Is it better to rent or buy a house?

In today's expensive real estate market—driven by low housing supply and high interest rates—many people face a dilemma: Is it better to buy or rent a house? While the answer isn't the same for everyone, there are common factors to consider.

Homeownership is still the most reliable way to build wealth for many American families. Yet today's housing market makes the buy-versus-rent decision more complex than ever. Renting typically offers flexibility and lower upfront costs, while owning a home often leads to lasting financial security. Understanding the key differences between renting and buying a house can help you make the right choice.

Key takeaways

- Despite high prices and interest rates, homeownership still outperforms renting for creating lasting financial security.

- Renting offers lower upfront costs and fewer maintenance responsibilities, but it doesn't build home equity.

- Strong credit, low debt and adequate savings can help buyers qualify for better mortgage terms and turn housing costs into lasting equity.

Which is cheaper: Buying or renting a home?

Across most of the US, it still costs less each month to rent than to buy. In fact, rent is lower than a typical mortgage payment in 48 of the nation's 50 largest metro areas, according to Realtor.com.

At the same time, home prices keep climbing, and mortgage rates remain remain above 6%—a one-two punch that makes it harder for many would-be buyers to afford a real estate purchase. All of this can make renting look more affordable at first, but this view doesn't account for the long-term trade-offs between renting and owning.

Why monthly costs don't tell the whole story

Federal data shows that home prices have risen every year since 2012, including a 2.3% year-over-year gain as of August 2025. Steady appreciation is one reason homeownership is still one of the most dependable ways to build wealth.

A fixed-rate mortgage is another reason. It provides predictable payments over time, and once your loan is paid off, debt-free homeownership can lower your cost of living significantly—which is particularly helpful in retirement when your income may be fixed.

Rent growth slowing, but still rising

By comparison, average rent growth nationwide was 2.4% year over year as of August 2025, according to Zillow Research. While this may sound modest compared to the 7% average over the previous 4 years, even small annual increases add up. Some cities—like Chicago, San Francisco, New York and Providence, Rhode Island—trend higher than the 2.4% average, with annual rent increases ranging from 4.6 to 6.1%.

Ultimately, location drives many of these differences. Use our rent-versus-buy calculator to compare costs in your area—but remember to add in property taxes, insurance, utilities, maintenance and repairs.

While renting may appear more affordable in the short term, homeownership offers the potential for long-term wealth accumulation that renting can't match.

Building wealth through homeownership

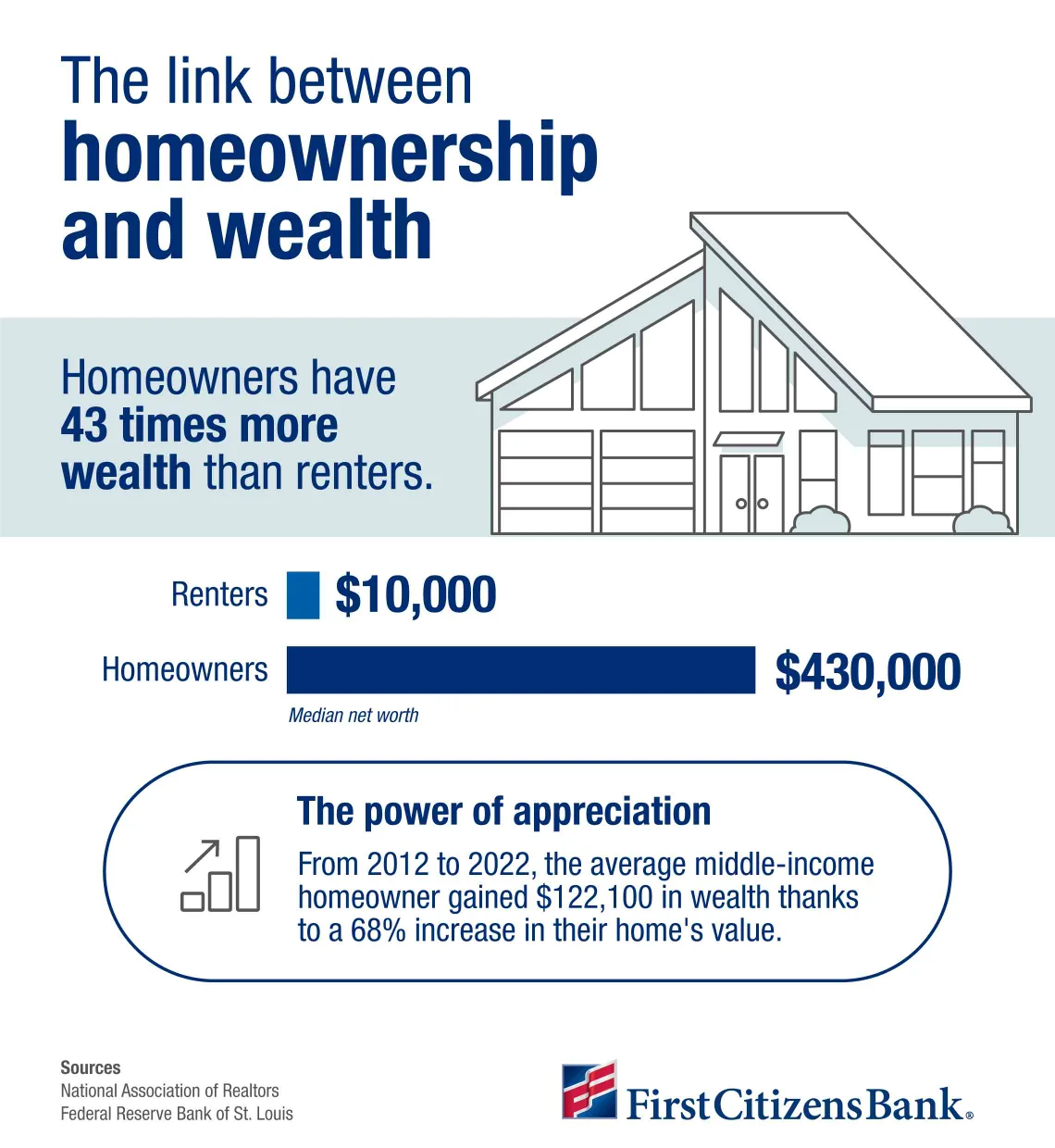

According to the National Association of Realtors, homeowners typically build 43 times more wealth than renters. This is because every mortgage payment and every increase in your home's value adds directly to your net worth, which is the total value of your assets minus your debts.

How home equity builds wealth

As you pay down your mortgage and your home value appreciates, you're building home equity—the portion of the property you truly own, calculated as your home's market value minus any remaining loan balance. Over time, this equity works like a built-in savings plan that grows alongside your home's value.

Even modest appreciation can make a big difference over a decade or more. And once your loan is paid off, this equity becomes one of your most valuable financial assets.

What steps should you take to prepare for homeownership?

Preparing for homeownership begins with improving your finances. It's the best way to qualify for favorable mortgage terms, which is especially important in today's high-rate environment.

Here are four factors that directly influence both eligibility and the interest rate you'll receive.

- Credit strength: Your credit score—typically ranging from 300 to 850—is an assessment of your ability to repay a loan based on your borrowing history. Most lenders require a score above 620 to qualify for a conventional mortgage and above 700 to secure a more competitive interest rate.

- Debt level: Calculate your debt-to-income ratio, or DTI, which is the percentage of your pretax income that goes toward monthly debt payments. Lenders usually prefer a total DTI below 36%. While some lenders may allow higher ratios, lowering your DTI will almost always improve your chances of approval and loan terms.

- Home affordability: Lenders will assess how well your housing costs fit your budget—factoring in mortgage payments, home insurance and property taxes. A common guideline is to keep these expenses between 25% and 30% of take-home pay. Use our home affordability calculator to estimate this for yourself.

- Down payment and other costs: The larger your down payment, the easier it is to qualify for and afford a mortgage. Many buyers aim for 20% of the home's purchase price, although some programs allow as low as 3%. When you're saving for homeownership, remember to also budget for closing costs—which can be between 2% and 5% of the price of your home for fees, taxes and insurance—and an emergency fund for maintenance or unexpected expenses.

Ultimately, having a full understanding of the homebuying process from preapproval to closing can help you make more confident decisions. Review our homebuyer education resources for guidance on financing options, home selection and other wealth-building strategies.

The right choice for you

So is it better to rent or buy a house? While renting may offer fewer responsibilities, homeownership remains the most proven path to lasting financial security for most Americans. Home equity can also serve as a flexible financial resource, unlocking borrowing opportunities to fund other goals.

If you're ready to build wealth through real estate, First Citizens can help. Our experienced mortgage professionals guide qualified buyers through today's complex housing market, helping to turn monthly housing costs into lasting equity and long-term financial security.

Ready to get started?

Get guidance through the homebuying process. We're here to help.