How to stress test your retirement game plan

Everyone has a unique vision of what their retirement will look like, but most people have two main goals in common—enjoying those years and not running out of money while they do so. By stress testing or even test driving your plan before retiring, you can determine whether you need to adjust your retirement game plan.

It may not be until they reach retirement that people find they feel bored, isolated or adrift. Today's financial advisors know that the days of simply retiring to a couch are gone. While the planning conversations you have may seem focused on finances, what you're really discussing is your future happiness.

"What are your dreams and wishes?" asks Jason Burkett, Premier Banking Sales Performance Manager for First Citizens. "What is your purpose, what is your passion? We ask a lot of these questions to get to know you. Then we help you think about how to translate those emotional goals into a quantifiable plan that can help you get from a dream to reality."

Planning for happiness

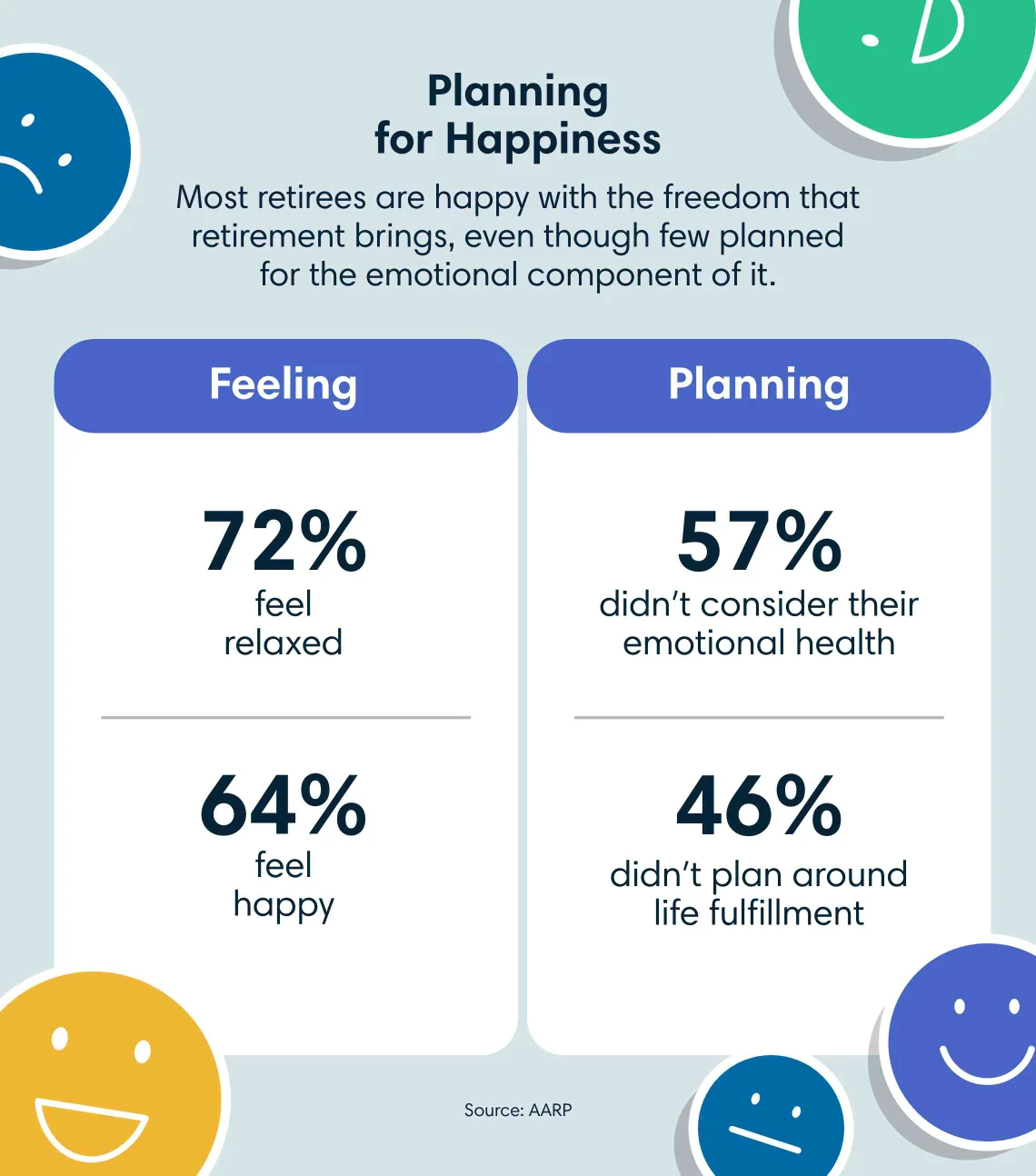

Most retirees are happy with the freedom that retirement brings, even though few planned for the emotional component of it.

According to a recent AARP study (PDF) on planning for a successful retirement, younger generations think of their future retirement as a time of freedom to do what they want. This is echoed among retirees: 72% feel relaxed and 64% feel happy.

Ironically, though, when people think about planning for retirement, feelings often take a back seat. The same study reports that over half, or 57%, of retired adults didn't consider their emotional health as they planned for retirement and almost half, or 46%, didn't plan around life fulfillment.

Part of that exercise could be taking your retirement game plan on a test drive to find out if you're ready for the freedom of retirement. Here are a few ways to try it out.

1 Start traveling

Traveling is often one of the top lifestyle goals in retirement. Get a taste of it beforehand by taking some long weekends away. You'll learn your preferences quickly: road trips versus flying, hotels versus short-term rentals, active itineraries versus leisurely free time and so on.

Once you experience the way you want to travel, how often and who you want to include in those plans, you can start mapping out how to afford trips in retirement.

"I spoke with someone the other day who made a big shift to buy an RV," Burkett says. "Another person thought they would bring their whole family somewhere every year, and after the first trip changed it to be every 5 years. Your goals can change as you remove some of these blind spots."

2 Pursue your passion project

Have you been waiting until retirement to try a brand new hobby, do some part-time creative work or start your own business? Any of these can add a renewed sense of purpose to your retirement years and even provide you with some extra income. However, there are many factors to consider, including the costs of time and materials, operational overhead, insurance and taxes.

"We see a lot of people finding their second act," Burkett says. "Picking up golf in retirement sounds great, but are you going to want to golf every day? We have to ask these questions to help you make a decision before you actually pull the trigger."

Again, research is key. Try out the new hobby, do the creative work or build a small business plan on the side for a few months and see how much time, energy and money they take. If they're positive experiences, your retirement plan can be adjusted to help you pursue them even further when the time comes—because your budget will be very different from what it is today.

3 Schedule volunteer time

One way retirees stay connected to their communities and maintain a sense of personal fulfillment is to volunteer their time. In fact, nearly a quarter of retired adults say it's a significant part of their lives, according to AARP.

Philanthropic work can be much more involved than people realize. Think about the causes you're most passionate about and learn more about the organizations you want to be involved with so you can understand the type of help they need. It could be more than just your time—there may be physical, social or financial demands, too.

"Just because you're retired, people might think that all you have is free time," Burkett says. "It's okay to say no or not right now so that you don't get overwhelmed and burn out."

Spend some weekend time working with the organizations to see how much you can handle. Learning the boundaries you may need to set ahead of time can help you strike the lifestyle balance you'll enjoy most in retirement.

Testing now may prevent dissatisfaction in the future

While most people assume they'll enjoy their retirement, it's hard to anticipate exactly what having all that freedom will feel like until you experience it. A report from Joblist noted that there's a significant trend of unretirement among people who retired during the pandemic and are now looking for work in the aftermath of it. And while some of those are looking for financial reasons, the report said 60% of those retirees looking for work were just looking for something to do.

"We want to help you have the retirement you want, and even the things that seem far gone aren't necessarily out of reach," Burkett says. "The right asset allocation, the right risk tolerance, the right schedule of contributions—we can put it all on paper as a retirement stress test to see where you are compared to your goals."

In other words, as he sums it up, "The dreams can be a reality."

Planning for the next stage of your life journey

Watch our video to see how life planning can help you achieve your goals in retirement.