Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

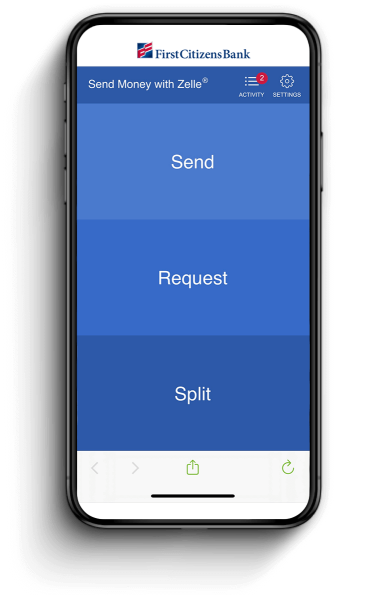

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Paperless statements are required. To be eligible for Primary Checking, you must sign up to receive First Citizens paperless statements within 60 days of account opening. If you do not sign up and receive paperless statements, your account will be converted automatically and without prior notice to you to a Select Checking account and will be subject to the fees and charges applicable to a Select Checking account. The applicable fees and charges will be debited from your account without further notice to you and will appear on your account statement. If you overdraw your account, fees may apply. Refer to our Personal Account Disclosures for full details.

Avoid the $18 monthly fee when you meet any one of these criteria: $5,000 combined daily balance on select accounts (Together Card, Regular Savings, Online Savings, Tiered Money Market Savings, Premier Relationship Money Market Savings, CDs, IRAs or Investor Services Account), at least $4,000 in monthly ACH direct deposits, EquityLine of at least $25,000, or $10,000+ original consumer loan (new or used auto, light or heavy truck, boat, aircraft, unsecured personal loan, or mortgage [excludes mortgages that First Citizens does not retain servicing]).

Avoid the $25 monthly fee when you meet any one of these criteria: $25,000 combined daily balance on any First Citizens deposit account (Together Card, Regular Savings, Online Savings, Tiered Money Market Savings, Premier Relationship Money Market Savings, CDs, IRAs or an Investor Services Account), at least $6,500 in monthly ACH direct deposits, EquityLine of at least $100,000, or $25,000+ original consumer loan (new or used auto, light or heavy truck, boat, aircraft, unsecured personal loan, or mortgage [excludes mortgages that First Citizens does not retain servicing]).

With the exception of the Sure Advantage and Together Card products (which are ineligible for overdraft service), if the available funds in your account are insufficient to pay an item when presented, First Citizens Bank will make a decision on whether to pay the item or return it unpaid. When we pay an item for which there are insufficient funds, it results in an overdraft. The following overdraft fee structure applies to eligible Consumer accounts: First Citizens Bank will charge you $25 each time we pay an item resulting in an overdraft, up to our limit of three (3) overdraft charges per business day. We will not charge you for overdrafts caused by transactions of $5.00 or less, nor for items returned unpaid. You are obligated to repay overdrafts immediately. Consumers have the option to decline overdraft service. First Citizens Bank also offers overdraft protection programs. Please see our Deposit Account Agreement (PDF) for additional details.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941