Business Vehicle & Equipment Financing

Get the equipment your business needs

Business equipment financing solutions that fit

Whatever equipment you need, we can help. Our financing specialists can guide you every step of the way, from selecting equipment to securing financing—helping you preserve cash flow with predictable monthly payments.

Secure the tools you need to get the job done

We're here to answer your questions

Get to know our equipment finance team

Grow your business with equipment financing

You have equipment needs. We have solutions. Whether you're just starting out or growing your business, we can help you find the type of business equipment financing that works best for you.

Choose the right equipment financing solution for your business

Try fair market leasing or a $1 buyout

Fair market value, or FMV, leasing lets you return equipment at the end of the term, while a $1 buyout gives you the option to own the equipment after the term ends.

Enjoy an open-end vehicle lease

An open-end lease combines the flexibility of ownership with the potential cash flow and the tax advantages of leasing.

Take advantage of term loans

We offer loan financing up to 100% for new and used equipment and vehicles. Typical terms are up to 5 years and can be structured to suit your needs.

Reap the benefits

Up to 100% financing is available for new or used vehicles and equipment, plus soft costs including sales tax. Typical terms range from 2 to 5 years. Flexible repayment schedules are available to meet cash flow needs, with terms structured to meet your tax or accounting needs.

The business equipment financing process

Our equipment financing specialists are here to guide you from start to finish.

Apply online

Apply for financing online in as little as 3 minutes.

E-sign your documents

Once you sign your documents electronically, we'll send your contracts in an online format.

Get financing

Once you're approved, we'll prepare the closing documents and pay the vendor for your purchase.

Learn the potential tax savings for your financed equipment

What's best for your budget: Purchase or lease?

Manage your business on the go

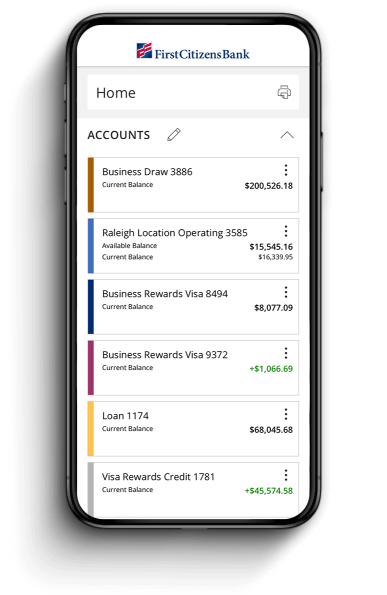

Manage your accounts from anywhere

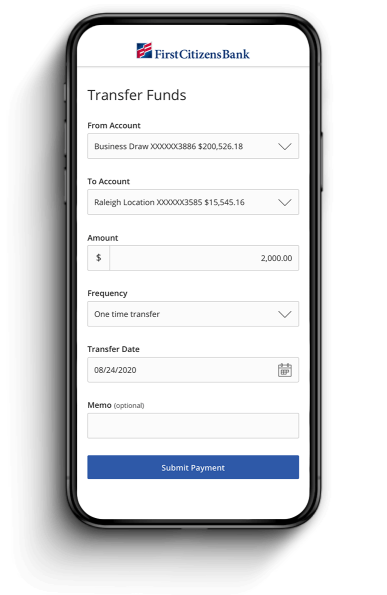

Send and transfer money using ACH and wires

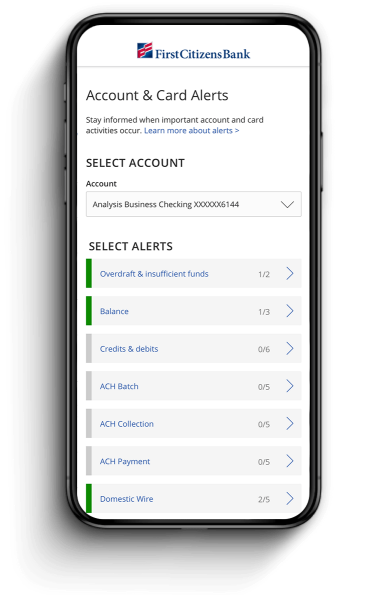

Receive account and security alerts