Get online and mobile access

Access Digital Banking for business from anywhere.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Basis Points

The Making Sense team highlights key issues from the first weeks of the new year, including US equities and a low-hire, low-fire labor market.

Designed with nonprofit organizations in mind, CORE business checking accounts help put you in control so you can handle everyday expenses while earning interest. Explore more benefits available with a nonprofit checking account.

No set minimums

Never worry about maintaining a balance with a nonprofit checking account.

Charity checking

This account is ideal for estate accounts, as well as civic and religious groups.D

No monthly fees

Enroll in paperless statements to avoid the monthly feeD for a nonprofit bank account.

Open a nonprofit checking accountD and take advantage of no minimum balance and no maintenance fees.D

Access Digital Banking for business from anywhere.

Earn interest on your daily collected nonprofit checking account balance.D

Get unlimited use of any First Citizens ATM or branch in our network—for free.D

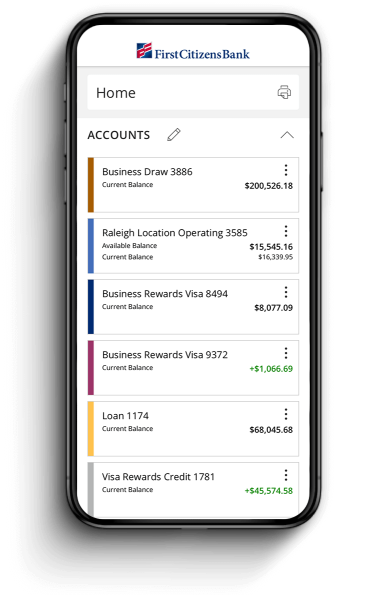

Manage your accounts from anywhere

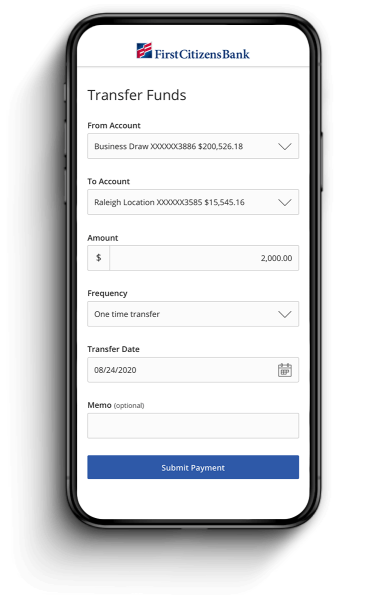

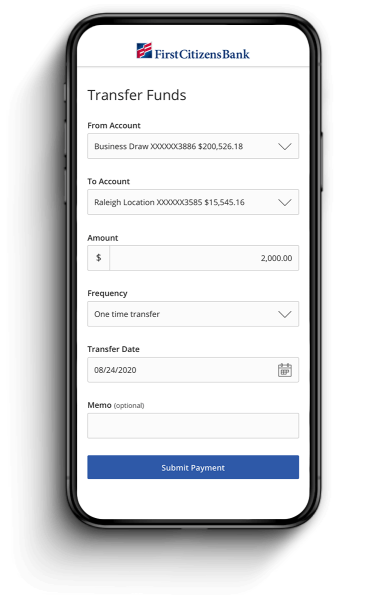

Send & transfer money with ACH and wires

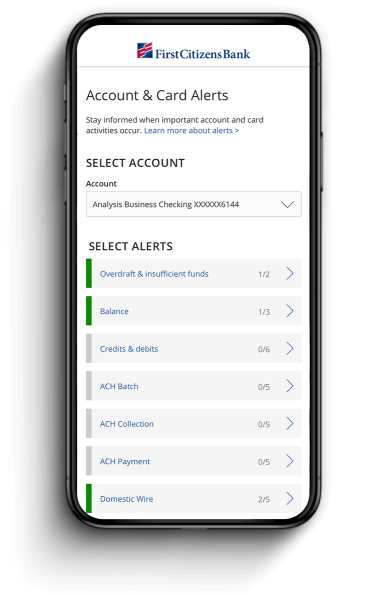

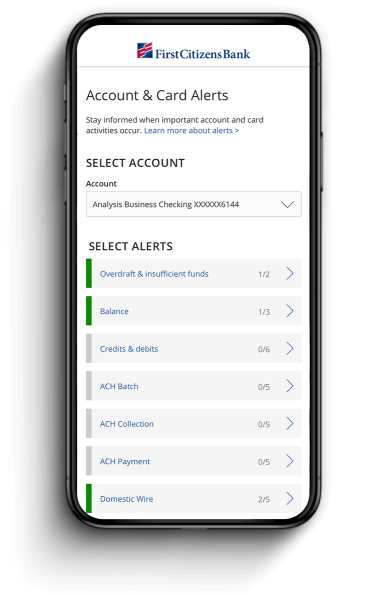

Receive account and security alerts

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts

A nonprofit bank account—or nonprofit checking account—is a type of account used by philanthropic organizations, religious groups and estate accounts. Organizations can use these accounts to conduct transactions.

You'll need to open a nonprofit checking account in person. To do so, you can find a branch near you.

Account openings are subject to bank approval.

For a list of account details and fees, see our Disclosure of Products and Fees—Business Accounts and Services (PDF).

Service fees may be charged by the third-party ATM operator or owner, or by the network owner for transactions at non-First Citizens ATMs. For transactions initiated outside of the United States, the fee will be 3.00% of the transaction amount.

Paperless statements are required to avoid a paper statement fee.

Each item or transaction (other than non-PIN debit card transactions) which results in a debit or credit to the account is considered a separate "item," including each check, paper draft, deposit, item deposited, wire transfer, electronic withdrawal or transfer and PIN-based transaction.

Each item in excess of 100 per month is $0.50 per item.

CORE Business Checking may be set up to earn interest, when required. Interest is compounded daily and paid monthly.

Each additional $100 coin and currency deposited is $0.30 per $100.

Not open to any other businesses.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.