3 tips to manage and pay for long-term care for your parents

More than 2/3 of people over age 65 will need at least some long-term care in their lifetime, according to the US Department of Health and Human Services.

If your parents already need significant care—or may soon need more—the time to plan is now, says Kelly Sullivan, Manager of Life Insurance Sales for First Citizens. In fact, the sooner you start planning for how to manage long-term care for your parents and support them as they age, the easier the transition will be. Even if you don't have time to plan because a parent has already developed an unforeseen health issue, you can still be smart about the decisions you need to make in the moment. Sullivan offers three tips for managing long-term care for an aging parent.

1Research options together and be adaptable

Many people assume that long-term care means moving into a facility, but most long-term care actually is provided at home by unpaid caregivers who are family members or through community support programs.

Remember that managing long-term care for your parents may evolve over time. At first, it may simply mean setting up meal delivery, bringing in someone to do household chores and making modifications to your parents' home, such as adding ramps and grab bars. For older adults who need more support, you can hire a home healthcare aide to help with personal care, or take them to an adult day care center while you go to work. Your Area Agency on Aging will have a list of local services.

If a parent needs to move in with you, you may want to consider a home equity line of credit to cover modifications to your house. You'll also have to determine whether the move is permanent enough that you need to sell your parents' current home. This could have a significant impact on the assets they have available to help pay for long-term care, but it also impacts the potential gift of that home to you or another sibling.

You may also want to investigate housing options such as senior apartments, assisted living facilities, nursing homes and continuing care communities. Check accreditation, licensure and other certifications, schedule visits, and ask your friends and colleagues about their experiences.

2Complete financial, legal and medical planning

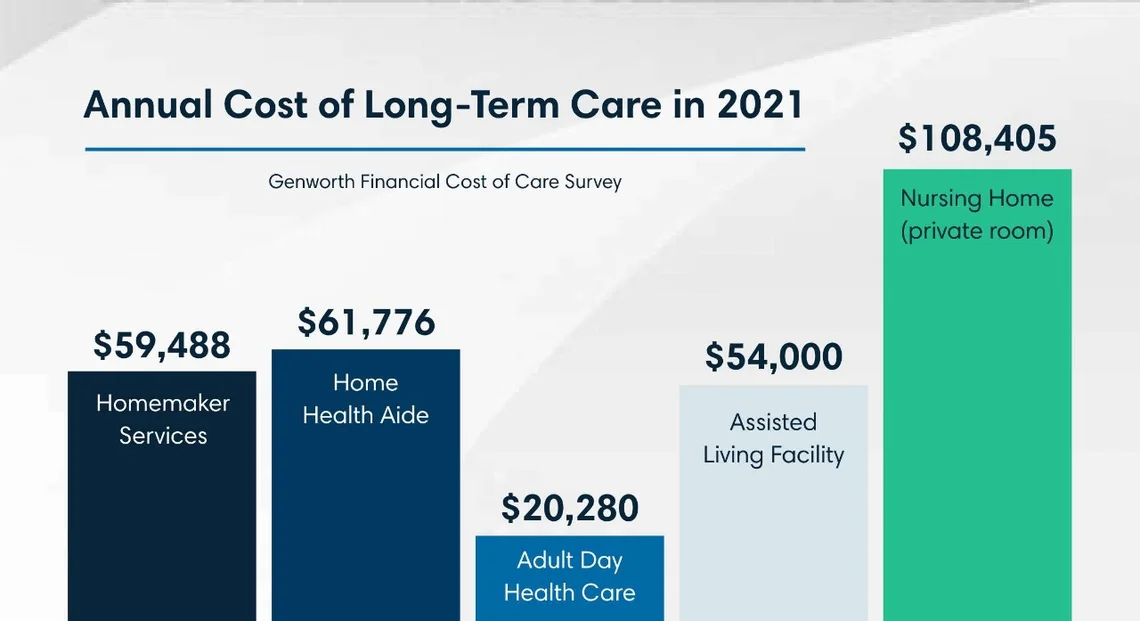

Professional long-term care can be expensive.

The average annual cost for an assisted living facility in 2021 was $54,000, according to the Genworth Cost of Care Survey. Annual costs for other types of care vary widely, ranging from $20,280 for adult day healthcare to $108,405 for a private nursing home room. Homemaker services averaged $59,488 and home health aides averaged $61,776. Ask your parents about their financial resources for long-term care. If you're lucky, they have a long-term care insurance policy. Other options to help pay for long-term care include veterans benefits, Medicaid, a reverse mortgage or selling their home. A financial advisor can help you understand the impact of the different ways of paying for long-term care.

Find out where your parent keeps their will, advanced directives, life insurance policies, military and marriage records, and other important documents. Make sure you know who has power of attorney and healthcare power of attorney.

"You want to have those things in place while they're relatively healthy. Otherwise, it can become quite difficult to follow what their intentions may have been," Sullivan says. If your parents failed to set up these documents before becoming incapacitated, you may need to go before a judge to be granted conservatorship, allowing you to make medical and financial decisions for that parent. Judges may also grant split guardianship, which could allow a family attorney to manage real estate and other assets while you manage other aspects, such as paying bills.

3Consider what your role should be

If you're considering having your parent move in with you, make sure your family's on board and consider the physical limitations of your home, Sullivan advises. Where will they live? Is the shower accessible?

Whether your parent lives with you or not, consider how much care you can realistically provide. Serving as your parent's main caregiver can be physically and emotionally draining, especially if you work full time or have young children. Talk to your financial advisor or a banker about the impact of your caregiving, especially if it includes providing financial support to your parent or if it impacts your income from work.

Tap siblings and other family members for support, Sullivan suggests, and take advantage of local services and resources. It's important to remember that you can still actively manage the long-term care of your parents even if you can't spend 24/7 with them yourself. Consider hybrid options, such as providing some care yourself but also relying on an in-home aide, and don't feel guilty about taking the time you need to take care of yourself and be with your spouse or children.

"Taking care of a parent all the time can be overwhelming," Sullivan says. "So, bring them to adult day care or have someone come into their home for a few hours. Giving yourself some rest is so important."