Balancing your financial life with the 60/20/20 rule

If you've struggled to find a budget you can stick with, the 60/20/20 budget may be the one element you're missing. It's a useful tool that can help you take control of your financial life—rather than feeling like your budget is controlling you.

Here's a closer look at what the 60/20/20 rule is, and how to apply it to your life for the long term.

What's the 60/20/20 rule?

The 60/20/20 budget rule applies a simple approach to how you should allocate your monthly income.

In this method, 60% of your monthly income goes to monthly living expenses. These can be fixed costs, meaning you pay the exact same amount each month, such as with mortgage payments. Or they can be fluctuating, like an electric or phone bill. If it's a true need, it goes in the 60% bucket. Any monthly minimum amounts you owe for credit card balances, car payments and student loans should go in this category.

Then, 20% of your monthly income is dedicated to saving. This can be money you put into an emergency savings fund, certificate of deposit, brokerage account or retirement account.

Finally, 20% of your monthly income goes to things you want to buy but could live without. Depending on your lifestyle and preferences, this might be shopping, going out to dinner or travel. You decide what expenses fall into this bucket.

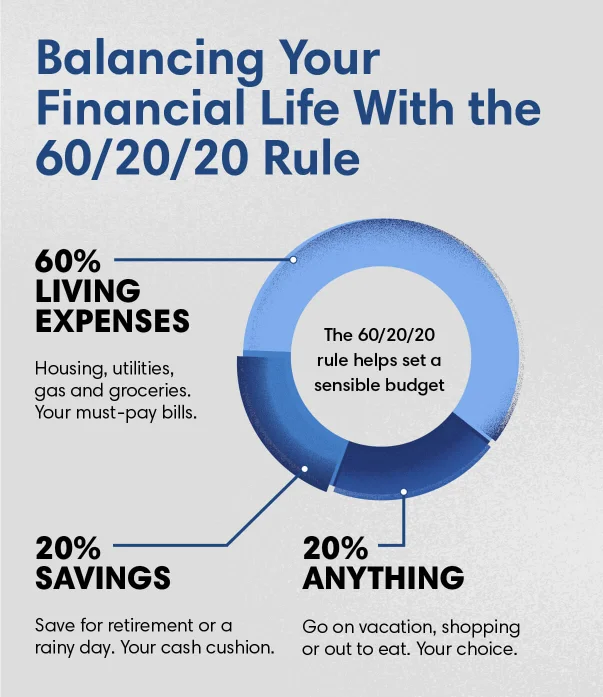

Balancing your financial life with the 60/20/20 rule

The 60/20/20 rule helps set a sensible budget.

- 60% living expenses: Housing, utilities, gas and groceries. Your must-pay bills.

- 20% savings: Save for retirement or a rainy day. Your cash cushion.

- 20% anything: Go on vacation, shopping or out to eat. Your choice.

How to use it

Figuring out how to use this budgeting technique is easy—there's no need for a budget calculator. Just start with your monthly income and do some simple math. Here's an example:

Let's suppose you make $3,000 a month. Because 60% of $3,000 is $1,800, that's how much you should spend on living expenses like rent, utility bills, gas and groceries each month.

Because 20% of $3,000 is $600, you'd put that much into some type of savings, investment or retirement account.

The remaining $600—the last 20%—is yours to allocate as you choose.

Once you figure out these boundaries, you just need to track where your money goes, so you know you're sticking to them throughout the month. The more you do it, the easier and more intuitive it'll become.

The benefits

This budget gives you the flexibility to spend some of your money how you want while ensuring you're making saving a priority. While managing debt and spending is key to financial stability, having a savings account gives you the safety net you need if you have an emergency, job loss or medical issue. Once you've built up an emergency savings fund equivalent to 3 to 6 months' worth of your monthly income, you might consider allocating your 20% savings toward building your net worth with investments or retirement contributions.

The 60/20/20 rule gives you plenty of freedom to make it your own. You can easily adapt it to fit your changing financial needs and priorities as you move through life. Want to get aggressive about knocking down that student loan debt? Maybe you allocate some of your 20% spending category to put more money toward your loan balance every few months. Need some new furniture? You could pull extra savings from your spending category for a few months until you're ready to buy.

Simple to implement and easy to stick to, the 60/20/20 budget puts adequate boundaries in place. This way, you're always aware of where your money goes, leaving you in charge of your financial choices. And if you ever need advice or have questions about budgeting, you can always talk with a banker at your local branch.