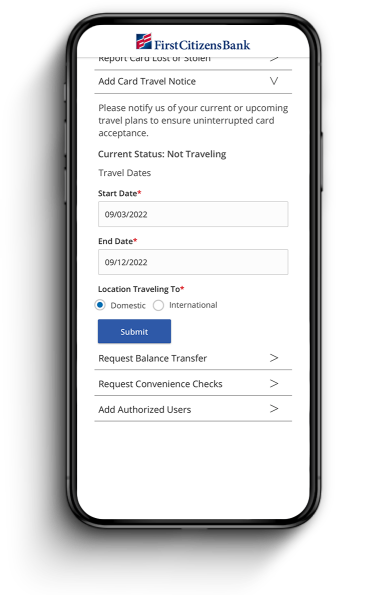

Notify us if you're traveling

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling

A secured credit card is a special credit card that requires you to put down a cash security deposit when you open the account. If you default on your payments, the cash deposit will serve as collateral. It also determines your credit limit (between $500 and $5,000 for our Secured Cash Back Credit Card.) The deposit is refundable if you close your account with no balance or graduate to an unsecured card. Secured credit cards can be especially useful for people with bad credit or little to no credit history.

Like any other credit card, you need to apply for a secured credit card. Once you've applied, we'll review your application, credit report and other information to determine whether you qualify. You'll hear back from us within 48 hours.

If you use a secured credit card responsibly, it can help build and improve your credit.

Cardholders earn 1% unlimited cash back on every $1 spent on qualifying purchases. That means for every $100 you spend, you'll earn $1 in rewards dollars. Certain terms, conditions and exclusions apply.

Yes. Cash back rewards expire after 3 years, on the last day of the month in which they were earned. For example, rewards dollars earned on January 3, 2023, will expire on January 31, 2026.

No. You begin earning rewards with the first dollar spent on qualifying purchases.

You can check your balance or redeem your cash back online anytime by logging in to Digital Banking. Then:

You can also check your balance or redeem cash back by calling the First Citizens Rewards Center at 866-645-1694, Monday through Saturday from 8 am to 9 pm ET and Sunday from 8 am to 6 pm ET.

You can redeem your cash back for a number of rewards:

No. There's no limit or cap on earning cash back with our secured cash back credit card.

You can redeem your cash back in any amount over $25. As long as it's $25 or more, you can request checking or savings deposits and statement credits in any amount down to the penny.

Please note that statement credits can't be applied toward any monthly minimum payments due.

Account openings and credit are subject to bank approval.

For more information, please see the First Citizens Consumer Credit Card Cardholder Agreement and Disclosure (PDF).

A First Citizens Secured Savings Account is required to obtain the Secured Credit Card Account. At least 100% of the credit line amount must remain on deposit in the Secured Savings Account. The deposit requirement ranges from a minimum of $500 to a maximum of $5,000 based upon the credit line amount. The deposit is refundable if you close your account and pay your balance in full, or if your account is upgraded to an unsecured card. Secured Savings account may have fees.

Purchases are defined as gross retail purchases less any returns or credits.

Cash and cash-like transactions, including, but not limited to, cash advances, ATM withdrawals, balance transfers, convenience checks, unauthorized charges, betting track or casino transactions, lottery tickets, money orders, money travelers' checks from nonfinancial institutions, foreign currency cash purchases, bail bonds, debit cancellation charges, and fees of any kind are excluded from earning reward dollars. Reward dollars earned for refused charges will be reversed. There is no cap on the amount of reward dollars that can be earned. All reward dollars earned, redeemed and expired will be determined based on a first-in, first-out ("FIFO") accounting convention.

Cellular Telephone Protection, Travel and Emergency Assistance Services, Auto Rental Collision Damage Waiver, Porch Piracy Protection, Rideshare Protection and Trip Delay Reimbursement provided by Visa®. Certain terms, conditions and exclusions apply. For complete details, please refer to Your Guide to Benefits for Visa Signature Cardholders (PDF) or Your Guide to Benefits for Visa Traditional Cardholders (PDF).

APR (Annual Percentage Rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of December 31, 2025, is 6.75% and may vary in the future. The transaction fee for cash advances is $10 or 5% of the amount of the cash advance, whichever is greater. The transaction fee for foreign transactions is 3% (0% for Travel Rewards) of each transaction after conversion to US dollars.

Balance transfer must occur within the first 90 days of account opening to qualify for the 0% APR (annual percentage rate) introductory offer and will be subject to a balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater. After the 12 billing cycle period, your APR will default to your purchase APR.

Periodically, the bank will review Secured Credit Card Accounts to determine whether they qualify for a collateral release and conversion to an unsecured credit card. Not all accounts will qualify for a collateral release and conversion to an unsecured credit card.

FICO® and “the score lenders use” are registered trademarks of Fair Isaac Corporation in the United States and other countries.

FICO® Score and associated educational content are provided solely for your own non-commercial personal review, use and benefit. First Citizens Bank and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. First Citizens Bank and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

The $29 initial annual fee will be charged to your Secured Credit Card Account during the first billing cycle and every 12 months thereafter.

Insurance products are not insured by the FDIC or any federal government agency and are not a deposit or other obligation of, or guaranteed by, any bank or bank affiliate.

Insurance products offered in California are offered by First Citizens Investor Services, Inc., d.b.a. FCIS Insurance Solutions, Agency #6001908.

APR (Annual Percentage Rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of December 31, 2025 is 6.75% and may vary in the future. The transaction fee for foreign transactions is 3% of each transaction after conversion to US dollars.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Earn more points on travel and get exclusive travel rewards.

Earn more points on special spending categories.

Transform everyday purchases into unlimited cash back.

Get our lowest available rate.

Still not sure? Compare Accounts

Need to make a change?