2025 wealth survey: Trends shaping money and planning

Marc Horgan

Executive Director

Personal wealth is never static. It shifts with markets, the economy and personal choices. Each year, our Beyond Wealth report provides a pulse check on these shifts, offering insights into how wealthy Americans are building, protecting and managing their money.

This year's wealth survey reveals that economic uncertainty is influencing both personal and business financial decisions. Yet while financial stress is high among wealthy Americans, so too is financial confidence—and rather than standing still, many are channeling stress into purposeful change.

Key takeaways

- More than half of wealthy Americans report feeling stressed about their finances in 2025.

- Individuals are building their resilience by diversifying their income sources and adjusting their spending and saving habits.

- Retirement targets are rising faster than savings, and the average expected retirement age has increased to 65.

- Overall financial confidence remains high, but significant planning gaps exist—particularly surrounding estate planning.

- Individuals working with advisors report greater preparedness and lower stress, highlighting the value of professional guidance.

Trends shaping wealth management in 2025

Income sources are expanding

Like many Americans, wealthy individuals depend primarily on employment—75%—and investments—89%—as key sources of income. This year, however, diversification appears to be on the rise, potentially as a safeguard against economic uncertainty.

Beyond salaries and portfolios, 45% report business ownership and 23% cite inheritance as income sources. Equity-based compensation is also gaining traction, with 43% receiving employee stock options or equity in 2025—up from 30% last year.

Confidence is balanced with caution

Stocks, ETFs and real estate continue to anchor many portfolios. Slightly less than half of wealthy Americans invest in private equity, and only about 1/3 hold cryptocurrency. However, key differences emerge between generations. While Baby Boomers favor more traditional vehicles, such as CDs and money market accounts, more than half of millennials invest in private equity and crypto.

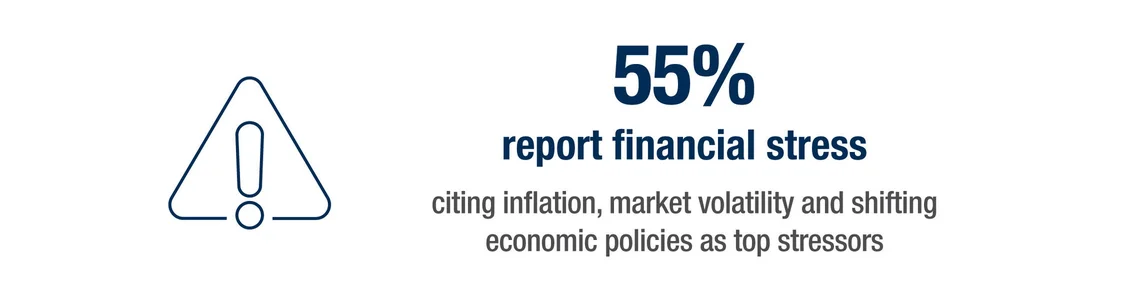

Stress is driving positive change

Wealthy Americans aren't immune to economic pressures. More than half report feeling somewhat or very stressed about their finances in 2025. This appears to be largely influenced by factors beyond their control, with 62% citing inflation as a top financial stressor, followed by market volatility, shifting government policies and high interest rates.

However, this stress is serving as a catalyst for action. Many are reinforcing their financial foundations—cutting back on discretionary spending, boosting retirement contributions and committing more toward investments.

How planning priorities are shifting

Beyond capturing sentiment, the 2025 wealth survey also explores how wealthy Americans are approaching financial planning in today's complex environment. Our findings on wealth management in 2025 show rising retirement expectations, persistent planning gaps and the growing importance of professional guidance.

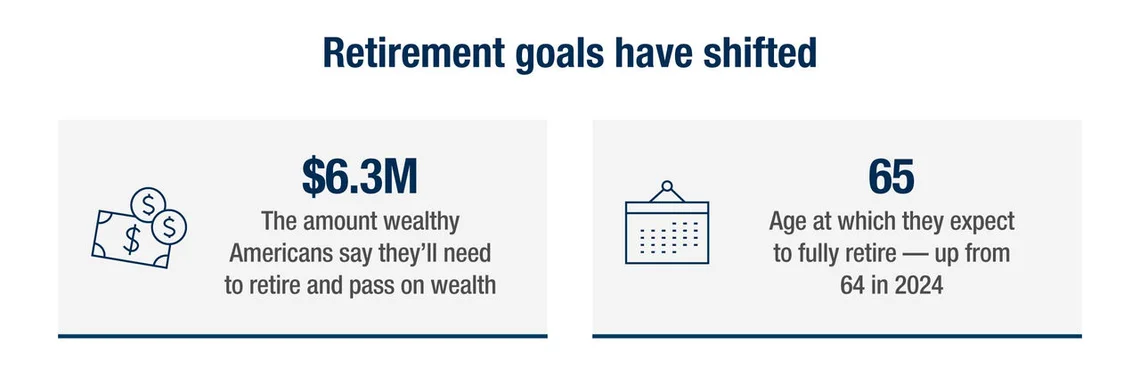

Retirement expectations are rising

Wealthy Americans now estimate they'll need an average of $4.1 million to retire comfortably and $6.3 million to both retire and pass on wealth. Despite these higher targets, savings have stayed flat at $1.6 million in both 2024 and 2025.

This widening gap may be influencing retirement plans for some. The average anticipated retirement age has risen from 64 to 65 since last year's report. More than a quarter of respondents lack confidence in their ability to retire on time—evidence that even significant wealth doesn't ensure certainty.

Planning gaps persist

Overall confidence remains high this year, with 96% reporting confidence in their financial situation. However, this sense of certainty drops when it comes to strategy. Just 21% say they're confident in every aspect of their planning efforts. Reducing tax liabilities, sustaining wealth throughout retirement and ensuring smooth wealth transfer were listed as key areas of concern. The disconnect between intent and execution is striking. While 87% say they feel prepared to pass on wealth, more than half lack a formal estate plan and over 1/3 haven't created a will.

Confidence grows with guidance

Many wealthy Americans indicate that professional guidance offers both practical and personal benefits. Three in four now engage with an advisor—most often not because of a single life event, but because their finances have become more complex or they've reached a new wealth threshold. While the primary motivator is a desire to grow wealth, the benefits run deeper.

More than half of those with an advisor say they feel better prepared for the future, and 43% report reduced financial stress. In an environment marked by heightened uncertainty, trusted and personalized advice has become indispensable for turning complexity into clarity—and stress into stability.

Six actionable steps for 2026

If this year's wealth survey findings echo some of your own challenges or concerns, now is the time to turn insight into action. These six steps can help you regain clarity and strengthen your financial foundation for the year ahead.

1Bolster your safety net

Everyday accounts and investments are important, but they shouldn't be your only line of defense against uncertainty. Maintain a dedicated, highly liquid emergency fund—ideally covering at least 3 to 6 months of living expenses. Tailor the amount to your own circumstances, factoring in dependents, lifestyle and the stability of your income streams.

2Recalibrate your portfolio

Market swings are inevitable, but unease may signal a time to rebalance. Ensure your mix of assets reflects both your long-term goals and current risk tolerance.

3Reinforce your retirement strategy

Rising targets make it more important than ever to stay proactive. Consider maxing out your retirement contributions, taking full advantage of employer matching and using catch-up provisions if you're eligible to get back on track. Even small adjustments today can help you catch up on retirement savings over time.

4Schedule an annual financial checkup

Just as you would a health screening, set aside time each year to revisit your wealth plan. A thorough review allows for timely adjustments as markets and personal circumstances evolve and new tax laws are introduced.

5Leverage professional guidance

Wealth brings complexity. An advisor can provide perspective, streamline decision-making and help you see beyond the noise of day-to-day headlines—building confidence that your long-term strategy is sound.

6Seek balance, not overload

Staying informed is critical, but constant information can create unnecessary anxiety. Curated resources—such as Making Sense, our weekly market update series—can keep you informed rather than overwhelmed.

The bottom line

The 2025 Beyond Wealth reports show that even for households with significant resources, financial confidence is never guaranteed—it's earned through action. This year's results highlight both opportunity and risk. Wealthy Americans are expanding income sources and diversifying their portfolios, yet many are also facing retirement gaps and unfinished estate plans. Stress levels are high, but so is the willingness to adapt.

These findings aren't just statistics—they're signals of areas where intentional planning matters most. Those who engage advisors, rebalance their strategies and close planning gaps not only report feeling better positioned financially, but they're also more confident and less stressed about the future.

To explore this year's findings or learn more about the survey methodology, read the Beyond Wealth Report for Wealthy Americans (PDF). If you're a business owner, read the companion report, Beyond Wealth Report for Business Owners (PDF), which highlights the forces impacting business owners in 2025 and the steps they're taking to adapt.