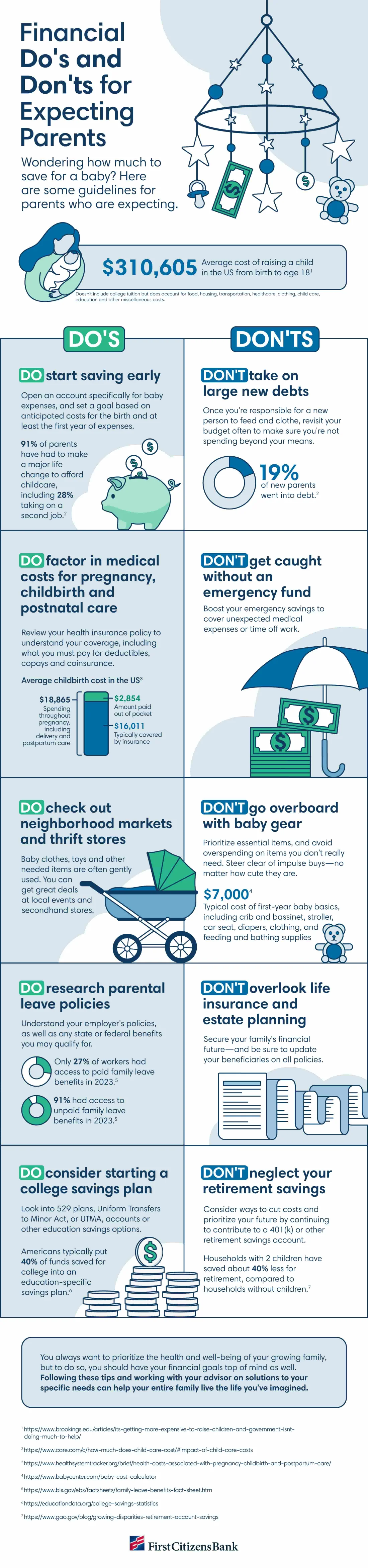

Wondering how much to save for a baby? Here are some guidelines for parents who are expecting.

- $310,605 is the average cost of raising a child in the US from birth to age 18.1 This doesn't include college tuition but does account for food, housing, transportation, healthcare, clothing, child care, education and other miscellaneous costs.

Do start saving early

Open an account specifically for baby expenses, and set a goal based on anticipated costs for the birth and at least the first year of expenses.

- 91% of parents have had to make a major life change to afford child care, including 28% taking on a second job.2

Don't take on large new debts

Once you're responsible for a new person to feed and clothe, revisit your budget often to make sure you're not spending beyond your means.

- 19% of new parents went into debt.2

Do factor in medical costs for pregnancy, childbirth and postnatal care

Review your health insurance policy to understand your coverage, including what you must pay for deductibles, copays and coinsurance.

- The average cost of childbirth in the US is $18,8653 throughout the pregnancy, including delivery and postpartum care. $2,854 is paid out of pocket, while the remaining $16,011 is typically covered by insurance.

Don't get caught without an emergency fund

Boost your emergency savings to cover unexpected medical expenses or time off work.

Do check out neighborhood markets and thrift stores

Baby clothes, toys and other needed items are often gently used. You can get great deals at local events and secondhand stores.

Don't go overboard with baby gear

Prioritize essential items, and avoid overspending on items you don't really need. Steer clear of impulse buys—no matter how cute they are.

- $7,000 is the typical cost of first-year baby basics,4 including crib and bassinet, stroller, car seat, diapers, clothing, and feeding and bathing supplies.

Do research parental leave policies

Understand your employer's policies, as well as any state or federal benefits you may qualify for.

- Only 27% of workers had access to paid family leave benefits in 2023.5

- 91% had access to unpaid family leave benefits in 2023.5

Don't overlook life insurance and estate planning

Secure your family's financial future—and be sure to update your beneficiaries on all policies.

Do consider starting a college savings plan

Look into 529 plans, Uniform Transfers to Minor Act, or UTMA, accounts or other education savings options.

- Americans typically put 40% of funds saved for college into an education-specific savings plan.6

Don't neglect your retirement savings

Consider ways to cut costs and prioritize your future by continuing to contribute to a 401(k) or other retirement savings account.

- Households with 2 children have saved about 40% less for retirement, compared to households without children.7

You always want to prioritize the health and well-being of your growing family, but to do so, you should have your financial goals top of mind as well. Following these tips and working with your advisor on solutions to your specific needs can help your entire family live the life you've imagined.

Sources:

1 https://www.brookings.edu/articles/its-getting-more-expensive-to-raise-children-and-government-isnt-doing-much-to-help/

2 https://www.care.com/c/how-much-does-child-care-cost/#impact-of-child-care-costs

3 https://www.healthsystemtracker.org/brief/health-costs-associated-with-pregnancy-childbirth-and-postpartum-care/

4 https://www.babycenter.com/baby-cost-calculator

5 https://www.bls.gov/ebs/factsheets/family-leave-benefits-fact-sheet.htm

6 https://educationdata.org/college-savings-statistics

7 https://www.gao.gov/blog/growing-disparities-retirement-account-savings