CIT Bank Personal Banking Customers

Learn more about your personal banking transition

Quickly find what you need below

Your Transition to Digital Banking ↓

Your transition timeline

Here's a look back at the key dates of your transition.

Welcome package mailed

The week of October 10, we mailed your welcome package with all the details you needed, including key things to know and do for the transition of your bank accounts to First Citizens.

New debit card

If you had a CIT Bank debit card, we sent you a First Citizens Visa® Debit Card in the mail. We also sent you a new PIN in a separate mailing.

Digital Banking transition letter

The week of October 31, we mailed you a letter with the details about your new Digital Banking account, including your new login ID and instructions for setting up a new password at First Citizens.

CIT Bank access ended

Start using your First Citizens Visa® Debit Card at 2 pm ET on Thursday, November 10. Your CIT Bank debit card stopped working at this time.

Online access to CIT Bank ended at 9 pm ET Thursday, November 10.

Conversion weekend

Unless otherwise notified, CIT Bank branches closed at 2 pm local time on Thursday, November 10, in observance of Veterans Day on Friday, November 11, and remained closed until they reopened as First Citizens branches on Monday, November 14. During this time, online and mobile banking were temporarily unavailable.

Transition completed

Your accounts and services became First Citizens accounts at 7 am ET Monday, November 14. Online and mobile access also became available at this time.

You can now use the First Citizens network of more than 550 branches in 21 states.

Get the details about your transition to Digital Banking

Bank from anywhere with your mobile devices

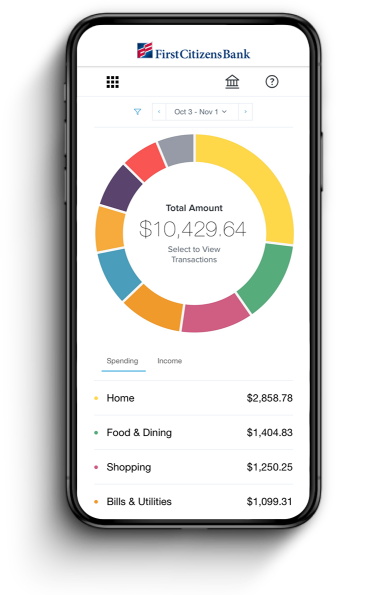

Track your spending habits

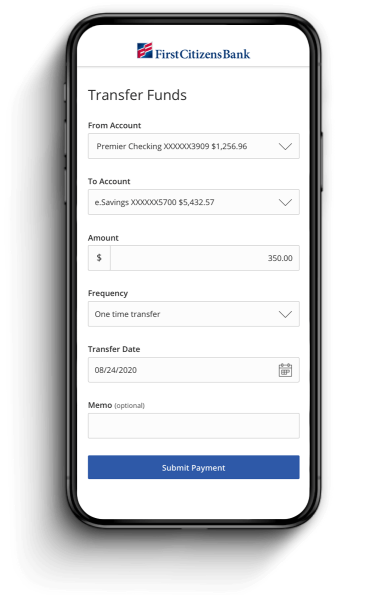

Seamlessly move your money

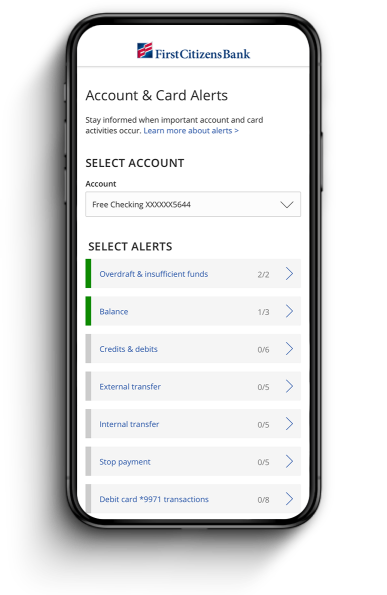

Set alerts for transactions

New opportunities in personal banking

First Citizens can make your banking better—and provide new ways to help you reach major life goals.