First Citizens BancShares Inc. and CIT Group Inc. recently merged, creating a top 20 US financial institution with more than $100 billion in assets. As the largest family-controlled bank in the nation, we're continuing a unique legacy of strength, stability and long-term thinking that has spanned generations.

Now that CIT is a division of First Citizens, we're not just getting bigger. We're creating a better bank—a one-stop financial destination providing a full suite of personal, business, commercial, and wealth products and services. We're also creating a stronger bank, with greater capacity and ability to offer more convenience and value.

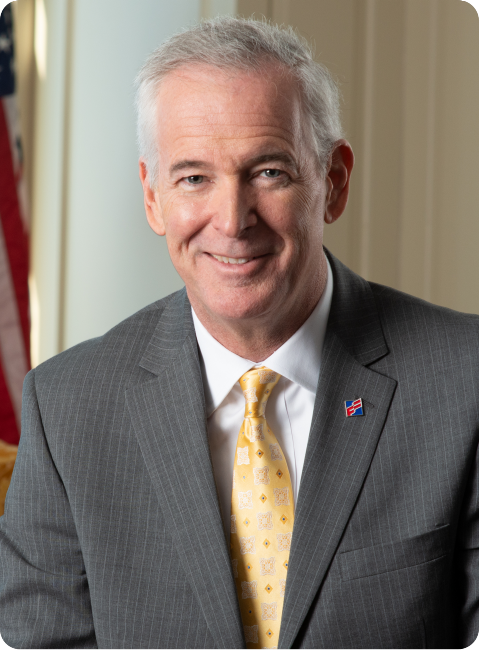

Message from our CEO

Everyday banking

What you need to know

For now, there are no changes in how you bank with us. Same service. Same values. In the long term, you'll get more. Together, we'll offer personal service and powerful tools, including:

"This is a transformational partnership for First Citizens and CIT designed to create long-term value for all of our constituents including our shareholders, our customers, our associates and our communities."

Frank Holding, Jr.

Chairman and CEO of First Citizens BancShares