2025 business owner survey: Confidence amid uncertainty

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

Owning a business today means managing complexity on every front. Our 2025 Beyond Wealth Report for Business Owners explores the forces shaping both personal wealth and business ownership in 2025.

Our 2025 survey of business owners offers a clear view of how Americans are expanding their businesses, navigating economic uncertainty, managing growth and planning for the future.

Key takeaways

- The 2025 Beyond Wealth report reveals how owners are growing their businesses, planning for the future and navigating ongoing economic uncertainty.

- From retooling operations to strengthening personal finances, owners are adapting with clarity—and with greater confidence than their peers.

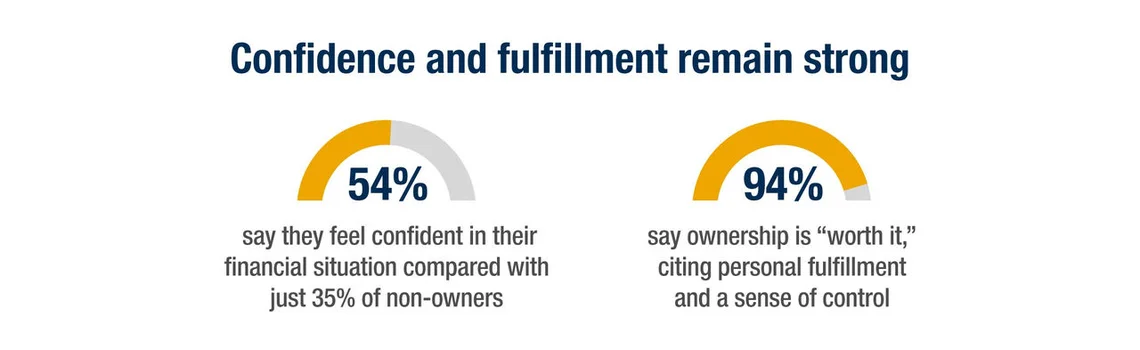

- Despite facing challenges, 94% say running a business is worth it, citing personal fulfillment as a key factor.

Trends shaping business ownership in 2025

This year's Beyond Wealth study reveals mounting economic pressures for owners and non-owners alike. Yet amid the uncertainty, business owners continue to press forward—staying focused on growth and positioning their businesses for what's next.

Confidence amid economic headwinds

More than half of business owners surveyed say they feel financially stressed. Sixty three percent cite inflation as a top concern, followed by shifting government economic policies and high interest rates.

Business owners are feeling economic pressure more acutely than non-owners, 55% of whom reported feeling financial stress. The uncertain impacts of changing tariffs, higher interest rates and a tight labor market have the potential to ripple far beyond their personal finances into their business balance sheets.

Despite these headwinds, business owners continue to show resilience. Nearly all owners surveyed affirm that running a business is worth the effort, pointing to personal fulfillment and a sense of control as key factors. More than half say they feel very confident in their financial situation, compared with just 1/3 of non-owners. This confidence isn't accidental—it's earned through adaptability and decisive action.

Actions shaping business resilience

Business owners are more likely than non-owners to say they've made changes in response to 2025 economic conditions. Many have made positive adjustments to their personal finances, such as increasing retirement contributions, boosting investments, cutting back on discretionary spending and paying down debt.

Inside their companies, owners are acting decisively as well. Many have raised prices and increased spending on marketing and advertising, while some report taking steps to restructure vendor or supplier relationships. Notably, very few are responding to economic conditions with staff cuts—just 9% report reducing headcount.

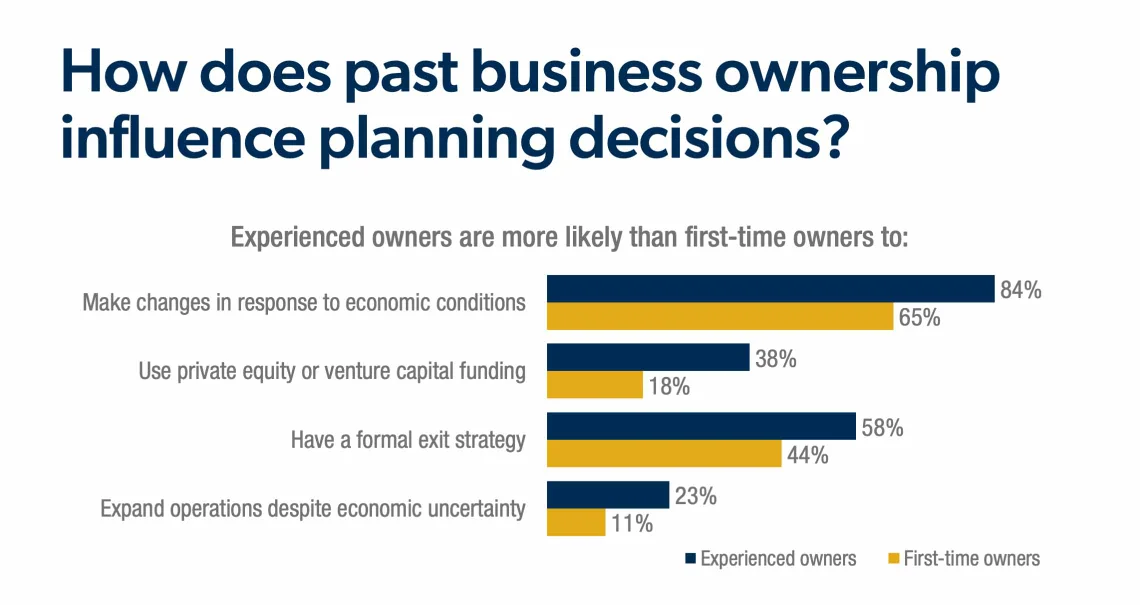

Seasoned owners seize the moment

Two in five current owners have previously run a business—and their experience appears to be shaping their behaviors. While many first-time owners remain somewhat cautious in their response to economic conditions, seasoned owners are focused on growth. They're roughly twice as likely to say they've expanded operations and hired more staff in response to economic uncertainty in 2025. These actions suggest both increased confidence and greater comfort with calculated risk.

Business ownership and life stages

This year's Beyond Wealth study also takes a closer look at the full life cycle of business ownership, exploring how entrepreneurs fund their ventures, make personal planning decisions and prepare for the future.

Financing growth from the ground up

For many entrepreneurs, launching a business starts with personal investment. Personal savings and traditional bank loans remain the primary sources of startup capital for business owners, while outside funding continues to play a smaller role. Nearly 1/3 have turned to investments from friends and family, and 23% have leveraged small business grants. Meanwhile, private equity, venture capital and angel investments are accessed by a small portion of owners.

However, experience changes the equation. Seasoned owners are twice as likely as first-time owners to secure private equity or venture capital funding, suggesting that stronger networks and lessons learned from prior ventures can open doors to a wide range of financing options.

Planning for life beyond the business

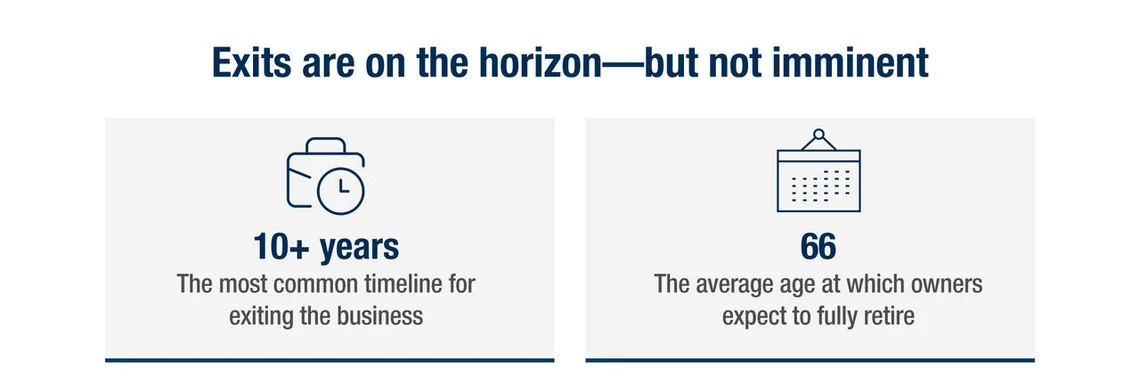

Business ownership has a clear influence on personal planning, particularly when it comes to retirement. Owners have set aside slightly more for retirement than non-owners, yet they also expect to work longer. On average, business owners plan to fully retire at age 66—a year later than their non-owner peers. They're also more likely to have taken key protective steps like securing life insurance, creating estate plans and establishing irrevocable trusts.

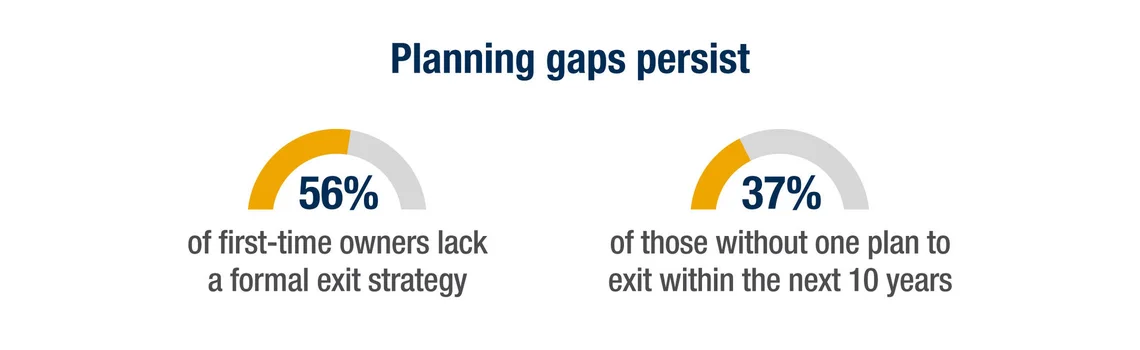

Gaps in exit planning

Still, essential gaps remain. Roughly half of business owners lack a formal exit strategy. Many intend to sell their business or pass it to family, but these goals may be difficult to achieve without a documented plan.

Experience helps close the gap. Even when their retirement timelines mirror first-time owners, seasoned owners are more likely than first-time owners to have an exit strategy in place—suggesting that prior experience reinforces the importance of planning early and often.

Transitioning on their own terms

When considering their retirement timeline, business owners are more likely than non-owners to consider things unrelated to money, such as the achievement of professional goals—36%—and the inability to continue working—29%.

For most business owners, stepping away doesn't always mean slowing down. Many plan on taking time to reconnect with friends and family, travel, focus on leisure and improve their mental and physical health.

Among those who have previously exited a business, satisfaction runs high. Owners with prior transitions under their belt report strong contentment with how their exits unfolded—proof that thoughtful planning and experience can make the process both rewarding and seamless.

5 actionable steps for business owners in 2026

If this year's findings echo some of the pressures you're experiencing, now is the time to turn insight into action. The following business strategies can help you build a strong foundation for the year ahead.

1Reassess your goals regularly

A resilient strategy begins with clear, relevant goals. Review your long-term objectives and financial projections at least once a year to track progress and ensure they remain realistic. Add checkpoints along the way—evaluate forecasts and industry benchmarks quarterly, review your finances monthly and revisit your broader plan after any major event. For businesses affected by tariffs or other economic shifts, these regular reviews provide the agility necessary to adapt.

2Safeguard your personal finances

Business and personal finances are often deeply intertwined. Taking steps to separate your business and personal wealth is an important first step. Maintaining a strong personal balance sheet with a solid safety net, manageable debt levels and diversified income streams can help provide stability during periods of business uncertainty.

3Invest in growth wisely

Economic uncertainty can make expansion feel risky, but pulling back too far can slow momentum. Thoughtful, data-driven investments in key areas can help your business stay competitive while building long-term resilience.

4Don't put off exit planning

Your eventual business exit is more than a transaction—it's a milestone that defines your legacy and shapes your financial future. The earlier you begin preparing for your exit, the more options and opportunities you'll have. Ideally, start 3 to 5 years in advance by reviewing your plan, clarifying goals and identifying your preferred transition path—whether that's passing your business to family or selling to an outside buyer.

5Engage professional support

Running a business while managing personal wealth can be demanding. Partnering with an advisor can bring perspective, simplify complex decisions and help ensure your plans are aligned with your goals. A comprehensive planning process can also help you uncover opportunities and mitigate risks that might otherwise be overlooked.

The bottom line

Running a business has always required vision, adaptability and perseverance—and this year's Beyond Wealth findings reaffirm this reality. Even as economic pressures mount, business owners are continuing to demonstrate confidence, control and resilience. While uncertainty may shape the environment, it doesn't have to define the outcome. With foresight, discipline and trusted guidance, business owners can continue turning today's challenges into tomorrow's opportunities.

To explore these findings in greater depth, download the full 2025 Beyond Wealth Report for Business Owners (PDF), or tune into episode 7 of Building More Than Business. For additional findings, explore our companion report, Beyond Wealth Report for Wealthy Americans (PDF).