Estate planning checklist: 5 steps to ensure a smooth transition for your family

Your children are grown, moved out of the house and are building lives of their own. So is the tactical part of parenting over? Not quite.

While you hope your kids never have to face a loss or sudden emergency, you can take steps now to help ensure they'll have support and clarity if the time comes for them to oversee your estate—whether due to an emergency or the simple process of aging. Follow this estate planning checklist to help you set them up for a smooth transition.

Get organized

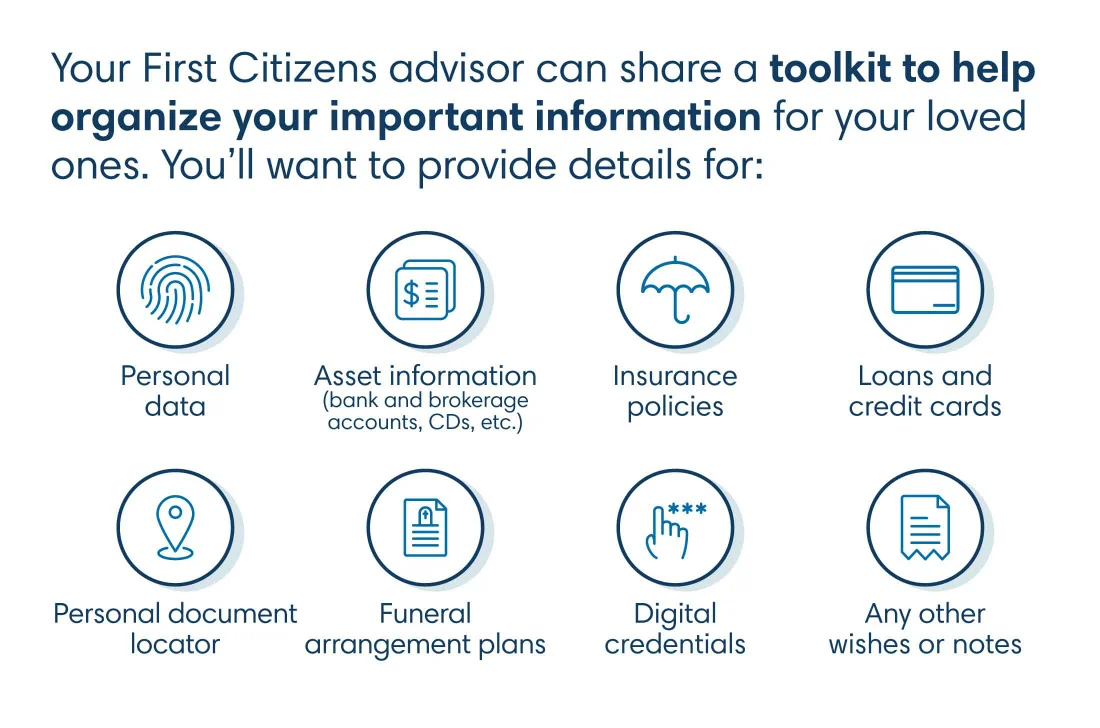

Your first step should be to make sure your children have access to important accounts and information.

"Having some sort of documentation of what your financial life looks like would be a good place to start," says Nerre Shuriah, Senior Wealth Planning Director at First Citizens. She says a list of accounts, passwords and other important information can be invaluable when emotions and stress levels are high.

"Somebody has to jump into your situation and figure out, 'What accounts do they have? How do I access them? Who are they paying?'" she says. "And the process has gotten even harder with automatic payments. Some automatic payments could be once a year."

There are also legacy considerations to keep in mind. "Without passwords, the ability to access email or social media accounts is gone. You may be able to access some platforms in a limited way as an heir, but not in the same way as the participant or owner," Shuriah says. "Some of that documented history now disappears. You need to document passwords so the next generation can access who you were as a person."

Compiling your estate planning documents may also have more immediate benefits. "Going through the exercise helps you get a grip on what's happening," Shuriah says. "You might find active subscriptions you didn't realize you were paying for or accounts you could consolidate."

It's important to keep this information in a secure place, such as a safe deposit box or fireproof safe in your home, and to make sure a trusted individual knows where to find the information. Shuriah recommends reviewing information annually or whenever significant life events occur to ensure everything is up to date.

Take advantage of estate planning tools

After documenting your current accounts, start looking toward the future. "There's a trove of documents that you need, and a lot of them are protection documents," Shuriah says.

The first of these documents is a last will and testament. In its most basic form, a will details how you want your assets distributed after you die, but it can also contain other instructions like burial arrangements.

However, a will has certain limitations. For example, if your assets are above a certain statutory threshold—which varies from state to state—your estate could be subject to review in probate court, where your records become public. "The probate process can be embarrassing, and it can be time-consuming and expensive," Shuriah says.

You may also want to consider setting up a revocable trust and putting your assets in the name of the trust. This can help avoid probate court, and its terms are effective immediately—so the named trustee can step in right away to help manage affairs.

"A will is good to have but it's never effective until you pass away, so [a will won't help with] any risks or situations that occur before you die—in a period where you may be unable to take care of your affairs fully," she says. "You may not have a level of incapacity that necessitates a guardianship, but a trust can give you that added help."

Consider additional documents

Another document to consider is what's commonly referred to as a transfer-on-death deed. The deed covers real estate like a primary residence and names an individual who would inherit the property's title upon your death.

"It would be automatic, and the property wouldn't have to go through the probate process," Shuriah explains. "A revocable trust requires you to draft a document and change the title with the county recorder, which may add some extra time and fees," she says, noting that a transfer-on-death deed is a simpler method that allows people to choose who will receive property without extra court supervision or oversight.

You'll also probably want to create power of attorney documents for specific situations, such as one for financial matters and another for healthcare-related issues. These give the named individual the legal authority to act on your behalf.

Anticipate adult children's future needs

Another step in the process of preparing your estate for your grown children is reviewing life insurance policies. You'll want to ensure that they provide adequate protection for your family in terms of future expenses. "Your last medical expenses could be excessive if you become ill," Shuriah says, adding that many people also want to make sure their policy will pay off their existing mortgage.

Life insurance can also be helpful if you have one or more family members who rely on your income. For example, a grandchild might depend on you to subsidize their college costs.

"Assessing all those needs, consolidating them, seeing where any shortfall is and getting a policy to cover it is so important," she says.

Discuss plans with your family

Once all of your documents are organized, communicate your plans and intentions with your family. Regular family meetings are a good way to discuss not only finances but also other topics you consider important.

"These meetings are a great chance to impart family values, whether that's philanthropic goals or just anything they want to pass from generation to generation," Shuriah says.

Another way to communicate your wishes is through an ethical will or letter of intent. While these aren't legally enforceable, they can provide guidance on the principles and beliefs you hope your heirs will carry on.

"These documents can help trustees with decisions that are gray," Shuriah says. "Not every decision regarding a distribution or choice is clear, so having that letter can help trustees interpret the writer's wishes."

Your financial professional can help you communicate with your family during these meetings. "We can take some of the emotion out of the meeting and help give it structure, because these aren't like your everyday family get-togethers," Shuriah says. "It helps to have us there sometimes to potentially change the dynamics of how family members interact and set new rules."

Your financial professional can also provide a planning toolkit to go over these and other options to consider—because the plans you make now will help your children down the road and give you peace of mind today.