7 ways to sell your business: Which one fits your goals?

Denise Sheldon

CFP®, CBEC™ | Senior Wealth Planning Strategist

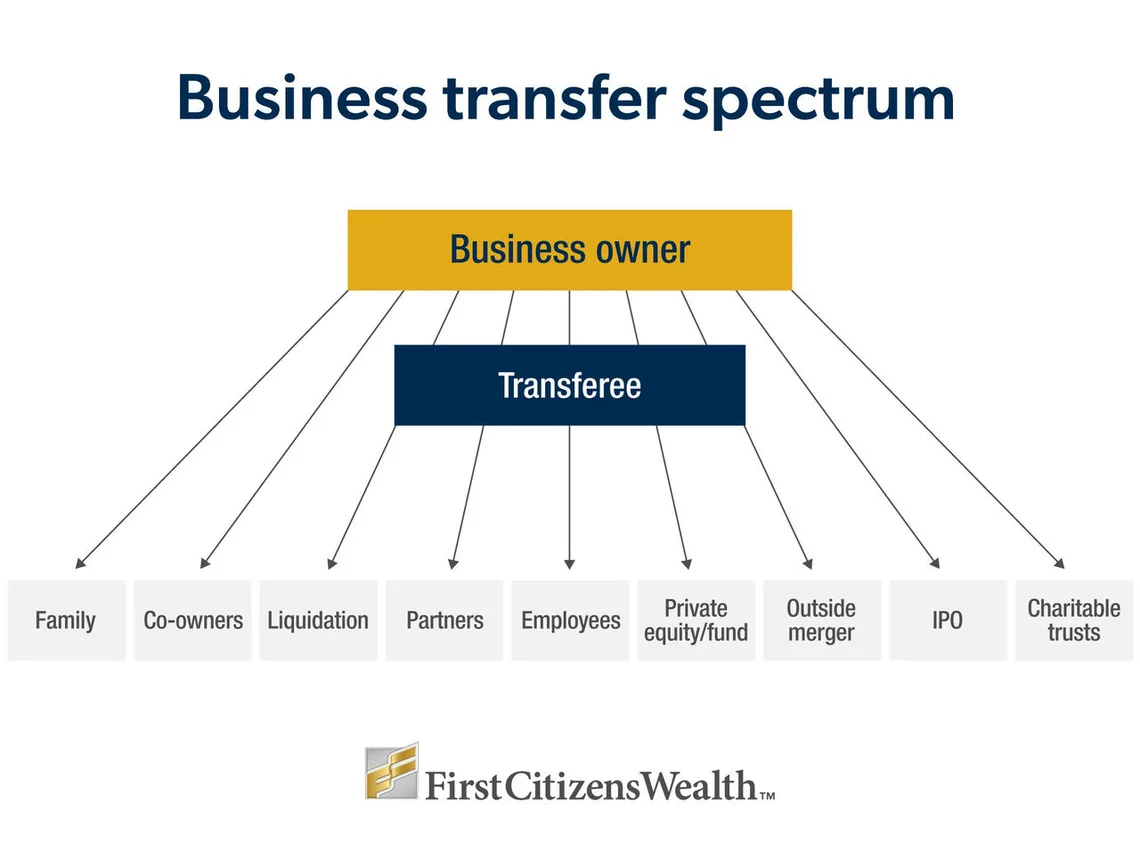

If you're a business owner considering your next chapter—whether you're ready to retire, step back from day-to-day operations or move on entirely—you may be wondering the best way to transfer business ownership of the business you've built. From selling to an outside buyer to transferring ownership to family, employees or partners, there are several paths to consider as you plan this milestone.

Each choice comes with its own advantages and disadvantages. Understanding your choices now can help you protect the value of your business and achieve an exit that aligns with your goals.

Practical business exit strategy options

As you begin planning the transfer of your company, consider the following seven options.

1Transferring your business to family

According to an October 2024 study conducted by First Citizens Wealth, half of owners indicate interest from their family in taking over.

Benefits

- Your professional legacy can live on through the next generation of family members.

- The parties involved are familiar with the nuances of the business and each other, making knowledge transfer easier.

- The transfer provides a fertile environment for multigenerational mentorship.

- There are potentially reduced estate and capital gains taxes.

Drawbacks

- Conflicts among family members may arise.

- There may be a lengthy payment period compared to a third-party transfer.

- Family members may struggle to meet their financial obligations.

2Selling your business to co-owners

Another popular choice for owners is transferring a business to a co-owner. This approach offers several potentially enticing advantages, often with less of the complexity involved with other sales options.

Benefits

- The transition process is often less involved.

- There's less potential for disruption of business operations compared to a third-party sale.

- There are potentially lower transfer risks for a buyer familiar with the business.

- There's typically less of an impact on management, staff and culture versus a third-party sale.

Drawbacks

- There are potential challenges when determining business value.

- Possible difficulties could arise when financing the transfer.

- You may be subject to an increased risk of payment default.

- The transfer may result in morale issues with existing employees.

3Selling your business to employees

Similar to co-owners, transferring business ownership to employees is preferred by many business owners who have handpicked successors who aren't in the family or already co-owners.

Benefits

- It's more likely to be a harmonious ownership transfer.

- The business gets to preserve its culture.

- There's a greater likelihood for enhanced employee engagement and retention.

- There are potential tax benefits for both you and the company.

Drawbacks

- Sale price may be lower versus a third-party transfer.

- Buyer financing may be needed for all or a portion of the sale.

- You may have less liquidity and increased risks.

- Employee stock ownership plans can be expensive and complicated to arrange.

4Merging with a company within your industry

This approach can be a solid option for those who have strong reputation or differentiation in their market—and who may not have a successor in mind.

Benefits

- There's the potential for higher value than other options.

- Combined staff means access to a broader pool of internal talent.

- The business may be able to defer tax liabilities.

Drawbacks

- There will be operational complexities related to the integration of the two organizations.

- There's a risk of low employee morale due to differences in corporate culture.

- The business could lose staff due to overlap of roles and responsibilities.

5Selling to a third party

While this approach is more complex up front because more parties are involved, it can end in higher value for you as the existing owner.

Benefits

- An array of buyers competing for the purchase could increase potential value.

- There could be a quicker transfer timeline.

- You'll have more liquidity than if you received installment payments, which are more common with family and employee transfers.

Drawbacks

- The buyer may make significant staffing cuts after the sale.

- You may not be able to return to industry due to noncompete agreements.

- Third-party sales are complex and require expert assistance.

6Selling via a charitable trust

The next two options can be significantly more costly and elaborate to implement. But transferring ownership of your business into a charitable trust can provide philanthropic benefits.

Benefits

- Selling through a charitable trust offers a range of income, capital gains and estate tax advantages.

- It can also provide a lasting philanthropic impact and control via the trust.

Drawbacks

- Once established, most charitable trusts can't be reversed.

7A public sale

The sale of a business—for example via an initial public offering, or IPO—can also offer significant financial upside and liquidity for all shareholders. Like a third-party sale, this complex process requires expertise and experience selling to public markets.

Benefits

- It allows the company and owners access to substantial capital.

- It provides liquidity for all company shareholders.

- It lets the company offer employees stock option incentives.

Drawbacks

- The company becomes heavily regulated and scrutinized.

- Costs are substantial, and the timelines are lengthy.

Bonus option: A blended sale

Many business owners are relieved to hear that they may combine two or more transfer approaches to sell their businesses. Typically, the most effective way to satisfy all parties involved is to sell portions of the business using a combination of tactics. For example, the transfer of a family business may involve gifting one portion and selling another.

These arrangements can often become more complex than a single-sale approach and require more assistance from professionals who are well-versed in their financial, tax and legal implications.

Consider the full spectrum when planning an exit strategy

The bottom line

Investing the time to establish a concrete succession plan well in advance of your exit can benefit everyone associated with your business. Whether you decide to transfer your business to family, employees or an outside party, developing a strategy that accounts for a buyer's needs as well as your own is vital to making your transition successful.

Learn more about the ways you can structure an effective business succession plan by contacting a First Citizens Wealth Consultant and ask about our Business Advisory services.