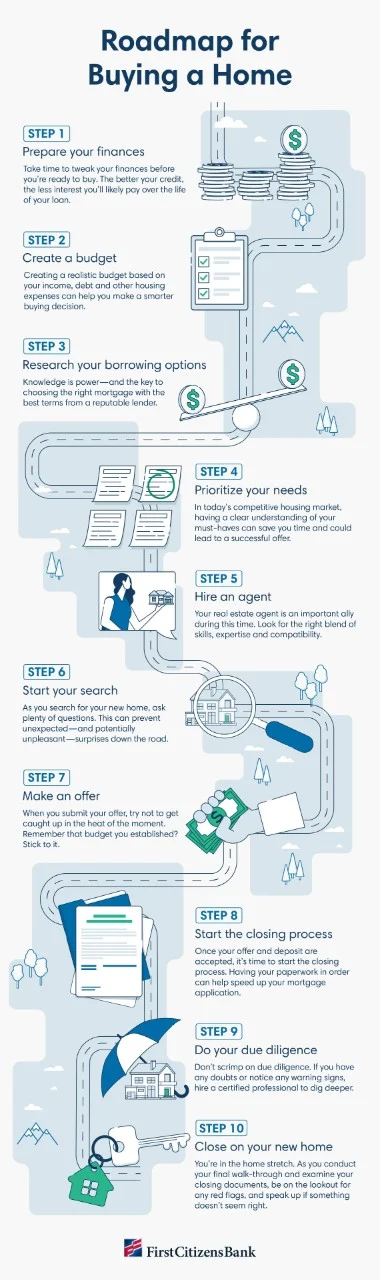

10-step guide to buying a house

Not only is a home one of the biggest purchases and one of the more significant commitments you'll make in your lifetime, it's also one of the most stress-inducing. Even if you're not a first-time homebuyer, navigating the steps to buying a house doesn't have to be overwhelming.

If you're ready to make the leap from renter to homeowner, here's what to expect, as well as some tips to help you through the steps involved with buying a house.

Step 1: Prepare your finances

Taking the time to get your finances in order may be one of the most important steps to buying a house, particularly if you're a first-time homebuyer.

When it comes to buying a home, the better your credit history and the larger your down payment, the better your mortgage interest rate will be. And while the difference of a fraction of a percentage point may seem negligible on paper, it can have a significant impact over the life of your loan.

For example, let's say you'll need to finance $300,000 over a 30-year period to purchase a home. At a 5% interest rate, you'll pay $279,767 in interest over the life of the loan. If your mortgage rate is 5.5%, however, you'll pay an additional $33,445 in interest over that same period.

Here are some things you can do to help ensure you're financially well-prepared before diving headfirst into the homebuying process.

Take steps to improve your credit

It may take some time for positive changes to hit your credit report, so start working on your credit at least 6 months before applying for a mortgage. As a first step, look for any errors or blemishes that may need to be addressed.

If you're carrying high balances on your credit cards, know that reducing credit utilization ratio can help raise your credit score. If you're new to this topic or are unsure where to begin, our guide to credit scores may be a helpful starting point.

Determine how much you'll need to save for a down payment

Depending on your qualifications and the type of mortgage you choose, you may be eligible to buy a home with a down payment that's less than the typical 20%. However, as a general rule, know that it pays to save. The bigger your down payment, the more money you'll save in interest payments over the life of your loan.

Step 2: Set a homebuying budget

Now is a good time to take a closer look at your income, current debts and personal spending habits to determine how much you can reasonably afford.

If you're a first-time homebuyer, this step can sometimes be tricky. This is because there are many other expenses—including insurance, homeowners association, or HOA, fees and taxes—that need to be included in your budget. Also, you'll likely encounter plenty of unexpected expenses as a homeowner, so sticking to your budget—even if you're preapproved for a larger amount—will be key to your long-term financial success.

Calculate your debt-to-income ratio

When determining your homebuying budget, it's helpful to start by calculating your debt-to-income, or DTI, ratio, which is your total debt compared to your monthly income. As a best practice, your total debt—including housing expenses—shouldn't exceed 36% of your monthly income. Use our DTI ratio calculator to run the numbers.

Determine how much house you can afford

Next, calculate your home affordability to estimate your homebuying budget. In addition to your estimated monthly mortgage payment, account for expenses like HOA fees and homeowners insurance. Some homebuying websites include this information within each listing, which you can use to estimate how much you might need to spend each month.

Buy a home within your budget

If your budget is a bit lower than the average home price in your area, buying a foreclosed home or buying a fixer-upper may be two options to consider.

Step 3: Explore your mortgage options

Navigating the many types of mortgages might be confusing, particularly if you're a first-time buyer. Taking the time to learn about your options before you're ready to apply for a mortgage can help you make a well-informed decision.

Find the right type of home loan

There's a range of borrowing options available, from conventional loans to government home loans like FHA loans. Research the differences between a fixed-rate mortgage and an adjustable-rate mortgage to determine which might be a better fit for your needs.

Know your mortgage terminology

As you research your options, keep our glossary of over 130 mortgage terms handy.

Find the right mortgage lender

Your relationship with your mortgage lender may last as long as 30 years, so choose carefully. Pay close attention to factors like stability and level of service—they can go a long way toward helping you choose the best mortgage lender for your situation.

Get preapproved for a mortgage

Once you've chosen a mortgage lender, they'll conduct a thorough review of your finances to determine your borrowing power. If you're preapproved, you'll receive a written letter from the mortgage lender stating that you qualify for a certain loan amount. Keep this letter handy—many sellers won't accept an offer until they see proof that you're able to finance the purchase.

Find the right mortgage

Ready to start researching your borrowing options? Explore our guide to shopping for a mortgage.

Step 4: Prioritize your wish list

The combination of low housing stock and increased demand has made today's housing market a particularly tricky one to navigate. However, having a clear sense of what's most important—and what you're willing to compromise on—may make the process of shopping for a home much easier.

Identify your must-haves

Before dipping your toes into the water, prioritize your wants and create a list of non-negotiables. Aside from a firm budget, consider location, square footage, lot size, home condition and home style. If your must-haves aren't available in the housing stock in your area, building a home versus buying may be something to consider.

Step 5: Find a real estate agent

From helping you find the right property and negotiating the purchase terms to smoothing out difficulties and keeping the closing process on track, your real estate agent will play a key role in your journey to homeownership.

Look for the right mix of traits

Before choosing an agent, evaluate their experience, reputation, communication skills, professionalism and responsiveness. And don't underestimate the importance of compatibility. Buying a home can be a stressful and sometimes emotional process, so having an agent whose personality and communication style are compatible with yours may make a big difference.

Review your contract

As a buyer, you won't directly pay a real estate agent. Instead, sellers cover the cost of an agent's commission, which is paid at settlement. Just make sure the contract you sign with your agent says they're legally required to look after your interests, which is often referred to as having a fiduciary responsibility.

Step 6: Shop for a home

With your down payment in the bank, preapproval in your hands and an agent to guide you, now's the time to look for your new home.

Ask the right questions

Each state has its own laws regarding seller disclosures. While many states require sellers to disclose significant issues with a property, the rules vary greatly. Some states use the caveat emptor, or buyer beware rule, meaning the onus is on the buyer to learn more about the home's condition.

These questions serve as a starting point to ensure you're getting the information you need.

What to ask when viewing a house:

- How long have the sellers lived here?

- Why are they selling this home?

- How long has this home been on the market?

- What's the average cost of utilities each month?

- What's the neighborhood like in terms of safety and amenities?

- Are all appliances and fixtures included in the sale of the home?

- Are there HOA fees?

What to ask before making an offer on a house:

- How old is the HVAC system?

- How old is the roof, and when was it last inspected?

- How old are the appliances?

- Are there previous insurance claims filed for the property?

- Where are the exact property lines?

- Are there easements?

- Are there restrictions, covenants or conditions that come with the property?

- Are there sellers' disclosures or known issues, such as damage, foundational issues, termites, lead paint or liens?

Step 7: Make an offer

Once you've found your dream home, work with your real estate agent to determine an appropriate offer price. Your agent will evaluate multiple factors to ensure your bid is competitive—including your budget, the home's condition, location and other recent sales in the area.

Draft and submit your offer

Once you've settled on an offer price, your agent will help you draft a home offer agreement. This document typically includes the proposed purchase price, amount of earnest money—a deposit you could lose if you back out of the contract—and any contingencies, which refer to the conditions that allow you to back out of the offer without losing your deposit. Once you've reviewed and signed the offer, your agent will submit it to the seller or to their real estate agent.

If the seller comes back with a counteroffer, decide if you want to increase your bid. It's easy to get caught up in the heat of the moment, so determine how high you're willing to go before submitting your offer.

Step 8: Start the closing process

Once your offer is accepted, it's time to initiate the closing process. Your first order of business will be to sign a purchase agreement and put down earnest money, which will take the home off the market.

Deposit earnest money

This monetary deposit—which typically ranges anywhere from 1% to 10% of a home's purchase price—is a good-faith deposit showing that you intend on purchasing the home following the due-diligence period. Earnest money will typically be transferred to a third party, such as a lawyer, broker or title company, and will be held in escrow until the sale is completed. If you back out of the agreement for a reason not covered by a contract contingency, you could lose this deposit.

Apply for a mortgage

As you complete your application, your lender will do another credit pull, re-evaluate your finances and begin the underwriting process—all necessary steps when applying for a mortgage. Use this mortgage application checklist so you have the required documentation and paperwork ready.

How to apply for a mortgage

Learn more about how to apply for a mortgage.

Step 9: Do your due diligence

While there are some exceptions, most contracts will give you time to conduct due diligence on the home. Depending on which homebuying contingencies were included in your agreement, you may be able to negotiate with the seller or walk away from the purchase if any issues arise during this period.

Hire a home inspector

Even if the seller provides you with a home inspection report, you should have your own inspection conducted. As you interview inspectors, ask what aspects of the home they'll evaluate. Depending on the home's location and condition, you may want to hire a professional to look for issues that may not be included in a standard home inspection, such as radon gas, asbestos, lead paint or toxic mold.

Get an appraisal

Most mortgage lenders will conduct a formal home appraisal, which are typically included in your closing costs. This step—which a neutral third party will carry out—ensures that the home you're hoping to buy is worth the purchase price. If the appraised value is lower than what you've agreed to pay for the home, you may need to renegotiate with the seller or pay for the difference out of pocket. If you've included an appraisal contingency in your purchase contract, you may also have the option to walk away from the sale.

Hire a title company

As the buyer, you'll also need to choose a title company and arrange for them to conduct a property title search and handle settlement. The home title search will involve looking for any tax liens, pending lawsuits or claims against the property to ensure that the seller is the legal owner of the property and that all legal matters are disclosed prior to closing. This is essential to protecting you from any unknown claims and, in some cases, may be required by your mortgage lender.

Step 10: The home stretch

There are a few final steps you'll need to take before finalizing your home purchase.

Get insurance

Most lenders will require you to show proof of title and homeowners insurance before settlement. It's required to purchase these before attending the closing.

Attend the final walk-through

Before the closing, you'll have an opportunity to do a walk-through of the home. Your real estate agent will help ensure that the home is in good condition and that nothing has changed since submitting your offer.

Once you and the seller have satisfied all of the requirements and your lender has completed the underwriting process, it's time to attend the closing, sign documents and take ownership of your new home. Take a little time to learn more about what to expect in our guide to navigating the closing process.

Ready for a new home?

Whether you're ready to buy or just thinking ahead, consider speaking with a mortgage banker. They can evaluate your financial picture, explain your financing options and provide you with actionable steps you can take to achieve your goal of homeownership.