Hemp business loans: Guide to SBA and USDA options

Between regulatory hurdles and legislative uncertainty, a cannabis business may find it difficult to access funding. Yet those involved in manufacturing, selling or distributing hemp-related products may have more borrowing options than they realize.

Government business loans from the US Small Business Administration, or SBA, and the US Department of Agriculture, or USDA, can be viable funding options for those looking to grow a hemp business. Learn more about the various types of government business loans that may be available, as well as their eligibility requirements.

Loan eligibility for cannabis businesses

While both hemp and marijuana products come from the Cannabis sativa plant, the government currently bases eligibility for SBA and USDA business loan programs on which type of product your business is involved with.

Eligibility for hemp businesses

Most companies involved in manufacturing, selling or distributing hemp-related products are eligible for government loans. This includes industrial uses ranging from textiles and building materials to dietary supplements and cosmetics.

In fact, the hemp industry is well positioned to leverage SBA loans. The agency has a strong interest in growing what's known as the bioeconomy, and it recognizes that hemp products can contribute to reducing carbon emissions.

"In many cases, these companies are just getting started," says Ryan Palmquest, director of cannabis business at First Citizens. "They're building out their infrastructure. So the hemp industry is typically a perfect fit for SBA loans."

For hemp businesses operating in rural areas, the USDA Business and Industry, or B&I, loan program may be another source of funding to consider.

"There are a lot of synergies between these two loan programs, and a number of successful deals in the hemp industry leverage both SBA loans and USDA business loans," Palmquest says.

Eligibility for other cannabis businesses

According to the most recent SBA guidance, businesses engaged in any activity considered illegal under federal, state or local law aren't eligible for SBA loans or any other government loan program. This ban includes all food-related products and any products containing more than a trace amount of THC, the psychoactive component of the plant.

Even businesses involved indirectly with marijuana—like those supplying equipment or services to marijuana companies—are excluded. Federal law still bans the sale and distribution of marijuana, holding that any financial dealings with a marijuana-related business would generally involve money that comes from illegal activities.

Government loans for hemp businesses

When exploring funding options, it's helpful to understand the advantages government business loan programs can offer. These loans are designed to support small businesses—particularly those in emerging industries like hemp—by providing flexible terms and reduced risk.

Government agencies like the SBA and USDA don't provide loans directly to business owners. Instead, they function as guarantors, backing loans fulfilled by third-party lenders, which are often banks. This government backing reduces risk for lenders, enabling them to qualify more businesses for financing.

Some key benefits of government loans include:

- Flexible loan-to-value ratios: Government loans often allow for more flexibility compared to traditional loans.

- Financing qualifications: When conventional loans aren't an option, SBA and USDA business loans may have different financing qualifications.

- Extended amortization periods: Longer repayment terms mean smaller loan payments, which can significantly improve your operation's cash flow.

- Lower down payment requirements: Reduced initial costs can also help free up funds for other business needs.

SBA loans

SBA loans are widely regarded for their effectiveness in helping small businesses secure necessary funding. This includes not only small businesses looking to grow but also those with owners seeking to buy a new business or exit their existing business.

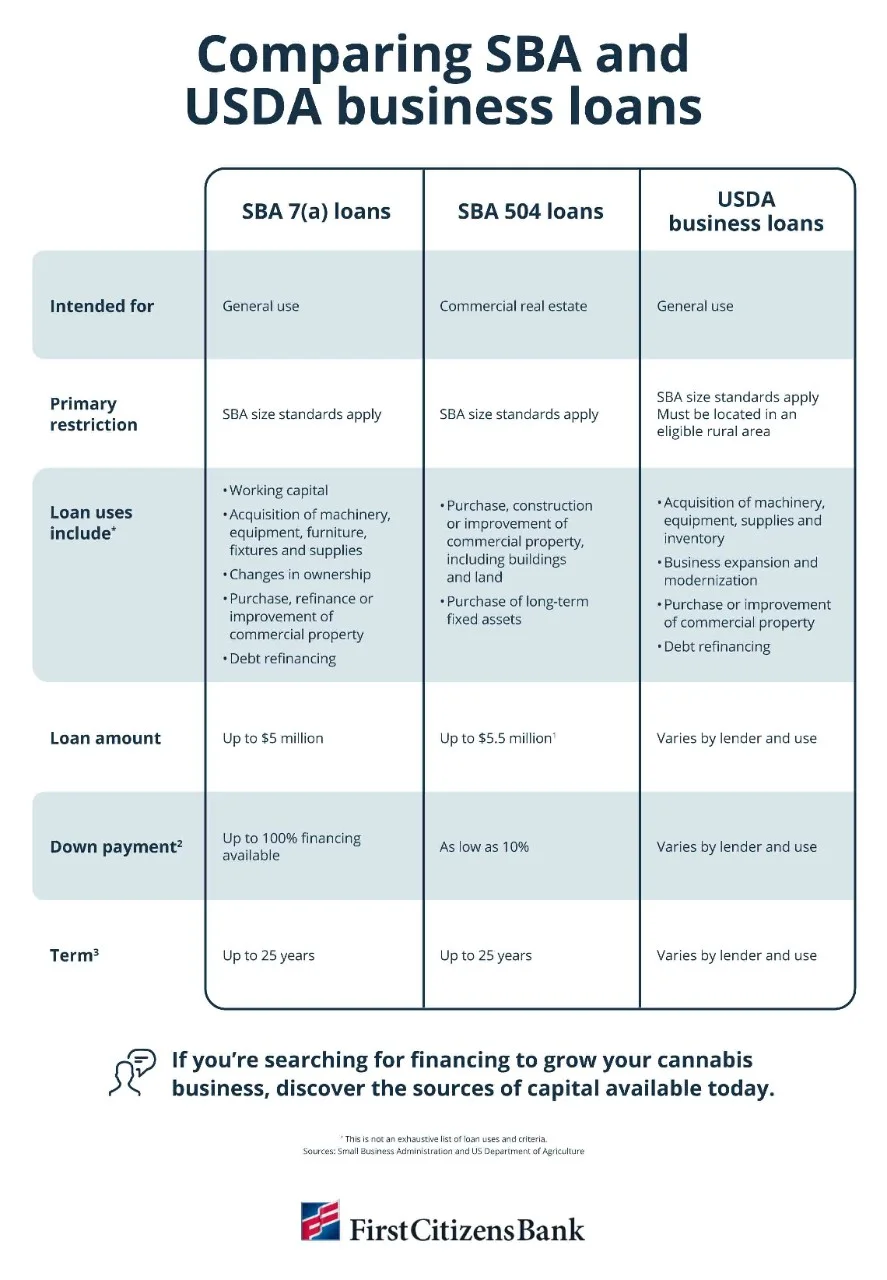

SBA 7(a) and 504 loan programs in particular have been instrumental in providing flexible financing solutions—making them a go-to option for many entrepreneurs, including hemp businesses.

- 7(a) loan program: The most common SBA loan, the 7(a) program, provides flexible funding that can be used for a variety of business needs, including start-up costs, equipment, supplies and real estate. The maximum loan amount is $5 million, with up to 100% financing. Longer repayment terms allow for improved cash flow.

- 504 loan program: This program is designed for financing major fixed assets, allowing businesses to cover up to 90% of the purchase or improvement costs for buildings, land, facilities and long-term machinery or equipment. The project is typically financed 50% by the lender, 40% by the SBA and 10% through a down payment. The maximum SBA portion is typically capped at $5 million, although certain projects may qualify for up to $5.5 million. A minimum down payment of 10% is required—with an additional down payment for start-ups and special-use buildings—and includes long repayment terms of up to 25 years and fixed, below-market interest rates on the SBA portion of the loan.

USDA business loans

The USDA's B&I loan program is especially advantageous for hemp businesses operating in specified rural areas. This is generally defined as locations with a population not exceeding 50,000. Like the SBA's 7(a) loan program, USDA B&I loans can cover a broad range of uses. However, they often have significantly higher borrowing limits.

Your loan officer can determine how much you may be eligible to borrow, and it's possible that you may qualify for more than one loan program. As a result, working with a lender that offers both SBA and USDA business loans may be beneficial.

Loan eligibility

To qualify for a government business loan, hemp businesses must meet the same basic requirements as any other company. For example, to qualify for SBA loans, they must operate as for-profit businesses in the US and conform to SBA size standards.

According to Adrienne Sipe, executive director of SBA lending at First Citizens, there are several ways to meet these standards. "Depending on the industry, your business may qualify as a small business based on either employee count or revenue size," she says. "But you can also use an alternative size standard to assess eligibility."

Specifically, your business must have less than $15 million in tangible net worth and less than $5 million in net income after federal income taxes for the previous 2 years.

In general, qualifying for a USDA business loan is like qualifying for an SBA loan. However, your business must be located in an eligible rural area. Another critical difference is that USDA business loans must be fully collateralized, which can pose a barrier for smaller hemp businesses.

"SBA collateral requirements vary, and insufficient collateral isn't an automatic reason for denial," Sipe says.

Applying for a government business loan

When applying for hemp business loans guaranteed by the SBA or USDA, you'll work through a bank or other lender. It's helpful to choose one with a deep understanding of government loan requirements, as well as the hemp and cannabis industry as a whole.

Regardless of the type of loan you pursue, you'll need to outline a sound business purpose for the loan and demonstrate your ability to repay it. Having management and industry experience is essential—especially for a niche industry like hemp—but lenders may consider relevant experience from other fields as well.

A successful application typically includes the following documentation:

- Business license

- Financial statements and projections

- Business and personal tax returns from the past 3 years

- Business debt schedule

- Personal financial statement

- Detailed business plan

- Specific funding request

How to apply for an SBA loan

"Getting approved for an SBA loan or USDA business loan depends a lot on the thoroughness of your application," Sipe says. "You'll need to show how your business makes money and describe its operating cash flow cycle. If you're providing projections, then make sure you explain what the assumptions are behind those numbers. The more information you provide, the better."

This aspect of the process may be complicated for first-time borrowers, and it's another reason relying on an experienced lender can be invaluable.

The bottom line

Both SBA loans and USDA business loans can be vital resources for hemp businesses seeking funding. By understanding the eligibility criteria and loan options available, you can better navigate the process.

Consult an experienced SBA lender who can assess your eligibility and help you find the best government business loans to meet your needs.

"Our understanding of the unique needs of hemp and cannabis businesses, coupled with our expertise in SBA loans, is why so many in this industry choose to bank with First Citizens," Sipe says.

Grow your business with First Citizens

Our experienced financial professionals have a deep knowledge of both the cannabis and hemp industries and are dedicated to making your banking experience as convenient and efficient as possible.