Unlimited use of domestic ATMs

Get a debit card with higher ATM and purchase limits, no ATM fees, and refunded surcharges.D

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Prepare your business for what's next in 2026

Get actionable strategies and insights to strengthen your business's financial resilience in the changing economic landscape.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

March Basis Points

The Making Sense team breaks down key topics related to conflict in the Middle East, energy markets and US growth.

Wire Transfers

Get free incoming wire transfers and two free outgoing wire transfers per year.

Our Best RatesD

Save more on home equity lines and earn more on CDs with preferred rates.

No ATM Fees

Access your money conveniently without being charged an ATM fee.D

Avoid the $50 monthly fee when you maintain a combined daily balance of $50,000 or more in any of these account types.

Get a debit card with higher ATM and purchase limits, no ATM fees, and refunded surcharges.D

Automatically cover overdrafts without incurring a fee.D

Save the most with our preferred ratesD on home equity lines of credit and earn more on account balances and CDs.

Earn up to 10‚000 bonus points on a new First Citizens Rewards Credit Card for meeting minimum spend requirements.D

Teach money management skills to younger family members with a Together Card at no additional cost.D

Subject to availability.

Send money with free external bank-to-bank transfers.D

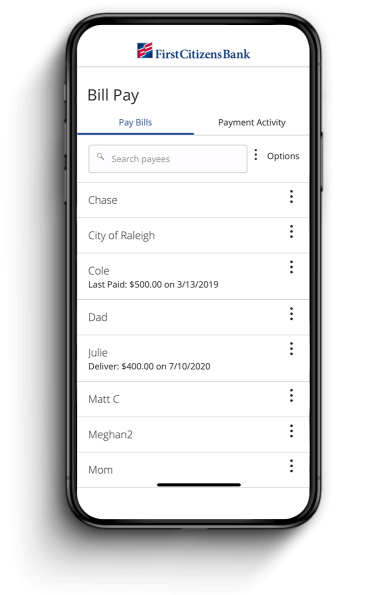

Pay your bills from any device

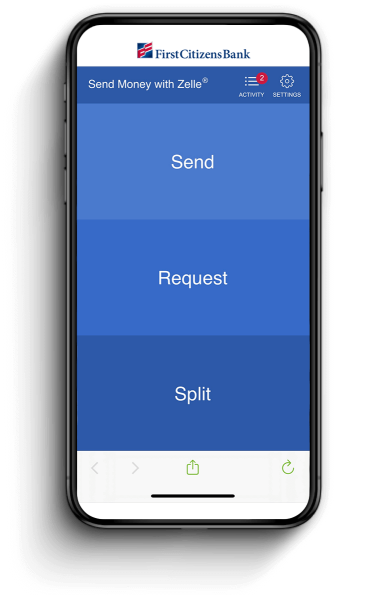

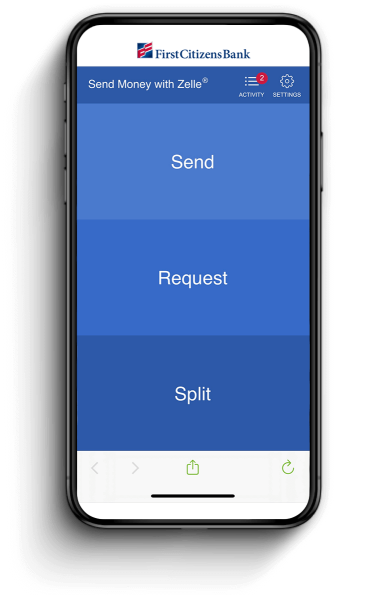

Send money with Zelle®

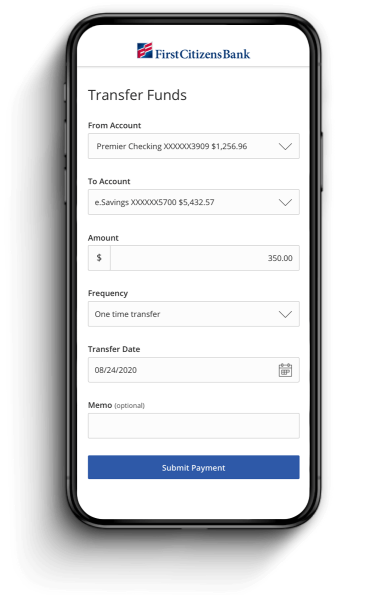

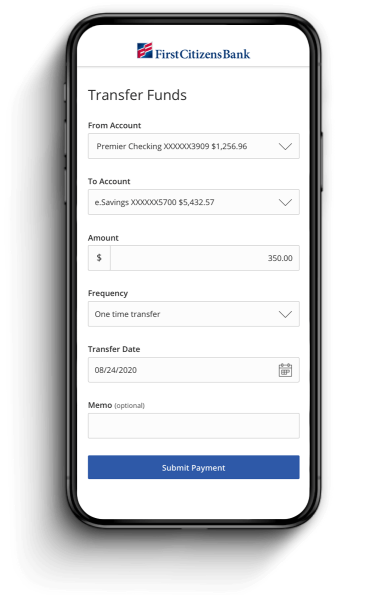

Transfer funds to other accounts

Pay your bills from any device

Send money with Zelle®

Transfer funds to other accounts

Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Limit of five per month.

For current rates, please call or visit your local branch.

Minimum opening balance of $100 in new funds to First Citizens, maximum of $1,000,000, required to receive the advertised APY.

Your investments in securities and insurance products are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by, any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. Past performance does not guarantee future results. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands, Products and Services Offered

First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares Inc. are the entities through which FCW products and services are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. (FCIS), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. (FCAM), and SVB Wealth LLC (SVBW), all SEC registered investment advisers. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions, or to all investors. Insurance products are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products are offered by First-Citizens Bank & Trust Company, Member FDIC, and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM, or SVBW and its investment professionals, visit: FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app. Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information. Fees may apply for use of certain services in First Citizens Digital Banking.

No transfer fees when linked to Savings Overdraft Protection or Checkline Reserve.

Service fees may be charged by the third-party ATM operator or owner, or by the network owner for transactions at non-First Citizens ATMs. For transactions initiated outside of the United States, the fee will be 3.00% of the transaction amount.

Together Card is a deposit account.

Subject to credit approval. Must spend $3,000 within the first 3 months of credit card account opening to receive 7,500 bonus points. Bonus points will be awarded within 60 days of qualification. Only valid one bonus per customer. Account must be in good standing. Bonus points will be added under the description: Premier Executive Checking Bonus for new account promotion Premier Executive Checking customers are still eligible for the 2,500 bonus point offer upon upgrade and payment of the annual rewards fee; therefore cardholders have an opportunity to receive up to 10,000 in bonus points. Premier Executive Checking will be excluded from other spend promotions that may be live during the time of their eligibility for this promotion.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services, and content on any third-party website.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Bank deposit products are offered by First-Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.