4 strategies to improve business working capital

Capital strategy helps businesses allocate resources effectively today while preparing for opportunities tomorrow. A thoughtful strategy creates the flexibility to invest, manage risk and keep operations moving when conditions change.

In the recent First Citizens webinar Planning capital with confidence: Optimizing cash flow and investments, Treasury Management Services Executive Kristen Saranteas, Executive Director of SBA Lending Adrienne Sipe and Director of Equipment Financing and Leasing Jennifer Champion were joined by T.J. McCaskill, CEO of Carolina Eye Associates, to share how treasury services, SBA loans and equipment financing can work together to strengthen financial strategies. With real client stories and practical examples, they showed how businesses can preserve liquidity, fund growth and plan with greater confidence.

1Start with a clear view of your capital

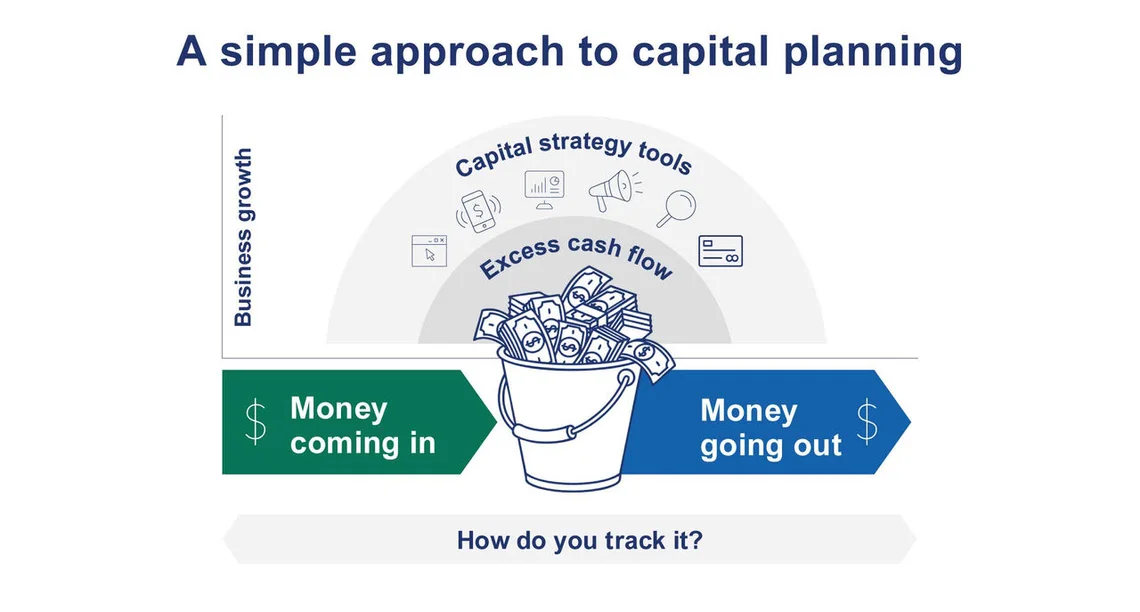

Capital strategy begins with cash flow visibility. Businesses that know what funds are coming in, what's going out and how excess cash is being managed are better equipped to make intentional decisions. This clarity can reveal the true cost of delayed receivables, highlight opportunities to reinvest excess funds or identify the need to shore up reserves.

"When we talk about capital planning, the first step is understanding what matters most to your business right now," Saranteas said. "Your needs change over time, which is why it's important to revisit your strategy regularly. Every stage of growth brings different priorities."

Businesses should look at capital strategy as a continuous process, not a one-time event, to help ensure decisions remain aligned with current challenges and future goals.

2Put treasury tools to work

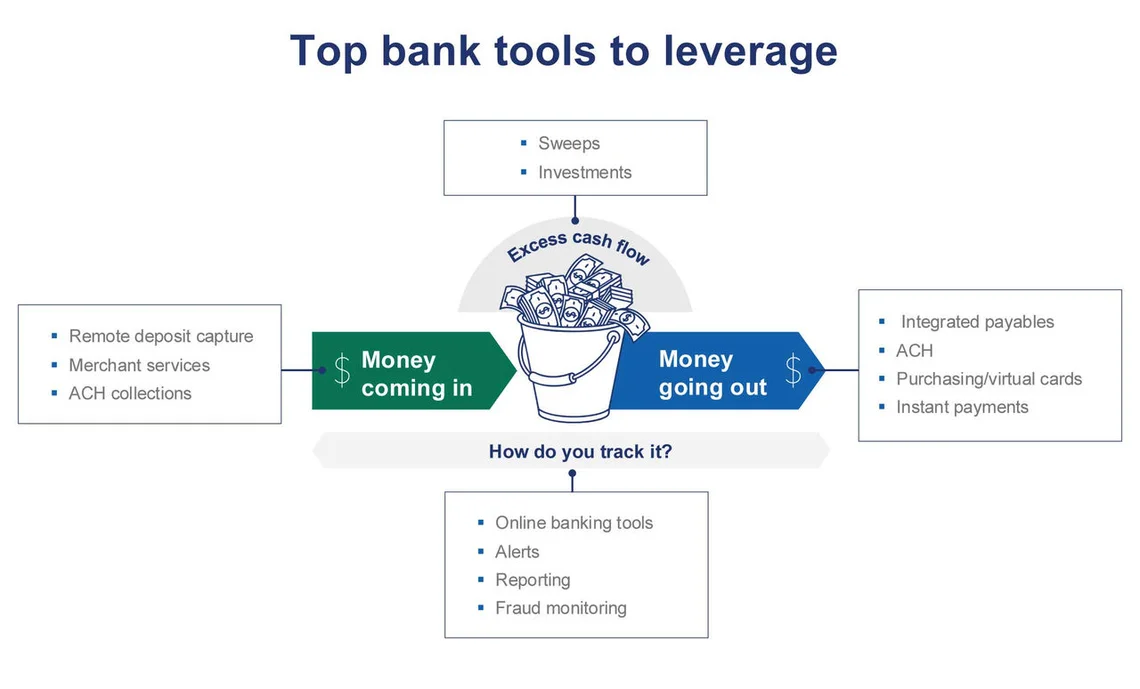

Treasury solutions are often underutilized, but they can transform how businesses manage cash flow and risk. Examples include receivables tools such as Remote Deposit Capture and ACH collections to accelerate incoming funds, and payables solutions such as integrated payables, purchasing cards and instant payments to create more predictable outflows.

There are several key components of a business's cash flow, from payment collection and processing to outbound disbursements and real-time monitoring.

"We currently use First Citizens' Remote Deposit Capture feature, which has been a big time saver for our accounting staff," McCaskill said. "It cuts down on trips to the branch and helps us process payments more efficiently."

Equally important are visibility and liquidity solutions. Online banking platforms, real-time alerts and reporting dashboards give leaders clearer insight into their financial position, while sweep accounts and tailored investments ensure idle funds are working efficiently. These tools not only streamline processes but also strengthen decision-making, reduce fraud risk and free up staff resources for higher-value work.

Businesses are encouraged to review their treasury setup regularly, ensuring that tools evolve alongside operational demands and growth objectives.

"Your treasury management partner is going to be watching your transaction flow and may see that you could be an ideal candidate for new technology that's coming," Saranteas said. "Your partner may prompt a review of your structure in order to see if you're a great fit for something that might improve your cash flow before you even realize you need it."

Cash management during transition moments

Moments of growth like acquisitions, expansions and operational shifts often signal it's time to reassess how cash moves through your business. In this exchange from the webinar, Saranteas and McCaskill walk through real-world examples of when to engage your treasury team and how the right tools support smoother transitions.

Learn more about cash management solutions at First Citizens Bank.

3Explore SBA lending as an option

SBA loans are a versatile tool available to businesses seeking to balance growth and liquidity. SBA loans balance growth investment with liquidity preservation through longer repayment terms, broader eligibility requirements and flexible fund usage across working capital, equipment purchases and real estate investments.

For established businesses, SBA loans can provide a pathway to expansion while preserving cash flow to keep your company in a strong position while scaling responsibly.

"One of the challenges we hear about from businesses is balancing the need to invest in your business with the need to preserve cash flow," Sipe said. "SBA loans can be a great option because they let you do both. You can pursue growth without straining day-to-day operations."

Exploring these options early can expand access and improve outcomes. Careful planning helps businesses align the right SBA program with their stage of growth and long-term objectives.

SBA loan options

|

SBA 7(a) loans |

SBA 504 loans |

SBA Express loans |

|

|---|---|---|---|

|

Use of proceeds |

Most flexible use of proceeds including acquisition, partner buyout or buy-in, startup, expansion, working capital, equipment inventory, debt refinance, construction, renovation, leasehold improvements, franchise financing and commercial real estate |

Commercial real estate acquisition and refinance |

Working capital and equipment financing, excluding titled vehicles |

|

Loan amount |

$400,000 to $5 million |

Up to $13.5 million |

$50,000 to $400,000 |

|

Down payment |

Up to 100% financing available |

As low as 10% |

100% financing |

|

SBA loan term |

Longer terms with repayment up to 25 years for real estate; for all other uses, up to 10 years full amortization with no balloon payments; initial flexible payment schedules to assist during business ramp-up or transition period |

Up to 25 years |

Up to 10 years full amortization with no balloon payments; initial flexible payment schedules |

|

Prepayment penalty |

Prepayment penalties apply to SBA loan terms of 15 years or more |

Prepayment penalties apply |

None |

SBA loans to expand, adapt and scale

When business owners need flexible capital to launch a new service line or invest in production equipment, SBA loans can offer a path traditional financing might not. In this clip from the webinar, Sipe shares two recent loan examples: one supporting a medical practice branching into staffing, and one helping an agricultural business scale with specialized equipment. Together, they show how SBA lending adapts to different growth needs while balancing risk, term and tax advantages.

Learn more about SBA loans at First Citizens Bank.

4Rethink how you invest in equipment buying versus financing

Equipment purchases often represent one of the largest capital outlays a business makes. Financing or leasing these investments can turn large upfront costs into manageable expenses that align with the useful life of the asset. This approach preserves working capital, leaving room for reinvestment in people, technology and other growth priorities.

Tax benefits further enhance the case for financing. Section 179 and bonus depreciation allow companies to deduct a significant portion of equipment costs in the year of purchase, reducing taxable income while still enabling critical upgrades. In industries where technology evolves quickly, financing strategies also provide flexibility to refresh equipment more frequently, helping businesses remain competitive without overcommitting resources.

"Financing and leasing allows businesses to use the newest technology now, pay over time, preserve your cash for strategic initiatives and avoid being locked into obsolete equipment," Champion said. "You can maintain flexibility while investing in assets that support growth. It's a smart long-term approach."

Equipment can be financed using appropriate SBA loan options or conventional equipment financing, and experts explored some of these differences in this webinar exchange.

SBA versus equipment financing

|

SBA loans |

Equipment financing |

|

|---|---|---|

|

Asset tie |

Secured by business assets; additional collateral may be required |

Specific to asset; uses UCC or VIN; typically equipment-specific |

|

Collateral |

If not fully secured, additional collateral may be required if available |

Secured by the financed equipment |

|

Underwriting |

Used when traditional underwriting isn't available |

Based on the asset and borrower credit; falls under the traditional scope of underwriting |

|

Amortization/Terms |

10 years or the useful life of the equipment; 100% financing available |

Terms aligned with the life of the equipment |

|

Tax considerations |

Can offer benefits such as interest deduction, Section 179 for qualified purchases and depreciation; discuss with your tax advisor |

Can offer benefits such as interest deduction, Section 179 for qualified purchases and depreciation; discuss with your tax advisor |

Learn more about equipment leasing and financing at First Citizens Bank.

Capital strategy as a competitive advantage

Every business's capital journey is unique, but a clear strategy can make the difference between reacting to change and planning with confidence. Treasury services, SBA lending and equipment financing each help companies build resilience and support long-term growth.

Businesses are encouraged to evaluate their current capital approach, identify areas for improvement and work with trusted partners to tailor strategies that reflect both immediate needs and future goals. With the right planning, capital becomes more than a safeguard—it becomes a catalyst for growth.

Key takeaways

- Strong capital strategies start with visibility into inflows, outflows and excess liquidity.

- Capital strategy tools like treasury services, SBA lending and equipment financing can help fund growth while protecting cash flow.

- Tailored strategies provide better control, clearer visibility and a stronger foundation for long-term planning.