Equipment leasing versus financing: Which is best?

From the latest imaging technology to industrial forklifts, your commercial enterprise may need some high-cost business equipment to keep operations flowing smoothly. Several options exist to help your business access the equipment it needs to function, including term loans, lines of credit and several types of equipment leases.

But is it better for a business to buy or lease equipment? This decision may depend on several key factors, including the useful life of the asset you're looking to acquire, the tax implications and more. Here's what to consider as you explore the benefits of equipment leasing versus financing.

Key takeaways

- Financing equipment may be preferable if you plan to hang on to the equipment for an extended period.

- Leasing equipment may be more effective for assets that become outdated quickly or when the equipment is needed short term.

- Equipment leases tend to be less costly in the short term. Financing, on the other hand, allows you to build equity, which may save money in the long term.

- It's important to understand the impact of depreciation on owned assets because it may lead to significant tax savings, especially for larger businesses.

Equipment leasing versus financing

While there's no universal solution to the equipment leasing versus financing debate, time is a clear distinguishing factor. Equipment financing may be preferable if you plan to hang onto the equipment for an extended period.

Obtaining financing through a loan or with a line of credit often costs less than leasing in the long run because once the asset is fully paid for, you'll have use of it without incurring an ongoing payment. You may even be able to leverage it as collateral for future financing.

On the flip side, leasing may be ideal for shorter-term needs. "Maybe you need a backhoe for a 3-year project, but that piece of equipment will not be necessary for future projects," explains Scott Lynch, Director of Sales for Equipment Finance at First Citizens. "In this scenario, a lease makes sense because you can bill the monthly payments to the job."

Robyn Gault, Senior Vice President for Commercial Partnerships at First Citizens, notes that leasing facilitates upgrades for assets affected by rapid innovation. "A lease is a pay-for-use model, and that's a flexible option for maintaining best-in-class equipment," she says.

Leases may be beneficial even for assets with a long, useful life because they may help your company stay nimble in the face of changing market conditions. In recent years, for example, increased volatility in the agricultural sector has led more farmers to consider leasing strategies for farm equipment.

Beyond how long you plan to keep the equipment, consider the specific attributes of each approach before making a decision.

How does equipment leasing work?

As with any other type of lease, an equipment lease is essentially a rental contract—where you agree to pay a set monthly fee for the use of the equipment throughout the duration of the agreement. Commercial equipment leases typically range from 24 to 72 months—after which time you may renew the lease, return the equipment or purchase the equipment at its fair market value or a bargain purchase price, depending on the type of lease.

Capital lease versus operating lease

If you opt to lease equipment, it's important to understand the differences between an operating lease and a capital lease—also called a finance lease. An operating lease is a pay-for-use agreement without any ownership obligation. As a result, monthly payments may be deducted as a regular business expense.

A capital lease, on the other hand, will give you the option to purchase the item at the end of the term. As a result, you may be able to claim depreciation and interest expense. However, there are additional stipulations to consider, so it's a good idea to consult with an accounting and tax specialist.

Types of equipment leases

Many variations of commercial equipment leases exist. However, in general, there are several common types—a true operating lease, a bargain-price capital lease and another, which can be set up as either a capital or an operating lease.

- Fair market value, or FMV, lease: With an FMV lease—also known as a true lease—you'll pay a fixed rate throughout the duration of the agreement. At the end of the lease term, you may exercise an option to purchase the equipment based on its fair market value at that time, but you're not obligated to do so.

- $1 buyout lease: A $1 buyout lease is a capital lease that sets a nominal purchase price for the leased asset—typically a single dollar—at the end of the lease term.

- Terminal rental adjustment clause, or TRAC, lease: A TRAC lease is a common way to finance a large commercial fleet of vehicles. These leases tend to be much more flexible than other types, allowing you to negotiate a tradeoff between lower monthly payments and higher residual value.

Advantages of leasing equipment

Leasing equipment may free up capital for other uses—a significant benefit over equipment financing. With no down payment typically required and the possibility of lower monthly payments compared to financing, equipment leases tend to be less costly in the short term. Some lease agreements may even include maintenance and service, further lowering operating costs.

Foregoing ownership means taking on less business risk in other ways as well—such as the risk of technological obsolescence, the potential for a decline in market value and changes in the business environment that may necessitate scaling operations up or down.

How does equipment financing work?

At its core, financing involves securing a loan or line of credit to purchase one or more items of equipment. The interest rates attached to the financing will vary based on macroeconomic conditions, your business's credit history, the longevity of your company's relationship with the lender and the type of equipment you're seeking to finance. Larger commercial businesses typically use two primary types of commercial loans for equipment financing—term loans and lines of credit.

Term loans for equipment financing

If you use a term loan to finance equipment, you're agreeing to make fixed payments for a specified period. Lenders offering equipment loans typically use the equipment itself as collateral, minimizing their risk. This allows borrowers to acquire the necessary equipment without using their working capital or other assets as security. Some lenders will even provide 100% financing for high-ticket items.

Equipment line of credit

With a commercial line of credit, you'll have access to a set amount of capital you can borrow against, pay down and use again as needed. This flexibility is attractive, as is the ability to make multiple equipment purchases without applying for a new loan each time.

Benefits of equipment financing

When deciding whether to lease or buy equipment for business purposes, equity is a key factor to consider. As you pay off the loan, your increasing equity in the equipment will contribute to your company's net worth and may boost its attractiveness to potential investors or lenders. Once the equipment is fully paid for, you may also benefit from its extended use at a reduced operating cost. You may even sell it to recoup a portion of your initial investment.

Other advantages may include the deductibility of interest expense, the freedom to customize the equipment, no restrictions on use and potential appreciation.

Tax benefits of owning equipment

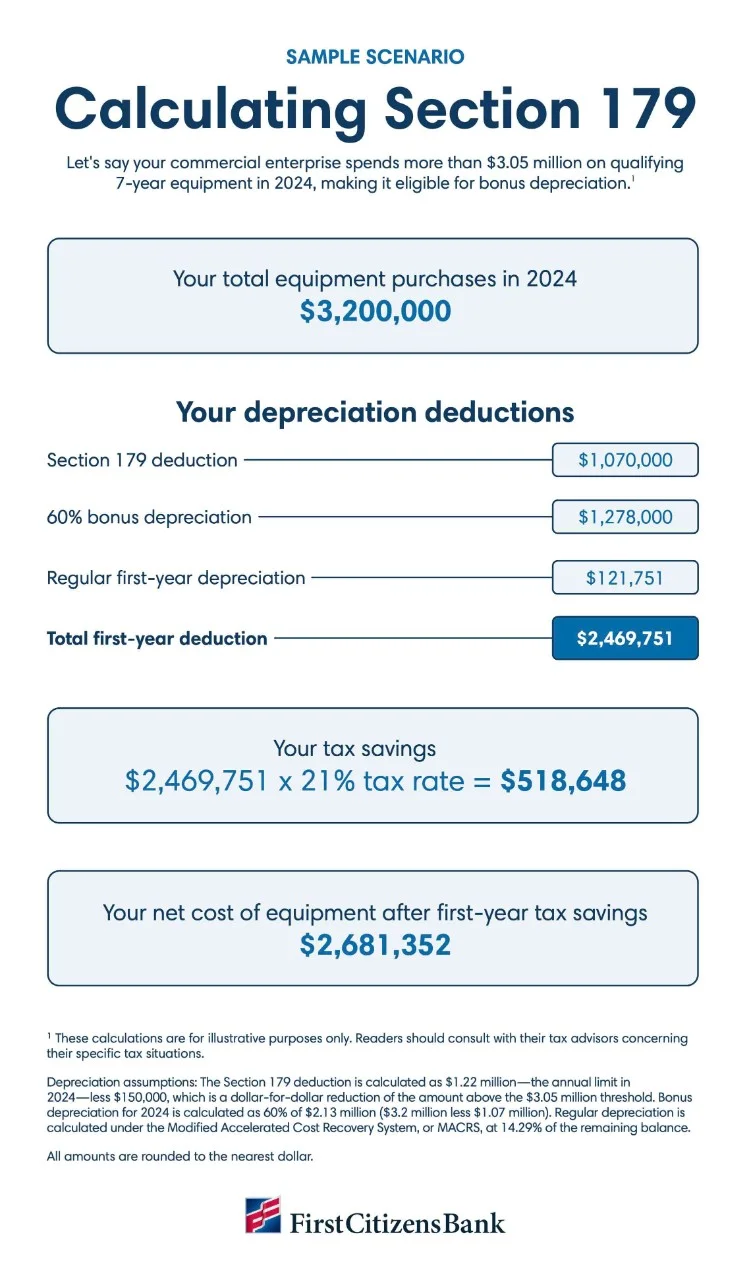

A major ownership advantage is depreciation—and this applies to both financed equipment and equipment purchased at the end of a capital lease. Under Section 179 of the Internal Revenue Code, a business may elect to immediately deduct the cost of any business property placed in service during the year, within generous limits.

In some cases, you may also claim a deduction for first-year bonus depreciation on the same qualifying property—although this break is set to gradually expire over the next few years. Also, any remaining cost may be depreciated over time.

It's important to understand the impact of depreciation because combining these powerful tax breaks may lead to significant tax savings, especially for larger businesses. "Nobody likes to pay taxes, but the larger the business, the more intricate their tax situation is," says Lynch. "Reducing tax liability is usually a top priority."

Equipment financing and leasing options

While many dealers offer financing for commercial business equipment, not all financing partners are created equal.

When dealers work with a bank that has extensive experience in equipment financing and leasing, there can be many benefits—including increased convenience for their customers.

Dealers that offer financing and leasing options through First Citizens Bank Equipment Finance, for example, are able to provide customers access to competitive rates and flexible terms right when they're purchasing equipment—saving those customers the time and effort they would otherwise spend sourcing their own financing.

"We have a one-page digital application, which provides access to fast approvals up to $250,000 without financials," Gault says.

Once an application has been approved, the bank will coordinate payment directly with the vendor.

"We understand speed, simplicity and consistency are important to our partners," Gault explains. "So vendors can be confident in connecting their customers with First Citizens for equipment leasing and financing solutions."

Get 100% financing for high-cost commercial business equipment

First Citizens provides loans and leases for transactions up to $100 million and more—with terms and rates tailored to meet the needs of middle market and large-cap businesses.