Digital Banking Transition

Your online access just got a boost

Powerful, secure, easy to use

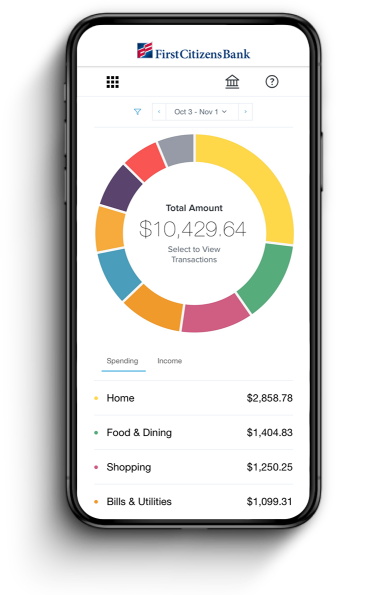

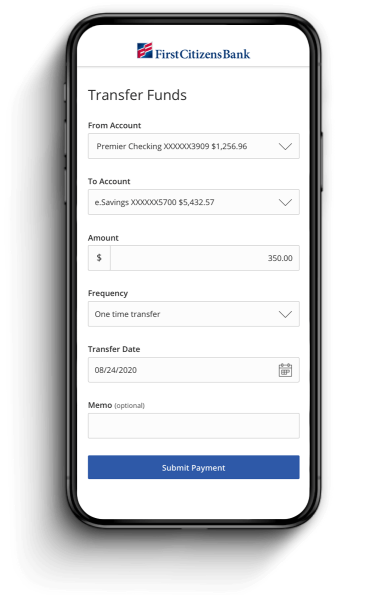

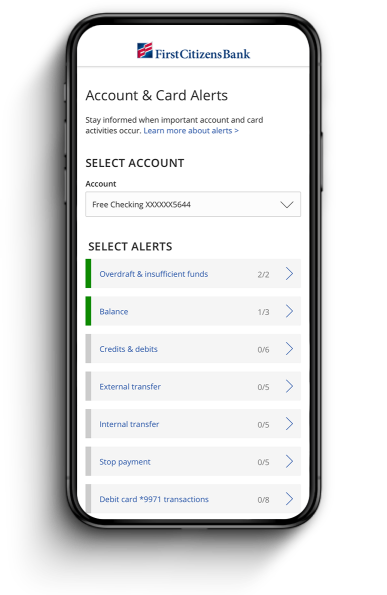

First Citizens Digital Banking goes far beyond the basics to deliver a new set of tools that can help you create and manage budgets, track your spending habits, set up all kinds of custom alerts and get immediate warnings of fraudulent activity. And those are just a few of its advantages.

How to get started

Bank from anywhere with your mobile devices

Track your spending habits

Seamlessly move your money

Set alerts for transactions