Balancing 401(k) and HSA pretax contributions

Saving for your future is one of the most important—and responsible—things you can do as you advance in your career. But determining how to save can be a balancing act. You may wonder how much you should contribute to your health savings account, or HSA—or whether you should put money in an HSA, 401(k) or both.

It's important to understand the similarities and differences between the two types of accounts. Both take pretax paycheck contributions. But which account should you prioritize?

First Citizens Wealth Paraplanner Craig Shively and Wealth Planning Strategist Nate Harris share things to consider as you plan your pretax contributions.

How much can I contribute to my 401(k)?

As companies have begun eliminating pensions, 401(k) plans have become popular employer-sponsored retirement plans. With a 401(k), employees can choose how much they contribute to their retirement savings each paycheck and withdraw the money when they retire.

The 401(k) contribution limit was $20,500 in 2022 and $22,500 in 2023. If you're 50 years old or older, you can make additional catch-up contributions up to $7,500 for 2023. In 2024, the contribution limit will jump to $23,000, while the catch-up limit will remain the same at $75,000.

There are two main types: a traditional 401(k) and a Roth 401(k). Depending on how your company sets up its plan, you may have the option to contribute to both.

With a traditional 401(k), you invest money from your paycheck before taxes. By investing pretax money, you can lower your taxable income—and potentially which tax bracket you end up in at the end of the year. However, you'll have to pay taxes on the money when you withdraw it years down the line.

With a Roth 401(k), you're putting taxed contributions from your paycheck into your investment account, which doesn't reduce your taxable income. But when you withdraw the money later, you don't have to worry about ever paying additional taxes on it.

"For younger employees, I'd recommend putting as much as I could into the Roth bucket because I know what the tax bracket today is going to be," Shively says. "I have no idea what the tax rates are going to be 30 years from now when I retire."

How much should I contribute to my HSA?

HSAs were created in 2003 to complement high-deductible health insurance plans. Using the money saved in an HSA, employees can pay for their own and their dependent family members' qualified medical expenses with pretax dollars.

"An HSA has the capability of having a triple tax advantage, which is why it's so useful," Harris says. "I don't know of anything else out there that has a triple tax advantage."

What this means is that your contributions go in pretax, can be invested and grow tax free, and then can be withdrawn tax free—as long as they're used to pay for qualified medical expenses. "You could literally never pay tax on those dollars," Harris notes.

With healthcare costs rising, a well-funded HSA could be especially important in the future—especially when you consider the financial impact of long-term healthcare.

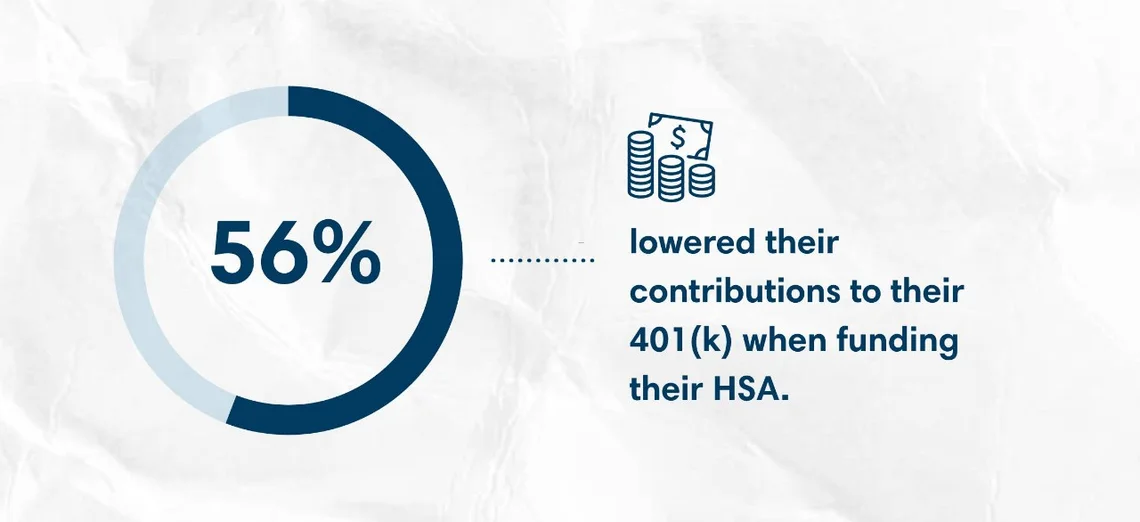

According to the Employee Benefit Research Institute, 56% of 401(k) participants reduced their 401(k) contributions in the first year they contributed to an HSA. With thoughtful planning, however, it doesn't have to be an either-or situation.

Should I max out my HSA?

With a little planning and good recordkeeping, HSAs can be used as a unique—and advantageous—investment vehicle. The contribution limits for 2022 are $3,650 for an individual and $7,000 for a family, with an additional $1,000 allowed for those older than 55. Because they're tied to high-deductible health plans, yours will roll over from one year to the next as long as you're enrolled.

"What I do personally—and what I recommend doing—is super-funding your HSA," Harris says. "This means putting in that $3,650 pretax, making sure that's invested. Then I pay for all of my medical costs out of pocket. I'm never pulling anything out of the HSA at this point. I want to let that money grow and compound for as long as possible."

If you can cover medical costs out of pocket, Harris says, the HSA allows you to be reimbursed for medical expenses in prior years as long as it had already been opened when the expense took place. If you save all receipts for the medical expenses you're paying cash for over your lifetime, you could pull money from your HSA account to reimburse yourself for these past medical expenses tax free after you retire. "You may hear it be called a stealth IRA," Harris says. Receipts are key in case you get audited.

If you need to use your HSA dollars for something other than qualified medical expenses, you can. Just be prepared to pay taxes and an additional 20% penalty on the money when you withdraw it. If you use an HSA for nonmedical expenses after age 65, you'll still have to pay taxes on it, but the penalty goes away.

401(k)s versus HSAs

401(k)s and HSAs are great savings vehicles—but how do you prioritize where to put your money? First, consider your unique situation. Your age and medical needs can play a big part. For example, if you're nearing retirement, prioritizing your HSA may make sense because healthcare is one of the largest expenses in retirement.

Second, while you may not be able to reach the maximum contribution for your HSA and 401(k), Shively and Harris say you should at least contribute enough to get your employer match if one is offered.

"The first best type of money is free money," Harris says. "I'm always making sure I get my employer's match for a 401(k) or HSA. Then, the second-best type of money is tax-free money."

After securing any employer match, Harris advises maxing out an HSA, then your Roth 401(k) and finally circling back and adding more to a traditional 401(k) if you have money left to invest.

With good planning, budgeting and an understanding of your investment options, your pretax contributions can grow into both a healthy retirement savings and a fund for current and future medical expenses.