Cash Rewards Credit Card

Get the credit card that gives you cash back

The possibilities are limitless

You won't find quarterly maximums here. Our Cash Rewards credit card gives you cash back on every purchase—and always at the same great rate.

Unlimited cash back

1.5% cash back on every $1 you spendD and no annual fee.

Convenient benefits

Go beyond rewards with a host of credit card benefits.

Special offer

Get 0% intro APRD on balance transfers within the first 12 months.D

Visit your local branch to apply

Simply earn cash back every day

Redeem your credit card rewards your way—such as transferring your cash back rewards to a First Citizens account.

Cash Rewards Credit Card Information

Card details and transaction fees

Balance transfers

0% introductory APRD for first 12 monthsD on balance transfers, then variable purchase rate of 17.24% to 26.24% based on creditworthiness applies.

Always know what you're earning

Keep it simple with 1.5% cash back on every purchase you make, every day.D

No annual fee

Enjoy all this card has to offer with $0 annual fee.

Tap your card to pay

Make quick and secure purchases with contactless payments.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

Credit card rewards calculator

Choose how you want to earn rewards

First Citizens offers several credit cards, but the best credit card for you depends on how you like to shop and spend your money. When it comes to earning reward points, which of our credit cards will be the most rewarding for you? Use this handy credit card rewards calculator to find out.

Want to compare all our credit card features?

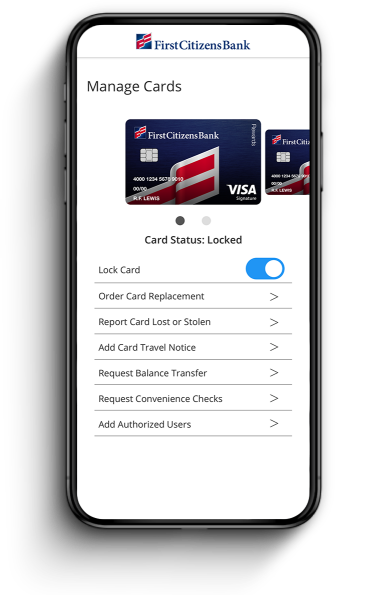

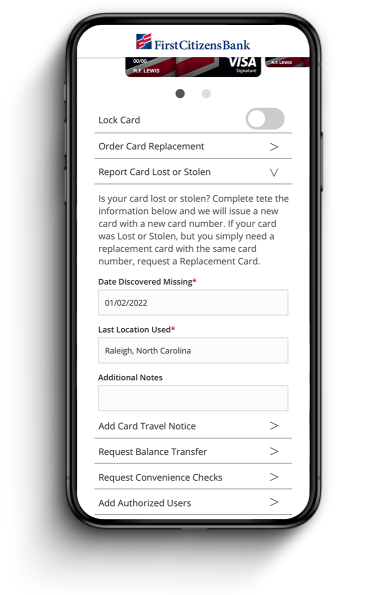

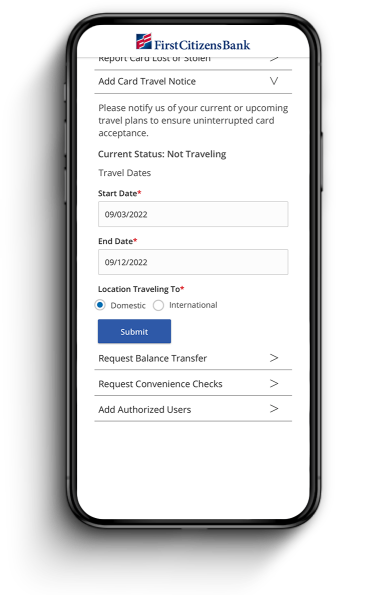

Access any of our card services from your phone

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling