Find your fit with multiple business checking account options

Whether your business is starting or expanding, our small business checking accounts are designed with your needs in mind. Customize your package by adding on discounted treasury management products, and leverage your First Citizens merchant services account to cover the monthly maintenance fee.

Get a Visa Business Debit card

Use your First Citizens debit card to make payments anywhere

Your Business Banking account comes with a Visa® Business debit card, which you can use for a fast, touch-free, secure way to pay.

Business Banking

Monthly maintenance fee: $0D

Ideal for businesses just getting started

Business Banking I

Monthly maintenance fee: $25 or $0DD

Created for growing businesses that need flexibility

Business Banking II

Monthly maintenance fee: $50 or $0DD

Perfect for practices and firms

Business Banking III

Monthly maintenance fee: $75 or $0DD

Customize a package to meet your needs

Compare small business bank accounts

Here's a quick glance at our small business checking accounts to help you decide.

Business Banking |

Business Banking I |

Business Banking II |

Business Banking III |

|

|---|---|---|---|---|

Business bank account features |

Essential checking |

Moderate activity |

Moderate activity |

Frequent activity |

Discounted Treasury Management services |

0 |

1 |

2 |

3 |

Monthly fee |

$0 when enrolled in paperless statementsD |

$0 if requirementsDD are met; otherwise, $25 |

$0 if requirementsDD are met; otherwise, $50 |

$0 if requirementsDD are met; otherwise, $75 |

Minimum opening deposit |

$100 |

$100 |

$100 |

$100 |

Monthly fee includes |

100 itemsDD |

250 itemsDD |

500 itemsDD |

750 itemsDD |

In-network ATM feeD |

$0 |

$0 |

$0 |

$0 |

Out-of-network ATM fee |

$2.50 |

$2.50 |

$2.50 |

$2.50 |

Check recovery service |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

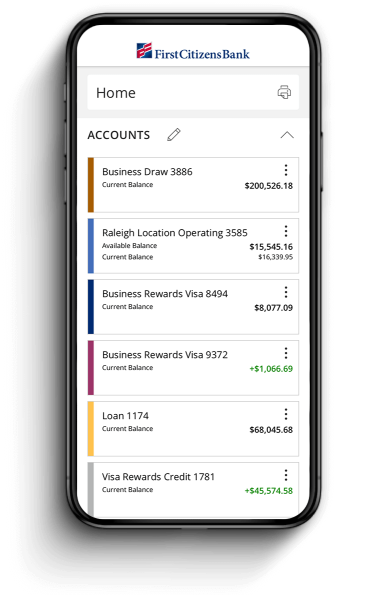

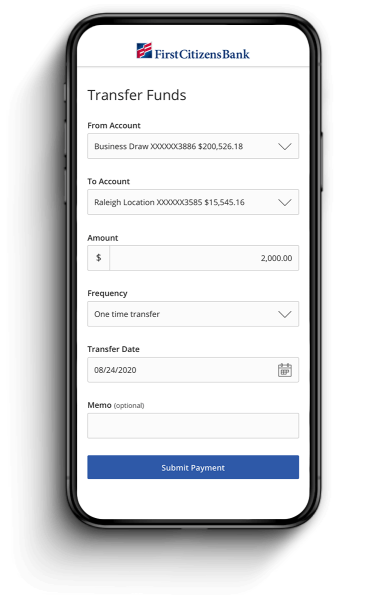

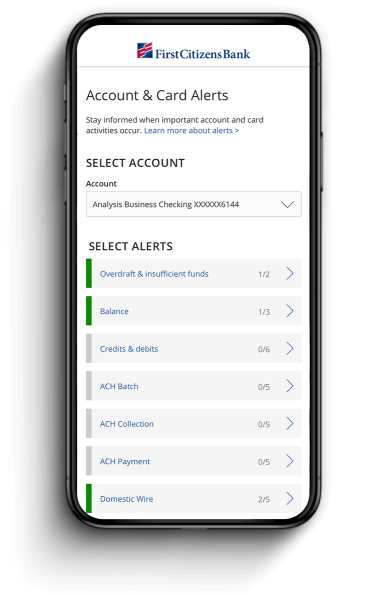

Business Digital Banking

Manage your business on the go

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts

Need something more specific for your business?

See if our Analysis or CORE business checking account solution is right for you.

CORE Business Checking

This business checking account is designed for—and only open to—small charitable organizations, small religious institutions and short-term end-of-life estate accounts.

Analysis Business Checking

This commercial checking account is designed for companies with complex financial needs and those that need advanced treasury management services.