When can you retire? How to know you're on track

It might be one of the most common questions financial planners and advisors get. "At what age can I retire?" But it's a tough answer to nail down. Financial planning for retirement has many moving parts.

To get started, however, it's a good idea to identify approximately how much you'll need to save to retire comfortably—and the progress you've made toward that goal. While the dollar figure will vary depending on the life you envision in retirement and your life expectancy, you can follow rough guidelines to assess your current financial situation.

1 Run the numbers

Determining when you can retire involves more than taking a peek at what you've saved in your retirement accounts. You'll need to have a clear picture of where you financially stand today to ensure the most accurate planning. Either on your own or in conjunction with your financial advisor, it's relatively easy to run the numbers on your savings and income streams.

- Calculate your net worth. An online net worth calculator can help you get a clear view of your current assets and liabilities.

- Identify current and future income streams. Rental properties, businesses and other revenue streams that add to your retirement income will impact how much you need to save.

- Review your current retirement savings. This includes qualified accounts such as IRAs, 401(k)s, defined benefit and pension plans, and even taxable investment accounts you've earmarked for additional retirement savings.

- Consider Social Security. When you choose to claim your Social Security benefits has a significant impact on financial planning for retirement. You can estimate your benefits by retirement age and use these figures to help you plan for lower and higher payments.

2 Design your retirement

Before you know whether you'll have enough money saved to retire—the key factor in determining when you can retire—you need to have an idea of what your dream retirement looks like. Here are some areas to think about so you can better understand what you'll need your retirement savings to cover when you make the big leap.

- Geography: Where you retire can have a significant impact on how far your savings stretch. State income taxes, property taxes and utility costs all need to be factored in.

- Medical expenses: The financial website Investopedia estimates that a 65-year-old couple who retired in 2022 could easily spend $315,000 on medical expenses throughout their retired years—not counting the median $108,405 annual cost for a private room in a nursing home. The earlier you plan to retire, especially before Medicare eligibility, the more you'll need to save.

- Income: If you plan to keep busy with a part-time job during retirement, it can make your savings last longer. Don't forget, though, that the Social Security Administration will deduct $1 from your benefit payment for every $2 you make over a certain benchmark, until you reach full retirement age. The benchmark changes every year. For 2023, it's $21,240 a year. The only exception involves the year in which you reach full retirement age. In that year, Social Security will deduct $1 for every $3 you make above a much higher limit—for 2023, it's $56,520. But only the income you earn up to your birthday is counted. After that, you can make as much as you like without penalty.

- Expenses: While it's ideal to roll into retirement with as few liabilities as possible, you'll need to account for living expenses such as taxes, utilities and groceries. Don't forget to factor in extras like travel and recreational expenses such as golf and fitness memberships.

- Legacy: Do you want to leave some money behind? You'll want to adjust your savings plan to accumulate any amounts you want to leave to family or charity in addition to covering your retirement. If charitable giving is part of your plan, you may want to consider establishing a qualified charitable distribution, or QCD, plan after you turn 72. A QCD allows you to funnel all or part of your required minimum distribution directly to a charity, tax free. Otherwise, you'll have to pay income taxes on your withdrawals.

3 Assess where you stand and create a plan

Once you have both your net worth and rough retirement plan in hand, it's time to set some benchmarks for your retirement savings to keep you on track for your ideal retirement age.

As a general rule of thumb, many financial planners assume that a typical retiree will need to spend about 80% of their pre-retirement income to maintain a comfortable lifestyle, although the percentage you'll need may be higher or lower. While Social Security and pensions will cover part of your anticipated retirement spending, you should consider how much you may need to withdraw from your retirement savings to fund your lifestyle and ensure that you won't run out of money.

Fidelity has developed a set of rough benchmarks for retirement savings targets by age, estimating that most people will want to maintain their pre-retirement lifestyle. Of course, your calculations may be different based on the design and cost of the retirement you're envisioning.

- Age 30: 1x your annual salary

- Age 40: 3x your annual salary

- Age 50: 6x your annual salary

- Age 55: 7x your annual salary

- Age 60: 8x your annual salary

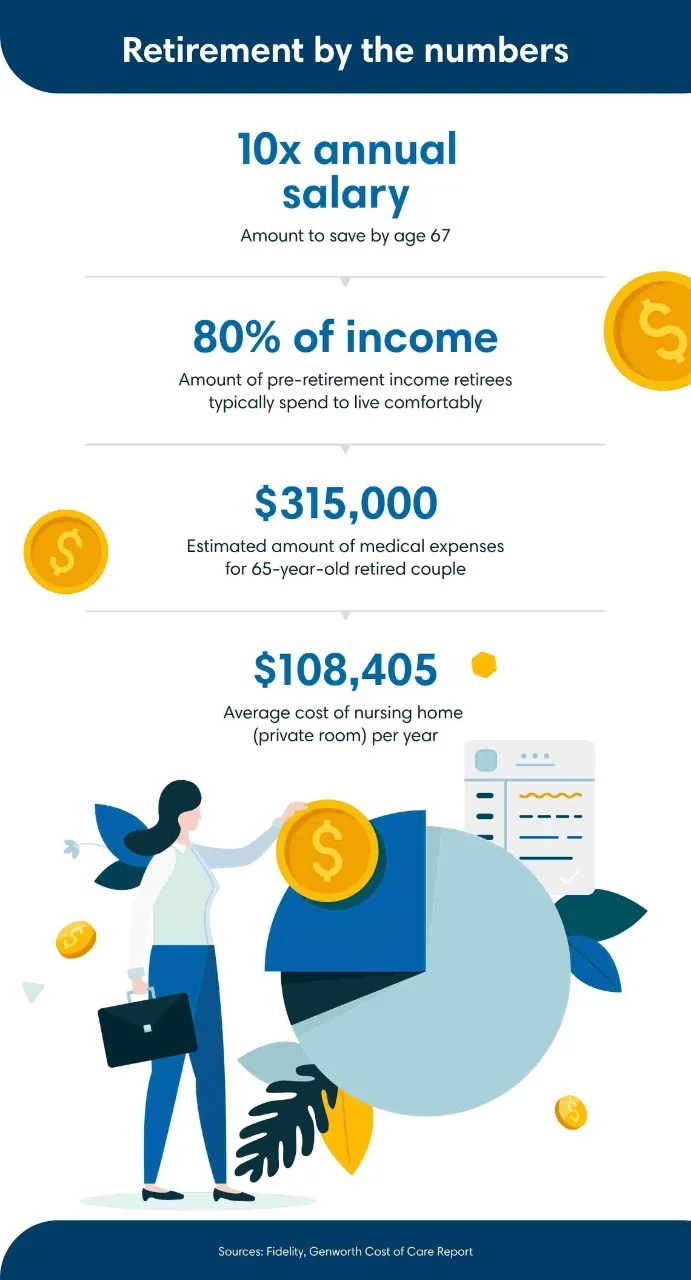

Retirement by the numbers

Based on research from Fidelity and the insurer Genworth Financial's annual Cost of Care Report, your retirement may look something like this.

- 10x your annual salary is the amount to save by age 67.

- 80% of income is the amount of pre-retirement income retirees typically spend to live comfortably.

- $315,000 is the estimated amount of medical expenses a 65-year-old retired couple can expect to spend.

- $108,405 is the average cost of a nursing home private room per year.

If your savings amount is behind the target figure, you can work with your financial advisor to develop a strategy to increase your savings or reduce potential future retirement expenses. If you're ahead of the game, you can consider accelerating paying off debts, creating a taxable investment account for additional savings or even working on your wealth transfer plans early.

The bottom line

Knowing when you can retire is truly about having a plan. The sooner you can craft a plan that aligns with your dream retirement age, the better you'll be able to cope with life's curveballs along the way. And once you have a plan in place, don't forget an annual financial checkup to make sure you stay on track. You and your dream retirement both deserve the extra attention.