Knowledge is power—especially when it comes to your finances

When you have a clear picture of where your money's going, it's easier to plan ahead and make decisions. The tools and services on this page can help you track and manage your funds, so you're always in the loop and up to date.

Prepare for the unexpected

Be proactive and layer multiple levels of protection.

Enjoy purchase assurance

Always know your balance and keep track with our online tools.

Avoid service disruptions

Stay in the know with security, card and account alerts.

Proactive protection

Educational resources

Brush up on your expertise by exploring our growing library of Insights. Browse dozens of simple, easy-to-read articles in a range of financial categories:

- Budgeting and Saving

- Banking and Security

- Calculators and more

Overdraft protection and services

Your checking account is automatically provided Basic Overdraft Service, but it's not your only option. Layering overdraft protection options or opting in to Enhanced Overdraft Service can help you prepare for unexpected expenses.

- Overdraft protection allows funds from your linked accounts to be used to cover overdrafts

- Enhanced Overdraft Service extends our Basic Overdraft Service to include potential coverage for ATM and one-time debit card transactionsD

Direct deposit

Enjoy the convenience of recurring automatic deposits with our direct deposit service.

- Great for regular monthly income (salary, pensions, SSI benefits, etc.)

- Receive an alert when your money is deposited

- Get same-day access to your deposited funds

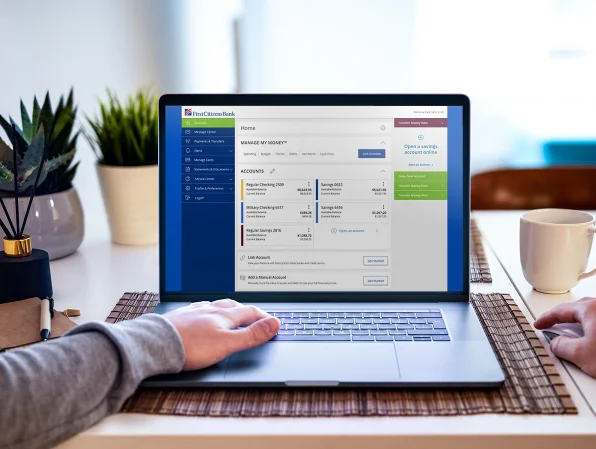

Manage your money online

Digital Banking

It's easy to keep a bird's-eye view of your finances with our online banking platform.

- Check your account balances anytime, anywhere

- Set up a budget and track your expenses

- Easily move money between accounts

- View your monthly statements and set up alerts

Mobile banking

Download our secure mobile app and access Digital Banking on the go. You can even deposit checks without visiting a branch.

Zelle® payments

Zelle® makes it easy and safe to send money directly to almost any bank account in the US—usually within minutes.D

Stay updated with alerts

Log in to Digital Banking to set up and manage your security, card and account alerts. You'll receive a text, an email or both whenever an alert is triggered.

Account alerts

These alerts help you track your account balances, and they can be customized to suit your needs.

- Get daily balance updates

- Receive an alert when overdraft protection is used

- Be notified when your balance drops below a specific amount

Card alerts

If you want to track debit or credit card activity, these alerts will keep you in the loop.

- Get a reminder before payment is due

- Be alerted if transactions exceed a specific amount

- Know when your card number is used to make a purchase

Security alerts

Turning on security alerts will help you stay informed about changes to your Digital Banking profile.

- Know if your login ID or password is changed

- Be alerted when someone logs in to your account

- Get notified when an external transfer is authorized