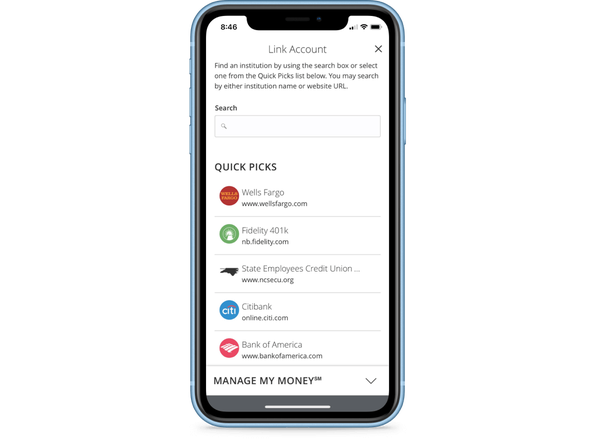

Accounts

See the big picture

Get a glimpse of your full financial picture by adding all your accounts to Manage My Money℠ in Digital Banking. You can even add the accounts you have with other banks.

- View your First Citizens account balances and transactions

- Connect your non-First Citizens checking, savings, mortgage, credit cards, loan and investment accounts

- Add non-bank accounts manually, such as the equity in your home or other property, fully paid for vehicles and other assets

- View your categorized transactions across all your accounts

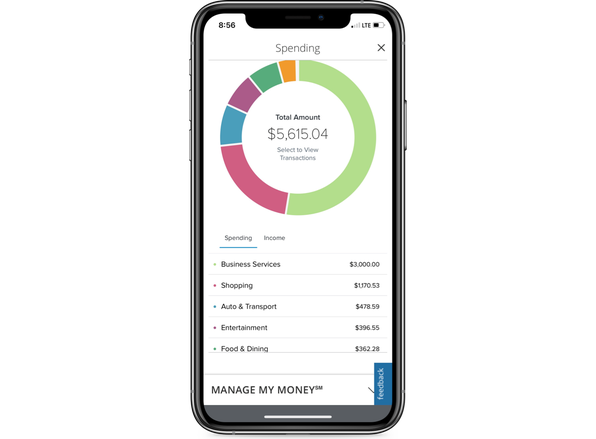

Spending

Know where your money goes

Clearly see where your money is going across all of your accounts.

- View your categorized spending across all your accounts

- See how much you spend on rent, utilities, travel, groceries, shopping and more

- Edit or re-categorize transactions, create sub-categories of spending and even split transactions between categories

- Track both personal and business expenses

Budget

Create and manage your budget

Use our money management tool to see how your spending impacts your budgets.

- Create budget categories to help you track your spending

- Visualize how your budgets are tracking with simple color coding. Green is for healthy budgets, red means you're over budget and yellow lets you know to watch your spending

- Review specific transactions in each budget category and update your budget if needed

- Create sub-budgets to track specific expenses

Trends

Track trends over time

Monitor how your spending changes over time to plan accordingly.

- Track your spending changes over time by category

- Use this view to help plan for unexpected or seasonal spending, such as increased travel in the summer or holiday spending

- See the transactions that lead to large changes in monthly spending to help you budget accordingly

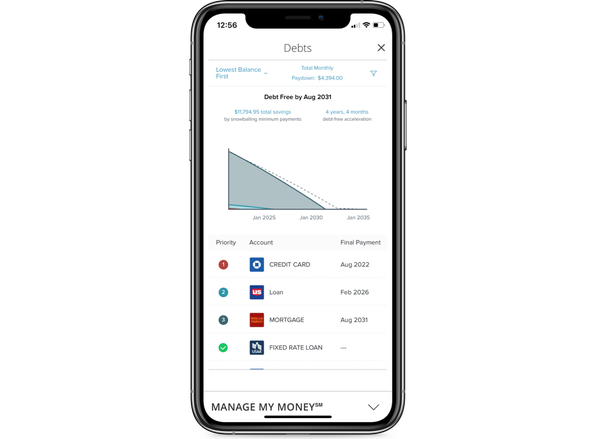

Debt

Keep tabs on debt

See all of your debt, including credit cards, car and student loans.

- View balance, interest rates and payments due for each loan or credit card (some external accounts may require entering this information if unavailable)

- Develop payoff scenarios around paying down debt based on lowest amount owed, highest interest rate and more

- Set monthly debt payment targets to help you become debt free sooner

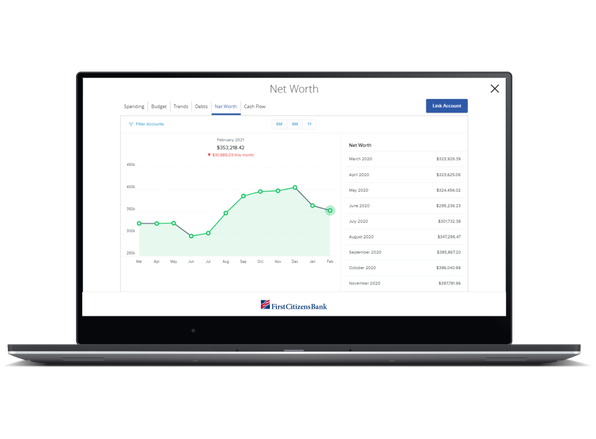

Net Worth

Monitor your net worth

See your full financial picture by linking all of your accounts with other financial institutions.

- View your net worth, including gains and losses, for all your accounts

- See how your net worth changes over time

- Analyze specific gains and losses for each account over time

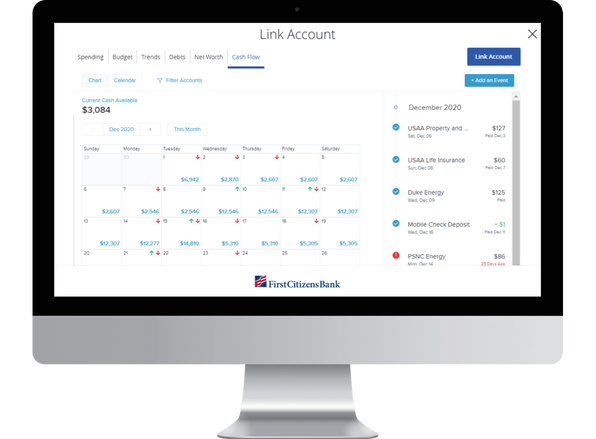

Cash Flow

Manage and view your cash flow

Keep track of your balances and how your scheduled transactions impact your account balances.

- See how payments including rent, utilities, recurring subscription services and other payments impact your balance

- Add your paycheck, direct deposit and other income to see your full monthly cash flow

- See how your balances change throughout the month, and if you need to consider making a transfer to avoid a low-balance day

Ready to get started?

Step 1

Open an account

To use Manage My Money, you'll need a First Citizens checking account.

Step 2

Log in

You automatically have access to Digital Banking with your new account. Simply log in.

Step 3

Add accounts

Select Manage My Money from the main menu to link other bank accounts, loans, investments and assets.