Checking and savings

Checking and savings accounts are available with no minimum balances or service feesD and include a Visa® debit card and overdraft protection.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Market Update

Phillip Neuhart and Blake Taylor take a deep dive into GDP growth, the housing market, policy developments and the scale of AI investments.

Our Bank at Work program offers financial wellness employee benefits to help attract and retain top talent. Explore our comprehensive solutions so you can offer employee banking perks in your own business.

Attract employees

Reward and retain employees with time- and money-saving benefits and services.

Avoid a minimum balance

Never worry about maintaining a minimum balance.

Access well-being tools

Access free educational sessions and consultations.

Checking and savings accounts are available with no minimum balances or service feesD and include a Visa® debit card and overdraft protection.

Get free checks, money orders and up to five cashier's checks.

Get $500 toward closing costs on a First Citizens mortgage,D preferred rates on business certificates of deposit and a free 3" x 5" safe deposit box.

Receive free financial evaluations, employee banking discounts and workplace financial education sessions.

Bank at Work is available for businesses with 10 or more employees.

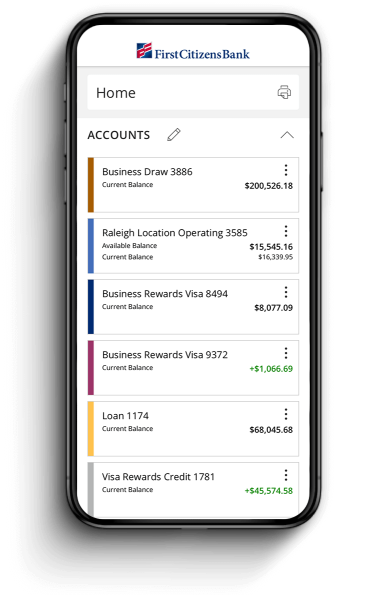

Manage your accounts from anywhere

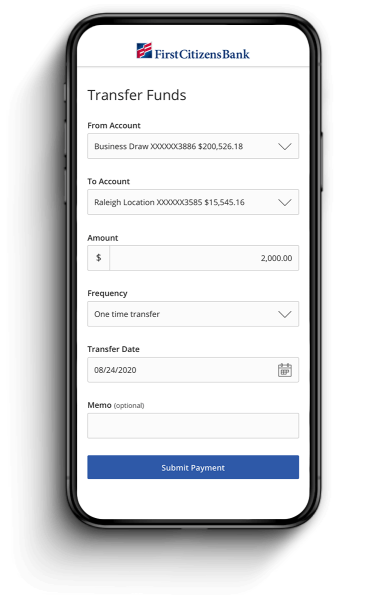

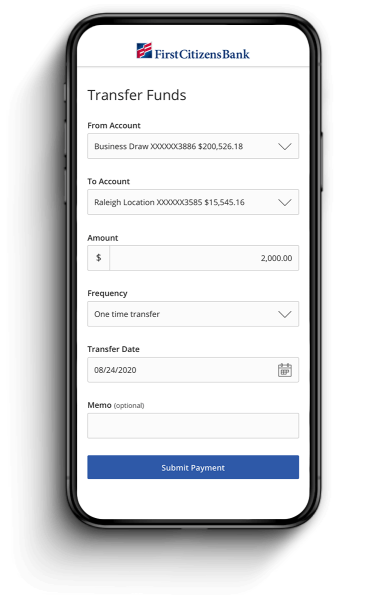

Send & transfer money with ACH and wires

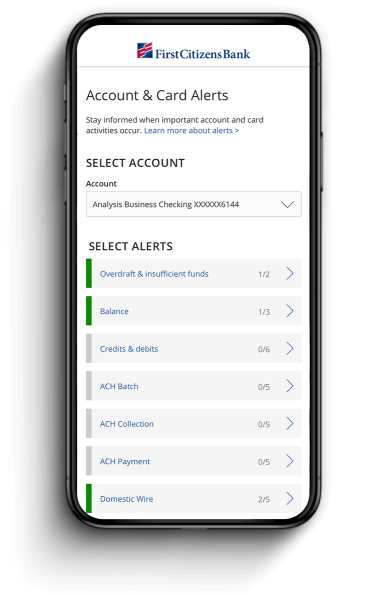

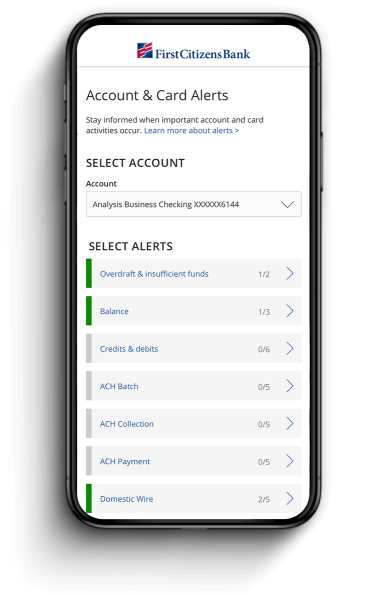

Receive account and security alerts

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts

Our Bank at Work program is an interest-bearing employee checking account with no minimum balance requirement and no monthly service charges when qualifiers are met. Bank at Work is for employees of our business clients and supplements your financial wellness employee benefits.

Bank at Work is available to companies with 10 employees or more.

Account openings and credit are subject to bank approval.

The following qualifiers are in place to avoid monthly service charges on Bank at Work checking. Customer must maintain direct deposit of pay into the Bank at Work checking account (at least one direct deposit per month is required), the customer’s employer must remain an active participant in the Bank at Work program and the customer must maintain continuous employment with the company through which the Bank at Work Program is offered. This offer is limited to one Bank at Work checking account per employee. This offer may be withdrawn or changed at any time without notice. Other restrictions and fees may apply.

Only one Bank at Work credit allowed per loan. The credit is only intended for the refinance or purchase of a primary home and excludes Money Saver Mortgages. The Bank at Work credit is not available on construction loans.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.