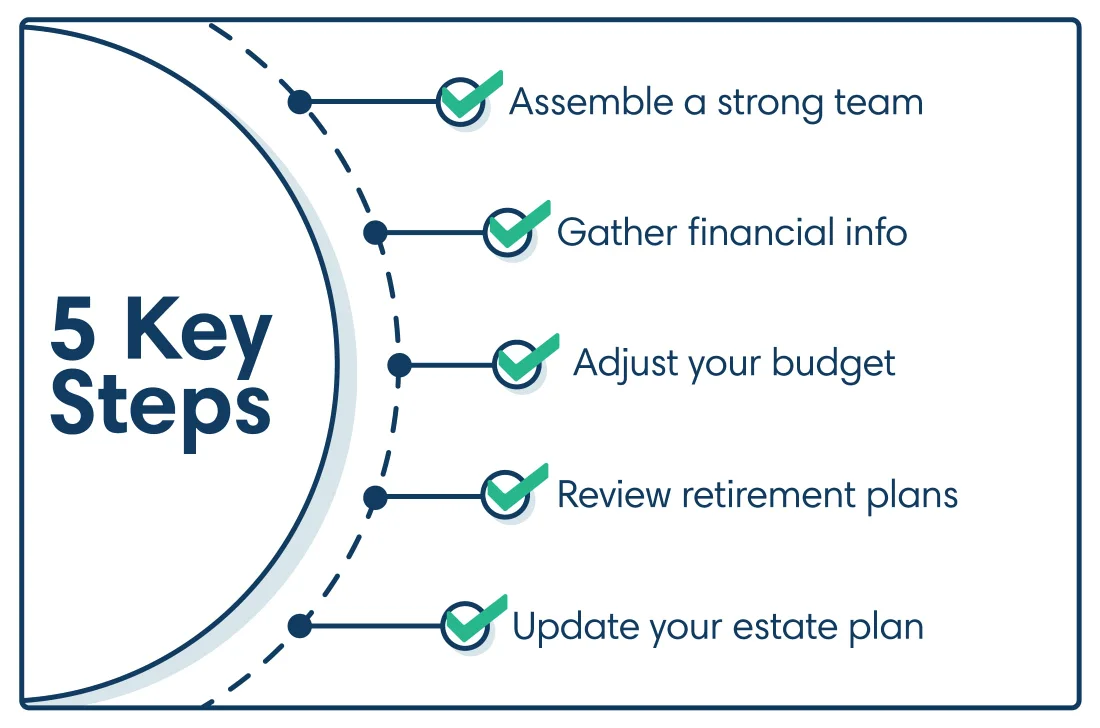

5 steps to secure your financial future during a divorce

It's common to feel overwhelmed and uncertain during and after a divorce. But there's a tool you can use when preparing for divorce—proactive financial planning. A solid strategy may help you find some peace of mind during this major life change.

"There are many things throughout the legal process of divorce that are completely out of your control," says Richard Houston, Senior Wealth Planning Strategist at First Citizens. "Creating a plan and being sure you're making decisions about everything that's in your control at this time is critical."

To help position yourself for financial stability as you move forward independently, consider these five steps.

1Assemble a strong team

The emotional aspects of divorce can make it an overwhelming time, so it's important to have a strong team in your corner. Ideally, you'll build a good rapport with a team that can guide you collaboratively.

One of the most important members of this team is a divorce attorney.

"Legal counsel is the first step, and the earlier you get them involved, the better," Houston says. "They're the ones who are ultimately going to be leading you through this process."

Your team might also include a tax professional and an estate planning attorney. If the divorce agreement includes decisions about real estate, you might also want to employ a real estate agent to help you understand the market value of properties.

It's also important to engage the support of a financial advisor. They can help you evaluate the financial impact of your divorce, create a holistic plan and coach you on how to prepare for the costs of divorce.

2Gather financial information

To ensure you and your spouse are equipped to make informed decisions, you'll need a clear picture of your combined finances. For this, you and your team should review various financial documents, including tax returns, bank statements, investment and retirement account information, loan statements and real estate or personal property information.

In addition to understanding the value of your assets, you can use these documents to get a handle on your household's debts. This is also an opportunity to review all your accounts to confirm ownership and titling, as well as to update any named beneficiaries.

It's important to maintain and protect your credit during this time, particularly if you and your spouse have joint accounts that will need to be closed or separated. Pull your credit report to check for errors or unfamiliar charges, and continue to monitor your report over time. It may also be a good idea to establish a credit card in your name if you don't have one already.

3Analyze your budget

Your income and expenses are likely to change after your divorce, so you should think about creating an updated spending plan that works with your new financial situation and lifestyle. Start by looking at your annual expenses and breaking out those that are discretionary or nice-to-have costs versus nondiscretionary, must-have costs. The latter category should include expenses, such as rent and utilities, as well as financial goals, such as paying down debt and saving for retirement.

Then you can determine whether those expenses will change once you've finalized your divorce and see how they compare to your post-divorce income, Houston says. If the expenses exceed your projected income, you'll need to adjust. That might require cutting back on discretionary expenses or looking at ways to increase your income.

In addition, speak with your financial and tax advisors to ensure you understand the long-term tax implications of dividing assets and how any spousal support will be taxed.

4Review your retirement plans

After a divorce, you'll likely need to reconsider many aspects of your retirement plan. You may need to recalibrate your savings goals and investment strategies or maximize contributions to retirement accounts. It's also important to understand the impact of divorce on your Social Security benefits and adjust your savings strategy as needed. The older and closer to retirement you are at the time of divorce, the more important it is to focus on these planning details.

No matter your age, you should aim to save at least 10% to 15% of your income for retirement, ideally in tax-advantaged accounts like a 401(k) or an Individual Retirement Account, or IRA. If saving at this level isn't realistic right away, start by putting away whatever you can with a plan to increase the amount you're saving over time.

If you're receiving retirement accounts as part of a divorce settlement, it's advisable to speak with a financial professional about the best strategy to handle those assets.

5Update your estate plan

In addition to updating beneficiaries, you'll likely need to revise the rest of your estate plan to ensure it reflects your current wishes. This may require changing fiduciary appointments, such as executor, trustee and agents for powers of attorney or healthcare directives.

"If your estate documents still identify the spouse you're divorcing as the primary person handling your estate and making financial decisions on your behalf, that may be a big problem," Houston says. "Those need to be updated as soon as possible."

Moving forward

Divorce often takes an emotional toll—but it also presents an opportunity to reshape your finances and head into your new life with confidence. With the right team in place, you'll be better able to protect your assets, manage your expenses and keep yourself on the path to financial security.