Compare our cards

Use our credit card comparison table to find the features, rates and rewards you want.

Features |

Earn More on Travel |

Earn Rewards on Everyday Purchases |

Earn Unlimited Cash Back |

Our Lowest Rate |

|---|---|---|---|---|

Purchase rate |

16.49% to 25.49% variable APRD based on creditworthiness |

16.49% to 25.49% variable APRD based on creditworthiness |

16.49% to 25.49% variable APRD based on creditworthiness |

13.49% to 22.49% variable APRD based on creditworthiness |

0% introductory APR for first 12 months, then 16.49% to 25.49% variable APRD |

0% introductory APR for first 12 months, then 16.49% to 25.49% variable APRD |

0% introductory APR for first 12 months, then 16.49% to 25.49% variable APRD |

0% introductory APR for first 12 months, then 13.49% to 22.49% variable APRD |

|

Base earnings for every $1 spentD |

1.5 points, unlimited |

1 point |

1.5% cash back, unlimited |

icon: sys-close |

Bonus category earnings for every $1 spentD |

3 points for travel, 2 points for dining |

3 points for gas and select streaming services, 2 points for grocery and drug stores |

icon: sys-close |

icon: sys-close |

Additional benefits |

$100 annual ancillary travel creditD |

icon: sys-close |

icon: sys-close |

icon: sys-close |

Annual fee |

$95, waived the first yearD |

$0 |

$0 |

$0 |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

|

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-close |

|

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

|

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

|

Visit your local branch to apply for a credit card

Balance Transfers

See how much you can save

0% introductory APRD for the first 12 months, then the purchase rate applies (see table above).D

0% APRD

Not quite sure? Answer a few questions to find the right credit card for you.

See how much you can earn with your rewards

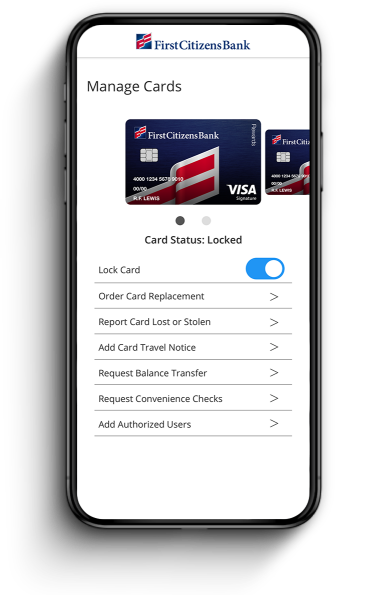

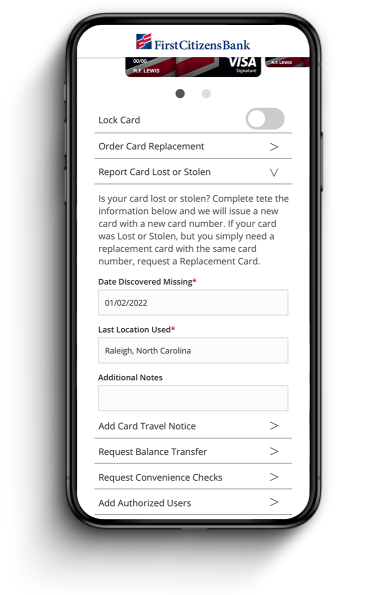

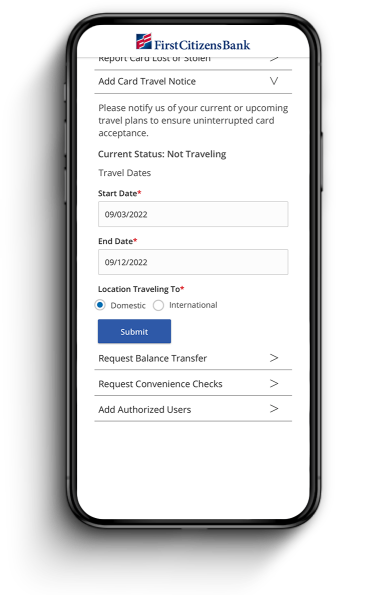

Manage Your Cards

Access any of our card services from your phone

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling