Simplify your solutions with commercial checking accounts

Designed for high-activity businesses with several related accounts and more complex financial needs, our commercial checking can help manage and improve cash flow through both interest-bearing and non-interest-bearing accounts.

Low monthly feeD

Offset some or all monthly expenses with an Earnings Credit Rate, or ECR.D

Flexibility

Manage a variety of cash flow options and optimize earnings.

Insight

Aggregate deposit accounts into a single relationship.

Commercial Checking Account Services

Empowering you to stay ahead

Streamline your business operations with our analysis-focused commercial checking account services, designed to optimize your financial management and support your growth. Our commercial checking account puts your money to work for you through a competitive ECR.

Let's start a conversation—we're here to help

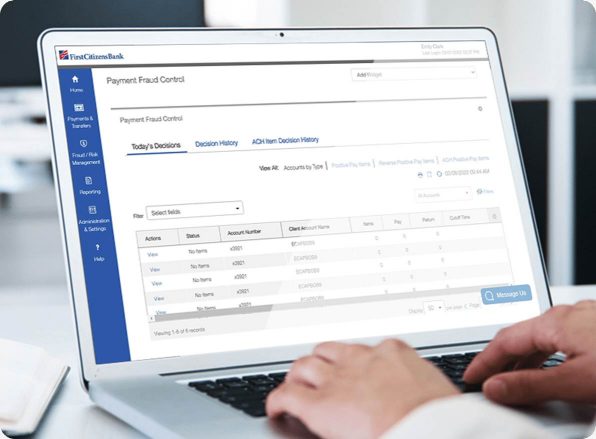

Digital Banking

Commercial Advantage

Accurately track cash flow

Manage your business on the go

Keep your assets secure