Send and receive payments instantly and securely

Payments take just seconds to process. You can send and receive them 24/7/365 and use them immediately.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Market Update

Phillip Neuhart and Blake Taylor take a deep dive into GDP growth, the housing market, policy developments and the scale of AI investments.

Every company has unique needs. If you want to streamline your payment services, Real-Time Payments, or RTP®, may be the right fit for your business. It allows businesses to conveniently pay and get paid by vendors, clients and employees immediately.

Payments take just seconds to process. You can send and receive them 24/7/365 and use them immediately.

Cash concentration and daily reconciliation is easy with RTP. Spend less time making sure you've paid or been paid—and more time focused on your company.

You can opt out of receiving RTP at any time by contacting the Business Engagement Center. We'll process your request within 3 business days and reject all RTP without further notification.

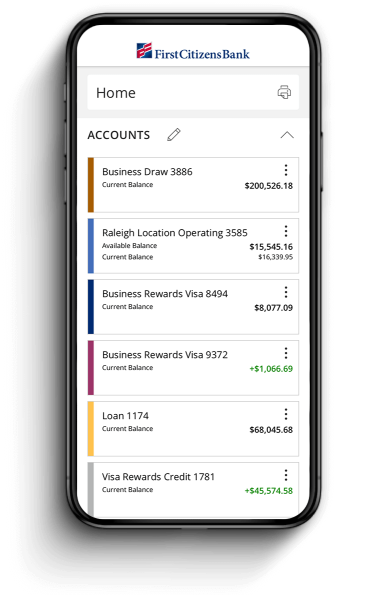

Manage your accounts from anywhere

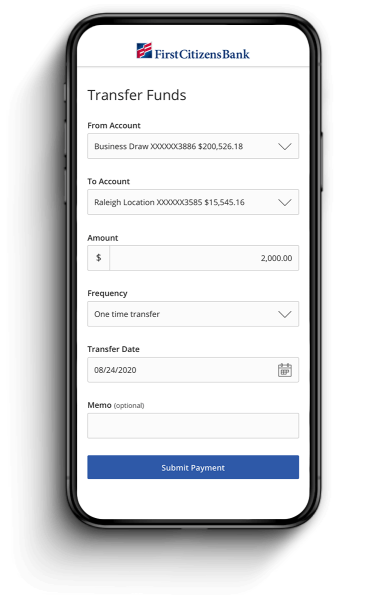

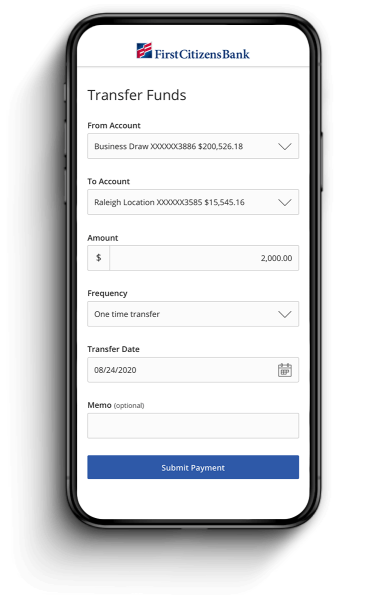

Send & transfer money with ACH and wires

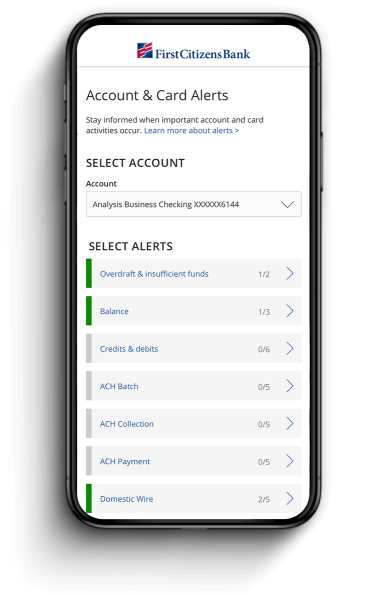

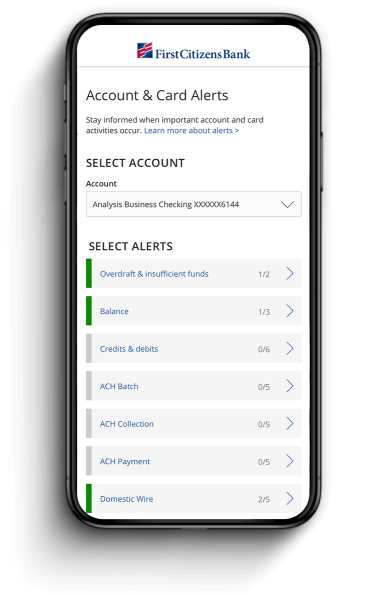

Receive account and security alerts

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts

A Real-Time Payment, or RTP®, is a transaction that moves in seconds through the RTP Network and settlement system offered by The Clearing House. This isn't an ACH or wire transaction.

The RTP Network provides the ability to conveniently distribute and access funds immediately, 24/7/365. All payments can only be initiated from and received by a federally insured US depository institution that's a registered participant on the RTP Network. Visit The Clearing House for a list of all participants on the network.

RTP, ACH and domestic wire payments are all methods of moving money between accounts, but they differ in terms of speed, cost and use cases. ACH is characterized by its cost-effectiveness but slower processing times. RTP excels in speed and accessibility for real-time transactions on a 24/7/365 basis. And domestic wire transfers fall in between, offering faster processing than ACH but with higher fees.

The choice depends on factors such as transaction urgency, dollar value of the transaction, cost considerations and the specific use case. For more details on these differences, see our Payment Comparison Overview (PDF).

Speak to your banker, or contact the Business Engagement Center at 866-322-4249 Monday through Friday, 8 am ET to 9 pm ET.

RTP is available 24/7/365, which allows you to send and receive payments any time. All payments post within seconds of when the payment was sent and received.

A sender may be limited on how much they can send from their participating bank, but the network rules allow you to receive up to $10 million per transaction.

No. RTPs are domestic only.

An RTP that you send will have a description of RTP Debit. Once the RTP posts to your account, you'll see RTP Debit and all or a portion of the recipient's name. This same information will be included on your bank statement.

An RTP that you receive will have a description of RTP Credit. Once the RTP posts to your account, you'll see RTP Credit, 20 characters of the sender's name and the 35-digit instruction ID for your payment. This same information will be included on your bank statement.

To receive an RTP, provide the sender with your routing number, 053100300 and your account number.

More businesses are starting to offer RTPs instead of checks, ACH or wires. Some of these businesses require you to select the option to receive an RTP instead of an ACH or wire. For example, if you're using a digital wallet like Venmo, you may need to select the RTP option to send your funds real-time to your bank account.

Once the bank initiates the transaction in the RTP network, it sends the payment and the recipient receives it within seconds.

Verify with the sender that they:

If you've opted out of receiving RTPs, you'll need to opt back in or have the sender pay you through a different payment type.

Have the sender provide the instruction ID sent with the payment and contact your local banker for additional assistance.

To send an RTP, you must be a Commercial Advantage customer and request to be enrolled in the service. Contact your banker to enroll. You'll need the routing and account numbers of the recipient.

You may sign up to receive an email remittance notice that includes any additional information provided by the sender. Contact your banker to submit a request to enroll to receive email remittance notices. Additional fees may apply.

You may also sign up to receive SMS text alerts. The alert will contain the first 23 characters of the sender's name, the amount and the last four digits of your account number. Contact your banker to submit a request to enroll to receive RTP SMS text alerts. Additional fees may apply.

Commercial Advantage customers can also set up an alert in Commercial Advantage to receive notification of receipt of an RTP.

Contact your banker to submit a request to opt out of receiving RTP.

Contact your banker to submit a request to opt in to receiving RTP.

If you suspect the RTP is fraudulent, being sent to the wrong person or the account number is incorrect, contact your banker or the Business Engagement Center at 888-322-4249 Monday through Friday, 8 am ET to 9 pm ET.

No. The RTP Network is a credit-push, one direction payment system that doesn't allow debits.

RTPs are irrevocable. The RTP Network is a credit and payment system that does not allow debits or disputes. If you suspect the RTP is erroneous or fraudulent, please contact your banker or contact the Customer Engagement Center at 888-323-4732 Monday through Friday, 8 am ET to 9 pm ET or Saturday and Sunday, 8 am ET to 8 pm ET.

You can get detailed remittance information on received RTP transactions through email, SMS text or Commercial Advantage.

RTP also includes the Payment-Related Messages and Non-Payment Messages feature, which allows a business or financial institution—both payee and payer—to request and send information regarding a payment and acknowledge receipt of a payment.

You can get detailed remittance information on received RTP transactions through email, SMS text or Commercial Advantage.

RTPs are limited to active checking and savings accounts.

Once the bank initiates the transaction in the RTP network, it sends the payment and the recipient receives it within seconds.

Business and commercial clients receive a fee at the time payment is received, at the time the remittance notice is accepted for each email address or at the time the SMS text alert is sent for each telephone number. Analysis accounts will receive the fee at the end of the month. Contact your banker for further information.

For more details on RTP functionalities in Commercial Advantage see the Real-Time Payments Guide (PDF) or contact your Relationship Manager.

With Digital Banking, you'll be able to view RTPs as posted transactions. However, there are no additional features. For additional features, you'll need Commercial Advantage.

It depends on the functionality that the receiver's bank offers to their clients. The network provides the ability for recipients to acknowledge a payment was received.

At First Citizens, only Commercial Advantage customers can acknowledge a payment. Please see the Real-Time Payments Guide (PDF) for instructions.

For a list of account details and fees, see our Disclosure of Products and Fees—Business Accounts and Services (PDF).

Real-Time Payment Send is only available in Commercial Advantage Plus and requires the Real-Time Payments module. Other terms, conditions and additional fees apply. Contact your banker or treasury sales officer to learn more about Commercial Advantage. Real-Time Payments Receive recipients must have a bank account that's enabled to receive Real-Time Payments.

RTP® is a registered trademark of The Clearing House Payments Company, LLC.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

All third-party trademarks referenced by First Citizens Bank remain the property of their respective owners. First Citizens Bank’s use of third-party trademarks does not indicate any relationship, sponsorship or endorsement between First Citizens Bank and the owners of these trademarks. All references by First Citizens Bank to third-party trademarks are to identify the corresponding third-party goods and services and intended to constitute nominative fair use under applicable trademark laws.

Normal bank approval applies.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Fill out the form below to connect with us about Real-Time Payments, or RTP®. Fields denoted with an asterisk (*) are required.

If you prefer to speak with someone directly, please give us a call.