Commercial Checking Accounts

Designed for growing companies with higher transaction volumes

Simplify your solutions with commercial checking accounts

Designed for high-activity businesses with several related accounts and more complex financial needs, our commercial checking can help manage and improve cash flow through both interest-bearing and non-interest-bearing accounts.

Low monthly feeD

Offset some or all monthly expenses with an Earnings Credit Rate, or ECR.D

Flexibility

Manage a variety of cash flow options and optimize earnings.

Insight

Aggregate deposit accounts into a single relationship.

Empowering you to stay ahead

Streamline your business operations with our analysis-focused commercial checking account services, designed to optimize your financial management and support your growth. Our commercial checking account puts your money to work for you through a competitive ECR.

Let's start a conversation—we're here to help

Commercial Advantage

Accurately track cash flow

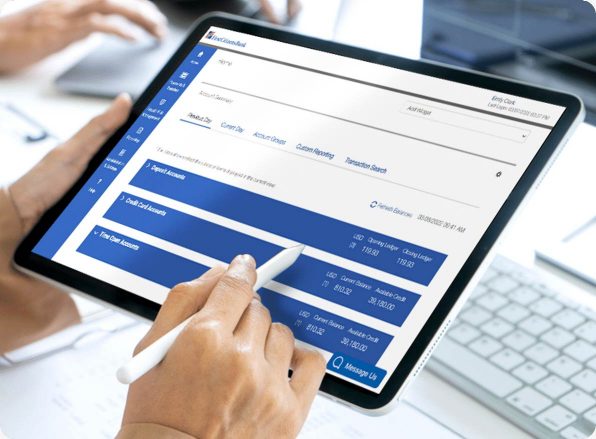

Manage your business on the go

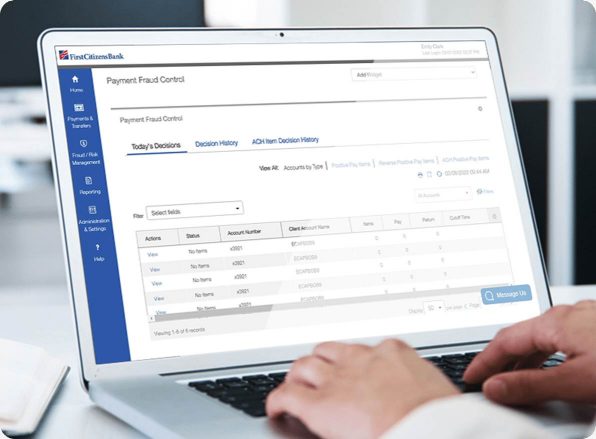

Keep your assets secure