Accelerate your funding with an auto loan that's right for you

Whether you're looking to buy a new car or refinance your existing auto loan, our auto financing team can help. We'll guide you through the lending process, lock in your interest rate and get you in the driver's seat.

Fixed rates

Get a low monthly payment, thanks to our competitive auto loan rates.

Quick and easy access

Get access to funds in as little as 24 hours.

Flexible terms

Up to 84-month terms are available for new auto loans.

Save more when you finance your vehicle with a new auto loan

Rates as low as

5.69% APRD

Auto Loan Benefits

Make it easier than ever to get a new ride

Whether you're buying a new or simply new-to-you car, we've got the auto loan you need.

How to get started

Buying a new or used vehicle is easier when you understand how to get an auto loan. Even if you're buying a new car from a dealership, you can choose where to get your auto financing—which can lead to substantial savings.

Step 1

Shop for a car

The first step toward getting an auto loan is finding the car you'd like to buy. This could mean a new or used car from a dealership or a private seller. Shopping around and comparing prices can help you find the best deal.

Step 2

Apply for an auto loan

Contact us or visit a local branch to apply for an auto loan. One of our auto financing experts will gather information about you and the vehicle you'd like to purchase.

Step 3

Prepare for closing

As we prepare to finalize your loan, we may reach out for more information. Feel free to ask any questions about the loan process. We're here to be your guide.

Step 4

Close your loan to receive your funds

You'll sign closing documents to finalize your auto loan. After closing, you'll receive your funds, which could arrive in as little as 24 hours. Then you can return to the seller to buy and enjoy your new ride.

Auto Loan Calculator

Estimate your truck or car loan payment

Use this auto loan calculator to estimate your monthly payment. Try changing values, like down payment amount or loan length, to find the auto financing option that works for you.

Digital Banking

Bank from anywhere with your mobile devices

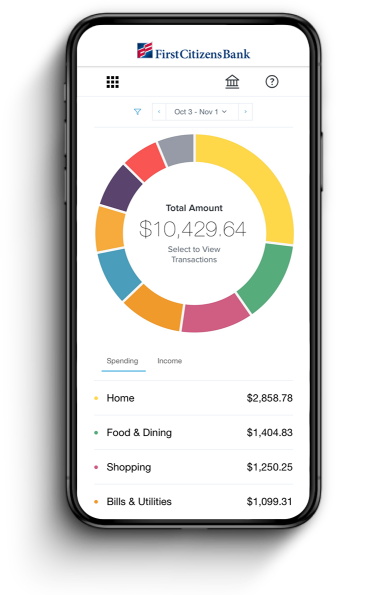

Track your spending habits

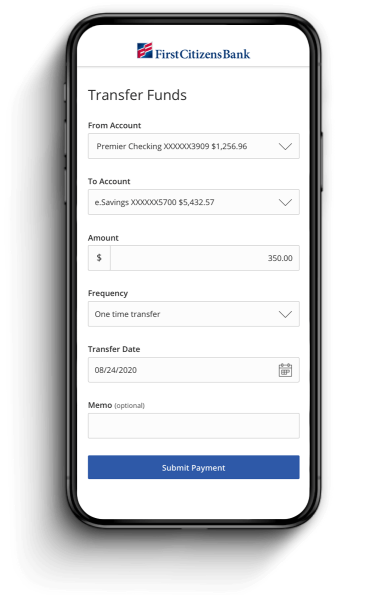

Seamlessly move your money

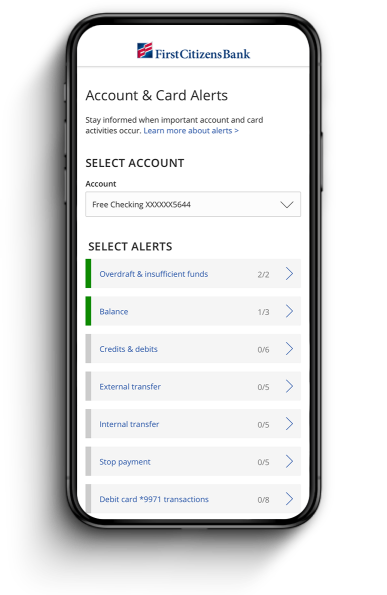

Set alerts for transactions