5 Cs of credit: What banks look for when lending

While banks don't have universal rules about what makes a person or business creditworthy, they're guided by some general principles. The five Cs of credit—character, capacity, capital, collateral and conditions—offer a solid credit analysis framework that banks can use to make lending decisions. Making choices that reflect the five Cs and building the habits you need to get there can take some of the stress out of applying for a new credit card or loan.

The five Cs provide a helpful rubric to measure your creditworthiness based on several factors. Let's dive in to the definition and purpose of each factor to learn why the five Cs of credit are important to determine loan eligibility.

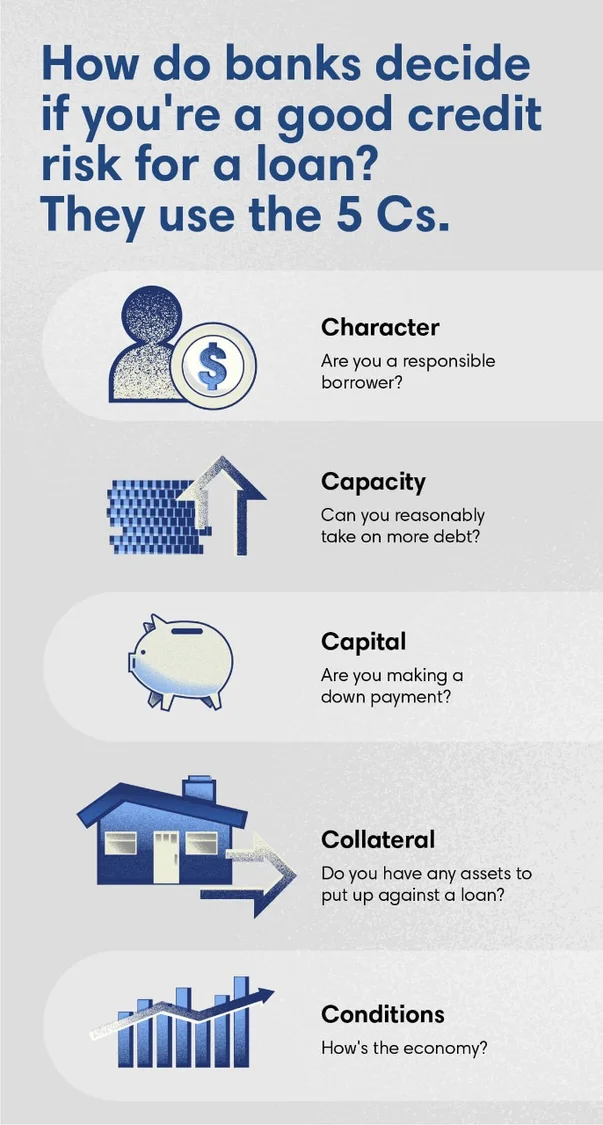

How do banks decide if you're a good credit risk for a loan?

They use the 5 Cs.

- Character: Are you a responsible borrower?

- Capacity: Can you reasonably take on more debt?

- Capital: Are you making a down payment?

- Collateral: Do you have any assets to put up against a loan?

- Conditions: How's the economy?

1Character

Character helps lenders discern your ability to repay a loan. Particularly important to character is your credit history. Your credit report will show all debts from the past 7 to 10 years. It provides insight into your ability to make on-time payments, as well as your length and mix of credit.

Your credit report will also assign you a FICO® score ranging from 300 to 850. Many lenders have a minimum FICO score you need to meet before you're eligible for a loan. Typically, the higher your score, the more likely you are to qualify for the types of credit you're after.

If you're a small business owner, lenders are likely to ask your permission to review your personal credit reports and will contact your bank to verify your handling of checking accounts and existing loans. Your personal credit history directly reflects your character and affects your ability to borrow for your business.

How to improve your credit character

Begin by ensuring that your credit report is accurate. You can request a free copy of your credit report from AnnualCreditReport.com once a year. If you find any discrepancies, report them to the three major credit bureaus: Equifax, Experian and TransUnion.

Payment history is one of the largest components of your FICO score. One way is to pay your bills on time by setting up automatic online payments for your debts. You can also pay down existing debt or use a co-signer with good credit when applying for a loan.

2Capacity

Capacity measures your ability to repay new debt based on your current obligations. Here, your cash flow is paramount, along with your debt-to-income ratio.

Lenders want to know how much you owe versus how much you own. The lower your debt-to-income ratio, the more favorably a bank will look at your request for credit. Other considerations include length of time at your current job and income stability.

How to improve your credit capacity

First, calculate your personal debt-to-income ratio by dividing your total monthly debt by your gross monthly income. Assess if the number is too high to apply for additional debt. Typically, banks look for a debt-to-income ratio of less than 36% as an indicator that a borrower is responsible with credit.

If you have low capacity due to a high debt-to-income ratio, try to pay down your debt. Debt consolidation or refinancing can help you improve your cash flow. Also, apply for a loan when you know you can prove job or income stability. The longer you're at a job—or have been in business—the more favorable your chances for a loan.

You can use a personal debt consolidation calculator or business debt consolidation calculator to determine whether you should consolidate your debt.

3Capital

Capital shows lenders you're serious and committed to the credit you're seeking. For a business loan, this means you've invested some of your own money into the business. For individual loans, this means having a down payment when applying for a loan or mortgage.

Down payments reduce the loan amount you'll need to finance your purchase. For example, if you purchase a $250,000 house with a 20% down payment, your loan amount is reduced by $50,000. Your $200,000 mortgage represents 80% of your home's value—in other words, your loan-to-value ratio is 80%. In mortgage lending, borrowers with a loan-to-value ratio of 80% or lower usually qualify for the best interest rates.

Do you have any cash on hand to provide as capital? Often, the more equity you have, the more favorable your loan conditions will be.

How to improve your credit capital

If you don't have savings, there are loans you can still apply for without capital. Your loan terms may not be as desirable, but if you're in good standing with the other Cs of credit, a bank may still lend you money.

If you don't need to borrow right away, you can build capital over time. Stick to a budget, find ways to save and create an emergency fund before borrowing. If an unexpected event occurs—such as losing your job—you'll want a nest egg to continue making timely payments on your loan.

4Collateral

Collateral provides assurance to the bank in case you're unable to pay for the loan. For example, if you secure an auto loan, the car is your collateral. If you default on your loan, the bank can repossess the car.

During the credit analysis phase, lenders will look at what sort of property—bank accounts, real estate, equipment or automobiles—they'll be able to use as collateral when they offer you a loan. Without collateral to secure your loan, lenders will see you as a bigger risk.

How to improve your credit collateral

Take stock of your possessions. Do you owe debt on any of them? What's the value of your property? These items may be seen as collateral if you're unable to repay your loan.

If you don't have collateral but still need to secure a loan, you might look for a co-signer. This is a person who has collateral to back the loan. Remember, using a co-signer is a big responsibility. You now have your own—and someone else's—financial security at stake.

5Conditions

This refers to the current economic health of the market and the industry you work in. Is the country going through an expansion or a recession? Are your prospects for advancing in your professional life currently growing or shrinking? What are the current employment trends, and are there layoffs expected?

How to improve your credit conditions

This component of the five Cs of credit is the least in your control, which makes it critical to plan ahead. Banks are more willing to give you credit during expansionary periods. When market conditions are favorable, this may be a good time to see what terms are available for the types of credit you're currently seeking.

Having a clear plan in place for what you want to do with the money can help you or your business secure a loan. In slower economic periods, banks prefer specific loans—such as home improvement loans—over signature loans, which can be used for any purpose.

Build a strong financial foundation

Keep these characteristics in mind as you try to better understand your credit situation and work toward your financial goals. If you can show a history of responsibly using credit in a way that reflects the five Cs of credit, you'll put yourself in a better position to obtain the financing you need to build the life you want.

What's your next financial goal? Here are a few of our products that we think could help you get there.