Quicker deposits

Open the door to faster payments with same-day ACH processing. Same-day ACH transactions provide faster funds availability.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

February Basis Points

The Making Sense team highlights key issues from the first weeks of the new year, including US equities and a low-hire, low-fire labor market.

Send electronic payments to your employees and vendors using our automated clearing house, or ACH, services. ACH payment services allow for fast and secure online money transfers, such as direct deposits or bill payments.

Flexible options

Send single and recurring payments for payroll, benefits, tax refunds and paying bills online.

Reduced costs

Eliminate costs for generating checks, mail and postage.

Simple deposits

Allow customers to make deposits quickly and easily.

Open the door to faster payments with same-day ACH processing. Same-day ACH transactions provide faster funds availability.

Disburse ACH payments securely online for payroll, reimbursements, tax refunds, annuities and interest payments.

Provide in-depth reporting for any credit returned or incorrect information that appears in an ACH transaction.

Your ACH questions, answered

Access frequently asked questions and view our interactive Digital Banking for Business User Guide for information on ACH payments and transactions.

National ACH website

Get the latest news, events and education related to ACH payment services at Nacha.org.

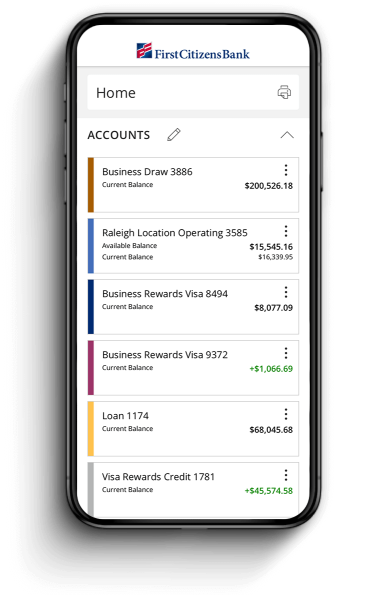

Manage your accounts from anywhere

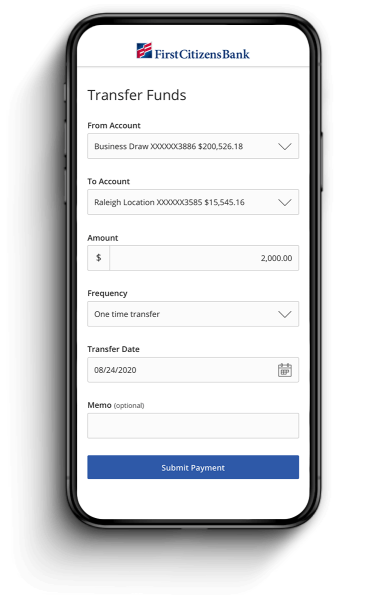

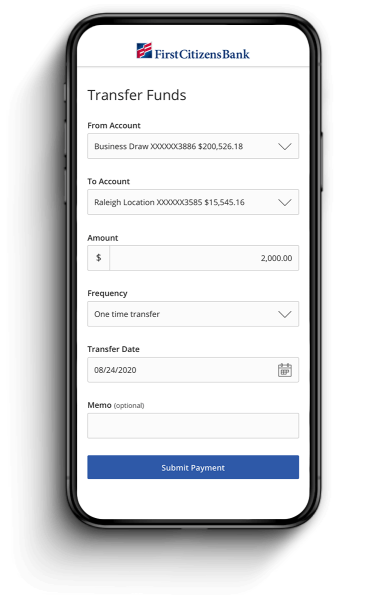

Send & transfer money with ACH and wires

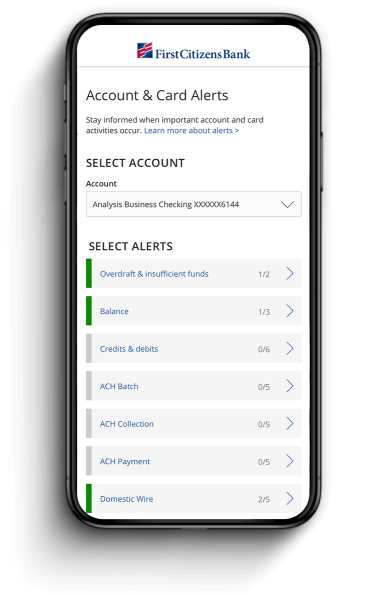

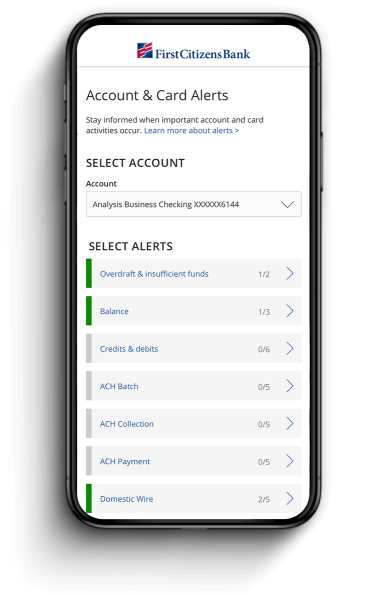

Receive account and security alerts

Manage your accounts from anywhere

Send & transfer money with ACH and wires

Receive account and security alerts

An ACH payment is a type of electronic credit or debit payment initiated through the Automated Clearing House network. The payment can be initiated between two banks or between two bank accounts that are held by the same bank.

Various types of payment methods are offered through Digital Banking for business. For step-by-step instructions, view our Digital Banking for Business User Guide. You can also check out the ACH payments and ACH templates videos on our Video Tutorials page.

An ACH transfer is an electronic transfer of funds between two bank accounts. It's initiated through the Automated Clearing House network so you can send payments or pay bills quickly, depending on the ACH payment services available at your bank.

ACH transfers and automatic payments are processed securely by either the Federal Reserve or the Clearing House Payments Company, and then funds are moved electronically from one bank to another. ACH payment services generally are offered by banks and other financial institutions and often include same-day processing and detailed reports online.

ACH is the Automated Clearing House network, which is a system that transfers funds electronically from one party to another. It allows you to pay bills, send payments or transfer money from your bank to another in a fast and secure way.

After a payment has processed and cleared, you can't make changes to that transaction. Detailed steps on the different ACH transaction types can be found in our Digital Banking for Business User Guide. You can learn more by watching the ACH payment services and ACH templates videos on our Video Tutorials page.

If you're assigned the Manage Template and Recipient rights, you can edit or delete a recipient template. View steps to do this for the different ACH transaction types in our Digital Banking for Business User Guide. Or you can watch the ACH payments and ACH templates videos on our Video Tutorials page.

Normal bank approval applies.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Fill out the form below to connect with us about ACH payments. Fields denoted with an asterisk (*) are required.

If you prefer to speak with someone directly, please give us a call.