USDA and SBA real estate loans for commercial property

Rising rents are an ongoing challenge for many small businesses. In fact, nearly six in 10 reported facing recent rent spikes, according to a survey by the networking platform Alignable. Yet while owning commercial space can offer stability and support future growth, qualifying for conventional financing and covering a large down payment may be a barrier for many.

For small business owners looking to buy a storefront, office, factory or other facility, government commercial real estate loans may offer a promising path forward. Learn more about using US Department of Agriculture, or USDA, and Small Business Administration, or SBA, real estate loans to buy commercial property.

Pros and cons of buying commercial property

In the early days of starting a small business, leasing is often easier and more accessible than buying commercial space. Yet over time, unexpected rent increases can strain budgets, limit long-term growth and, in many cities, even dictate the future of the business.

While buying commercial property may be highly beneficial for many small businesses, it's important to make sure the benefits outweigh any potential downsides.

Benefits of buying commercial property

For many small business owners, increased stability is a key benefit of buying commercial real estate. Others include potential tax breaks, the flexibility to make improvements and the opportunity to rent unused portions of the property.

"What's more, as the property's value appreciates over time, it can have a positive impact on the valuation of the business," says Shiloh Hall, Wholesale Sales Manager of SBA Lending at First Citizens. "The ultimate goal is to start building wealth through a long-term asset."

Potential barriers to consider

However, there are some drawbacks that can deter small businesses from purchasing commercial property. These include:

- Upfront costs, including a down payment and closing costs

- Inability to qualify for a conventional business loan

- The cost and responsibility associated with building maintenance and repairs

While these factors can be a barrier for many small business owners, loans backed by the SBA and the USDA may help minimize a few hurdles.

Government loans for small businesses

SBA and USDA business loans are two types of government loans for small businesses. These loans are guaranteed by the federal government but fulfilled by banks and other third-party lenders. This backing helps reduce risk for lenders, enabling them to extend loans to a broader pool of entrepreneurs.

Government loans for small businesses typically offer longer repayment periods and lower down payments, making them an attractive financing option.

"Each of these benefits helps the borrower maintain working capital, which allows them to focus their cash flow on growing the business, versus having it tied up in the long-term asset of real estate," says Alan Black, Senior Vice President and SBA National Sales Manager for First Citizens.

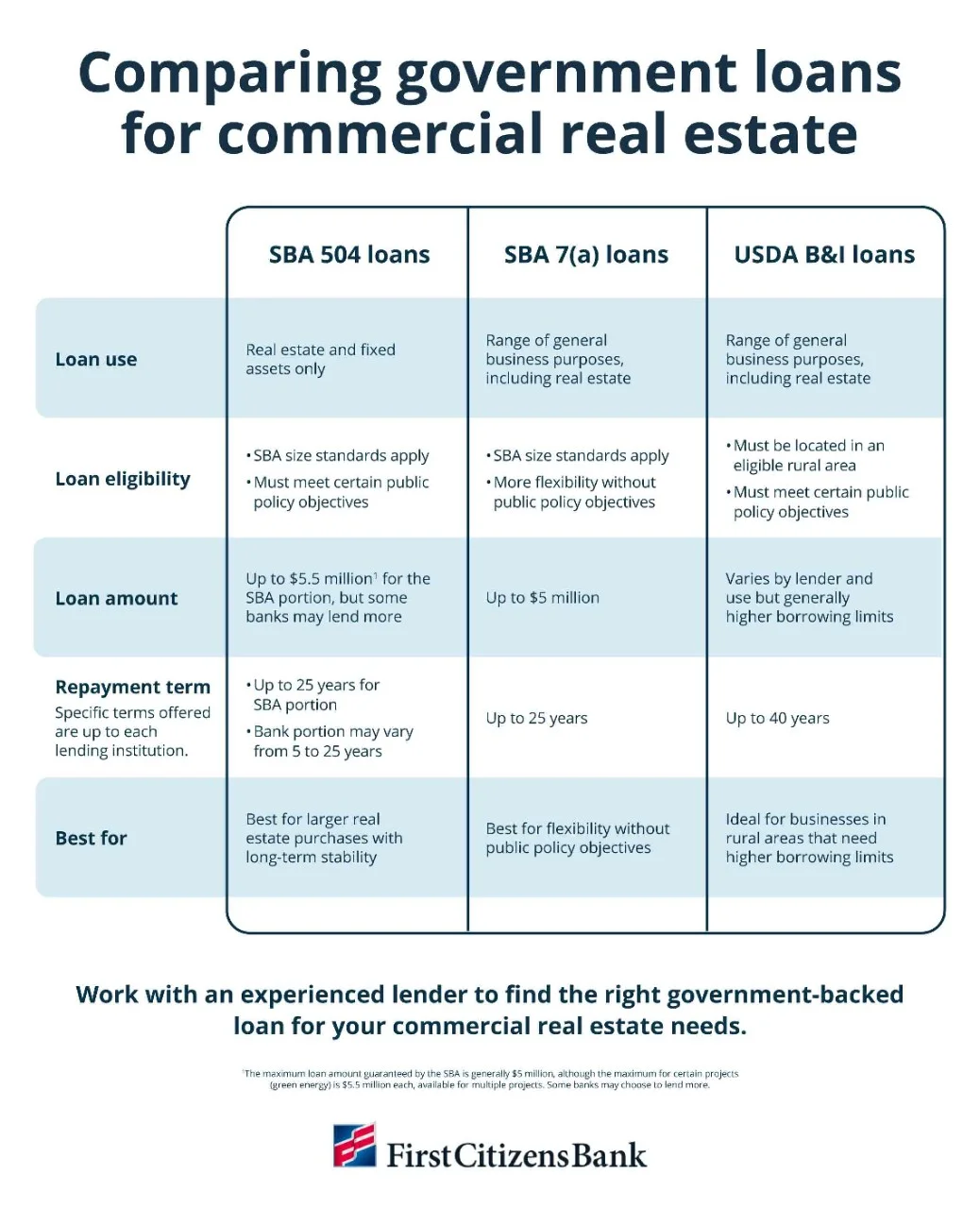

Among the various types of government-backed loans available, SBA 7(a) and 504 loans and USDA business loans are best suited for those wishing to buy or develop commercial real estate.

SBA 7(a) loans

The SBA's most popular loan, the 7(a) loan, can be used for a range of purposes, including buying, refinancing or improving real estate. Eligible business owners can borrow up to $5 million, and most SBA 7(a) loans have a repayment period of up to 25 years for real estate. SBA 7(a) loans can also include working capital, equipment and inventory in the use of proceeds of the loan. This isn't the case with 504 loans.

SBA 504 loans

The SBA's 504 loans are long-term, fixed-rate loans that can be used for a variety of purposes, including the purchase, construction or improvement of commercial real estate. Businesses can also use 504 loans to buy fixed assets with a useful life of more than 10 years. Eligible business owners can borrow up to $5 million.

The structure of a 504 loan splits funding into three parts. The third-party lender holds the first mortgage, typically 50% of the project cost. The SBA-backed portion of the loan will be a second mortgage, financing up to 40% of eligible costs. Finally, the borrower provides the remaining amount in the form of a down payment.

USDA B&I loans

The USDA's Business and Industry, or B&I, loans can be an appealing option for financing commercial real estate in an eligible rural area. B&I loans are typically guaranteed up to 80% by the USDA, and may be used to fund a wide range of business activities—including the purchase or improvement of real estate. However, many lenders offer significantly higher borrowing limits for these loans.

Eligibility for SBA real estate loans

To finance the purchase of commercial property with an SBA loan, you must maintain a minimum owner occupancy of 51% for existing buildings and 60% for new construction.

"SBA loans are designed to support small businesses and spur job creation, not provide financing for passive investors," Hall explains. "For example, a multi-tenant office building, where income is derived from rental payments, wouldn't be eligible. But if you're buying a 100,000-square-foot building with the intent to lease 25% of the space—because you think you'll expand down the road or need the lease income to make the mortgage payment—that could qualify."

Borrowers must also meet several general SBA loan requirements. For example, their business must be for profit and located in the US.

USDA B&I loan requirements

The eligibility criteria for USDA B&I loans are similar to those of SBA loans with an important distinction—the property must be located in an eligible rural area. Applicants must also demonstrate that loan funds will remain within the US and that the funding will help create or retain jobs for rural US residents. Unlike SBA loans, nonprofit businesses are eligible for B&I loans.

Choosing the right government loan

When it comes to choosing the right government loan for financing commercial real estate, there are some important factors to consider.

Loan amount

SBA 7(a) loans are limited to $5 million, but it's possible for a bank to do a conventional loan for the balance exceeding that amount. SBA 504 loans technically have no maximum. The SBA-backed portion has a maximum of $5 million or $5.5 million under the Green Loan program, but the bank can fund a larger portion of the project if it meets their loan-to-value guidelines. USDA B&I loans can typically be much higher, but banks often have their own maximums.

Length of repayment

SBA 504, 7(a) and USDA B&I programs all offer long repayment terms that can help improve cash flow. The bank's portion of a 504 loan may have a balloon or shorter amortization, so be sure to discuss the details with your lender.

Use of proceeds

SBA 7(a) and USDA B&I loans allow for more flexible use of funds.

"For example, if you're opening a bakery, you'd be limited to using the proceeds from a 504 loan for expenses like buying a property and installing major fixtures in the kitchen," Hall explains. "With a 7(a) or B&I loan, however, you could also fund other fixtures, inventory and working capital—all in one loan."

Ability to meet objectives

Both SBA 504 and USDA B&I loans require borrowers to meet certain objectives. For example, those interested in a 504 loan must be able to meet goals surrounding job creation and retention, community development, public policy or energy reduction. If you're not able to achieve these objectives, a 7(a) loan may be a better fit.

If you're uncertain which government commercial real estate loan is right for you, speak with a government loan specialist. They can assess your needs and match you with an appropriate loan or combination of government commercial real estate loans.

Applying for USDA or SBA real estate loans

As you begin the process of applying for a USDA or SBA real estate loan, remember that preparation is key.

Your lender will provide you with a list of documentation requirements. Some common requests include:

- Personal and business tax returns from the past 3 years

- Financial documents, including a current profit-and-loss statement and balance sheet

- Financial projections for startups or expansions

- A detailed business plan that makes clear your ability to sustain your business if your business is a startup

- Purchase agreements or construction contracts related to the real estate

Your lender should review these documents to ensure that your business is in a good position to handle additional financial obligations.

"It's vital to work with an experienced lender who can help guide you through the process and who has the resources to process your loan in an efficient, timely manner," Black says.

The bottom line

If you're interested in using government loans for business property, you'll need the right financial partner to help you apply for financing. Given the complexities of applying for a USDA or SBA real estate loan, navigating the process with an experienced lender is key.

"That's why we don't just provide our customers a loan, we offer them a full relationship," Black says.

Hall echoes this sentiment. "We watch our customers grow through their life cycle, helping them obtain their first property and maybe one day expanding to a larger facility, or even additional locations."

Fuel your business's dreams

We can help you navigate every step of the SBA loan process. Find a lender in your area to get started.